As the electrical car (EV) market evolves, understanding the dynamics of lithium turns into vital. With shifting shopper preferences, altering laws, and fluctuating costs, this text highlights the tendencies and targets considerably impacting the business.

The EV Panorama: PHEVs, BEVs, and Regulatory Changes

Plug-in electrical autos (PEVs) are autos that use rechargeable batteries as their major supply of energy and might be charged by plugging into {an electrical} outlet or charging station. PEVs supply decreased emissions in comparison with conventional inner combustion engine (ICE) autos and might contribute to decreasing dependence on fossil fuels.

PEVs embrace each plug-in hybrid electrical autos (PHEVs) and battery electric vehicles (BEVs), as each sorts are rechargeable utilizing exterior electrical energy sources.

In response to slowing revenue progress, decreased authorities subsidies, and ongoing considerations about restricted charging infrastructure in sure areas, shoppers and automakers are more and more turning to PHEVs as a extra inexpensive interim resolution on the trail towards full electrification.

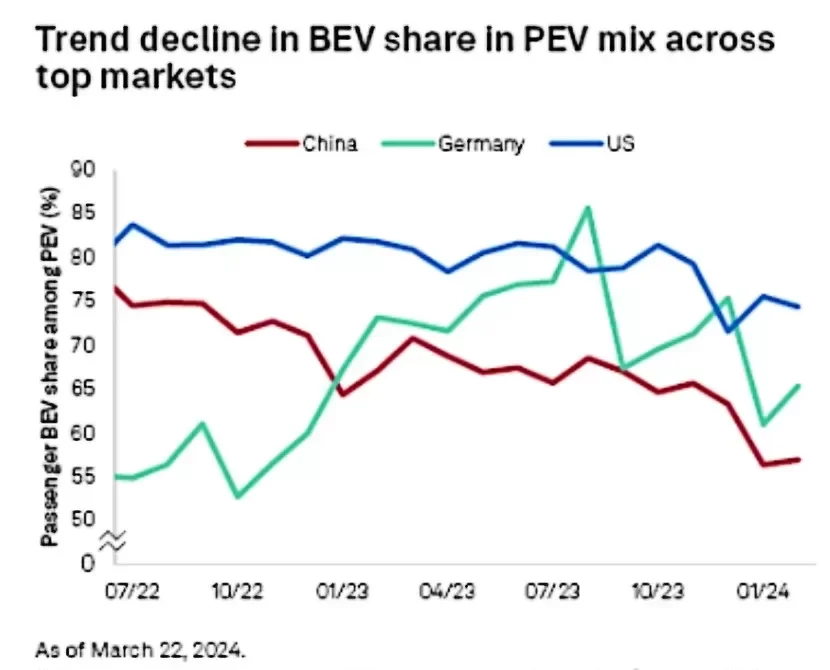

In China, the share of BEVs throughout the PEV market decreased by 10% factors to 57.0% in February in comparison with the identical interval final yr. This declining pattern can also be evident in the US and Germany, in response to S&P International Commodity Insights report.

-

Each the US and the European Union (EU) are adjusting their PEV targets in response to business suggestions.

The Biden administration’s last tailpipe rule, which units bold targets for BEV penetration, has been revised decrease in comparison with the preliminary proposal. The finalized rule locations larger emphasis on the position of PHEVs, aiming for BEVs to characterize 56% of latest automobile gross sales by 2032. PHEVs account for a 13% share, leading to a complete PEV share of 69%.

Equally, the EU is present process the legislative course of to enact its Euro 7 car emissions rule. Following resistance from automakers and member states, the EU has adjusted its strategy to BEV adoption within the quick time period. Nonetheless, the bloc continues to push for its long-term objective of phasing out new ICE autos by 2035.

