Join daily news updates from CleanTechnica on electronic mail. Or follow us on Google News!

Plugin autos are all the fad within the Chinese language auto market, even within the slowest month of the 12 months — as a result of Chinese language New 12 months celebrations. Attributable to the truth that festivities occurred this 12 months in February, and final 12 months they have been in January, the market had an apparently so so month, with plugins scoring 440,000 gross sales (in a 1.33-million-unit total market). That’s down 9% 12 months over 12 months (YoY).

However contemplating that this February had fewer work days than within the earlier 12 months, as a result of New 12 months festivities, then even a single-digit drop is a constructive signal. Wanting deeper on the numbers, BEVs have been down 22%, whereas PHEVs nonetheless managed to develop 22% in February! That’s an incredible efficiency for the expertise, which is at present experiencing a golden age within the Chinese language market.

This pulls the year-to-date (YTD) tally to shut to 1.1 million items, and with March set to be one other sturdy month, we must always see Q1 finish on a constructive be aware.

Share-wise, February noticed plugin autos hit 33% market share! Full electrics (BEVs) alone accounted for 22% of the nation’s auto gross sales. This pulled the 2024 share additionally to 33% (20% BEV), and contemplating that the final month of the quarter is often a powerful month, we are able to assume that the nation’s plugin automobile market share will finish across the 35% mark in Q1, and the primary half of the 12 months ought to see it already near 40%.

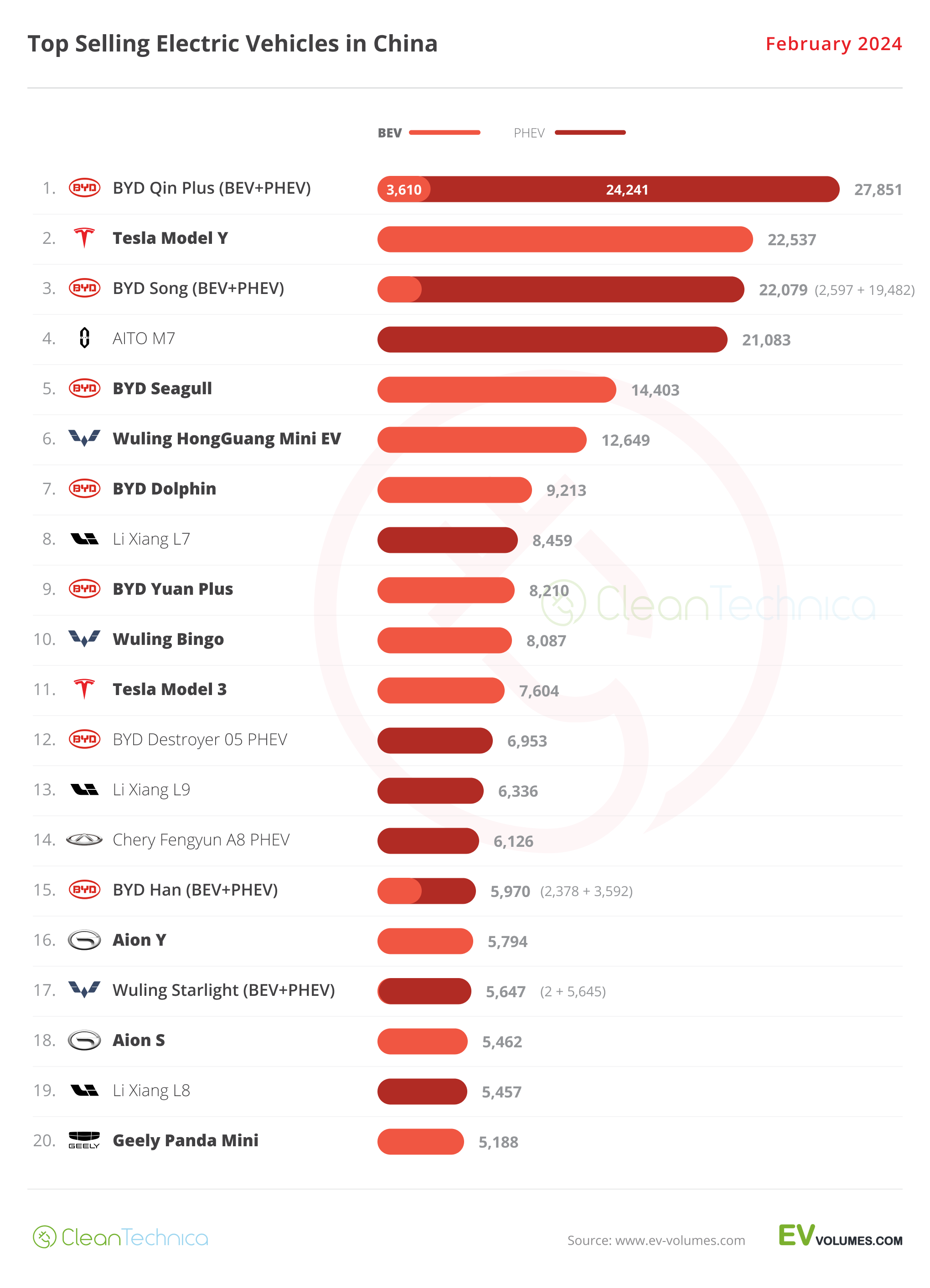