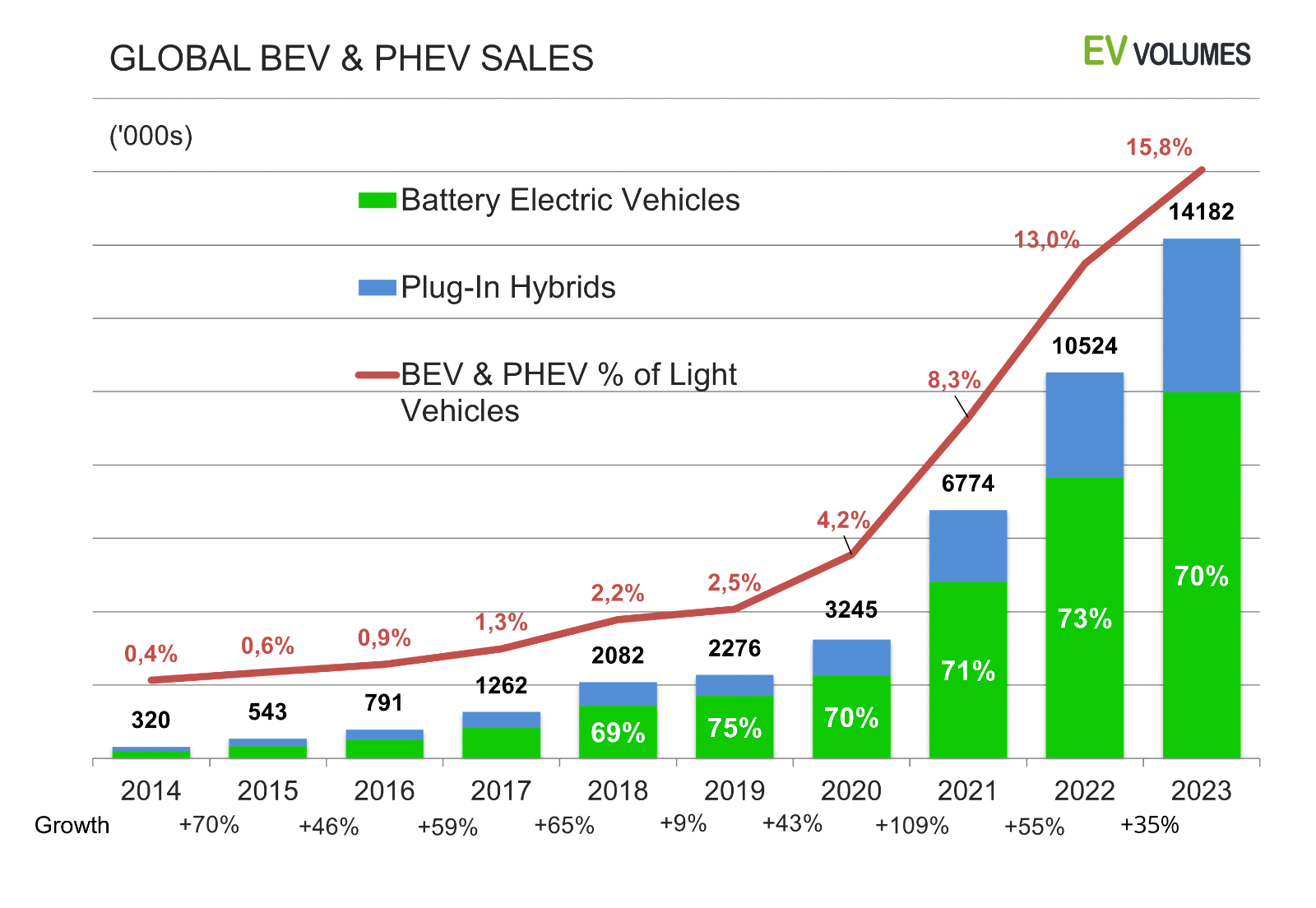

Since 2014 till 2023, BEVs acquired essentially the most gross sales globally as per EV Volumes tracking reportas illustrated under.

As subsidies for PEVs diminish, the momentum of PEV gross sales will rely on elements corresponding to shopper revenue, car pricing, mannequin choice, efficiency, and regulatory pressures on emissions discount from producers.

As subsidies for PEVs diminish, the momentum of PEV gross sales will rely on elements corresponding to shopper revenue, car pricing, mannequin choice, efficiency, and regulatory pressures on emissions discount from producers.

Looser emissions requirements might gradual the adoption of BEVs in favor of PHEVs, which make the most of smaller batteries and fewer metals.

Lithium: Gearing Up the World of EVs

What powers every of those electrical autos is a vital mineral they name the “white gold” or lithium. It’s one of many key supplies used to make batteries for EVs.

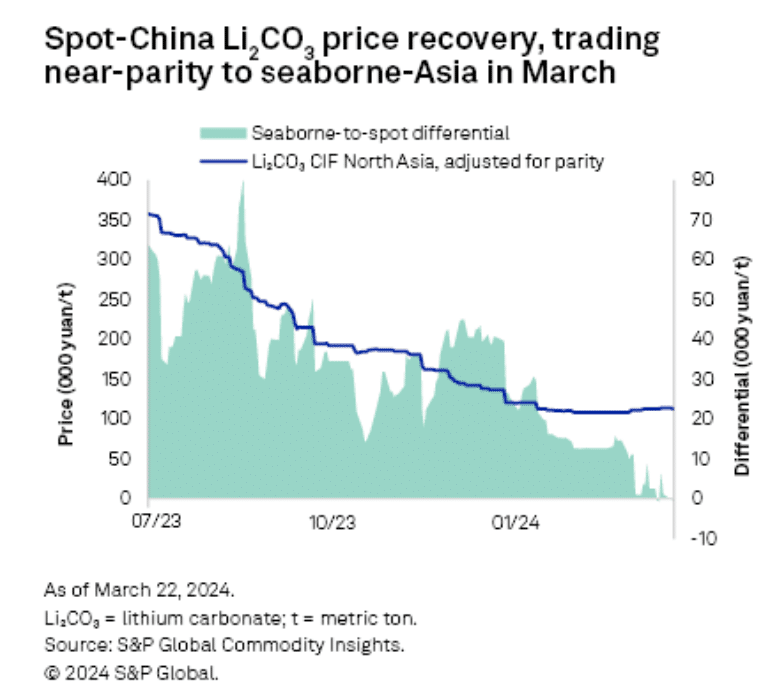

Per S&P International report, lithium costs skilled a slight enhance in March. That is pushed by varied elements together with manufacturing cuts, public sale outcomes, and improved sentiment concerning demand for traction batteries.

Costs rose by 5.1% and a pair of.1%, respectively, for lithium carbonate CIF Asia and delivered duty-paid foundation, through the month as much as March 22.

Some lithium producers have resumed auctions to establish a perceived “true” value for his or her merchandise. Whereas the spodumene value has been climbing since February, it stays deep in the associated fee curve regardless of quite a few manufacturing cuts.

The lithium carbonate CIF Asia value ranged between $13,500/ton and $15,000/ton as much as March 21. That’s greater than double the vary noticed from April to December 2020, which was between $6,300/ton and $7,250/ton, as proven above.

Many lithium producers have highlighted of their fourth-quarter 2023 earnings calls the problem of precisely forecasting the value they may obtain for his or her lithium merchandise. The world’s largest lithium producer, Albemarle, shifted its funding technique in response to evolving market situations.

Notably, lithium public sale value means that lithium costs are anticipated to rise by the top of the yr. Albemarle is planning a collection of upcoming auctions, beginning with 10,000 metric tons of spodumene.

Lithium costs have stabilized for the reason that starting of 2024 and at the moment are larger than the underside of the earlier cycle. This displays the present larger price construction.

What Lies Forward for Lithium?

Lithium prices have fallen to ranges not seen in over 2 years. Whereas provide cuts counsel an upward trajectory for costs, the extent of the value restoration has been comparatively modest so far, significantly for lithium, regardless of latest manufacturing cuts.

Costs in April might obtain additional assist if stronger March gross sales and traction battery manufacturing information verify optimistic demand tendencies.

Buyers proceed to indicate curiosity in lithium initiatives, regardless of short-term challenges, recognizing the long-term potential they provide.

On common, it takes nearly 17 years for lithium initiatives to progress from discovery to commissioning, primarily based on latest updates on mine lead occasions. This underscores the long-term perspective required for traders within the lithium sector, regardless of short-term fluctuations in costs and demand.

Behind all these, the present low-price atmosphere permits for a deal with effectivity and the elimination of high-cost manufacturing. Positioning the marketplace for an eventual enhance in demand and costs.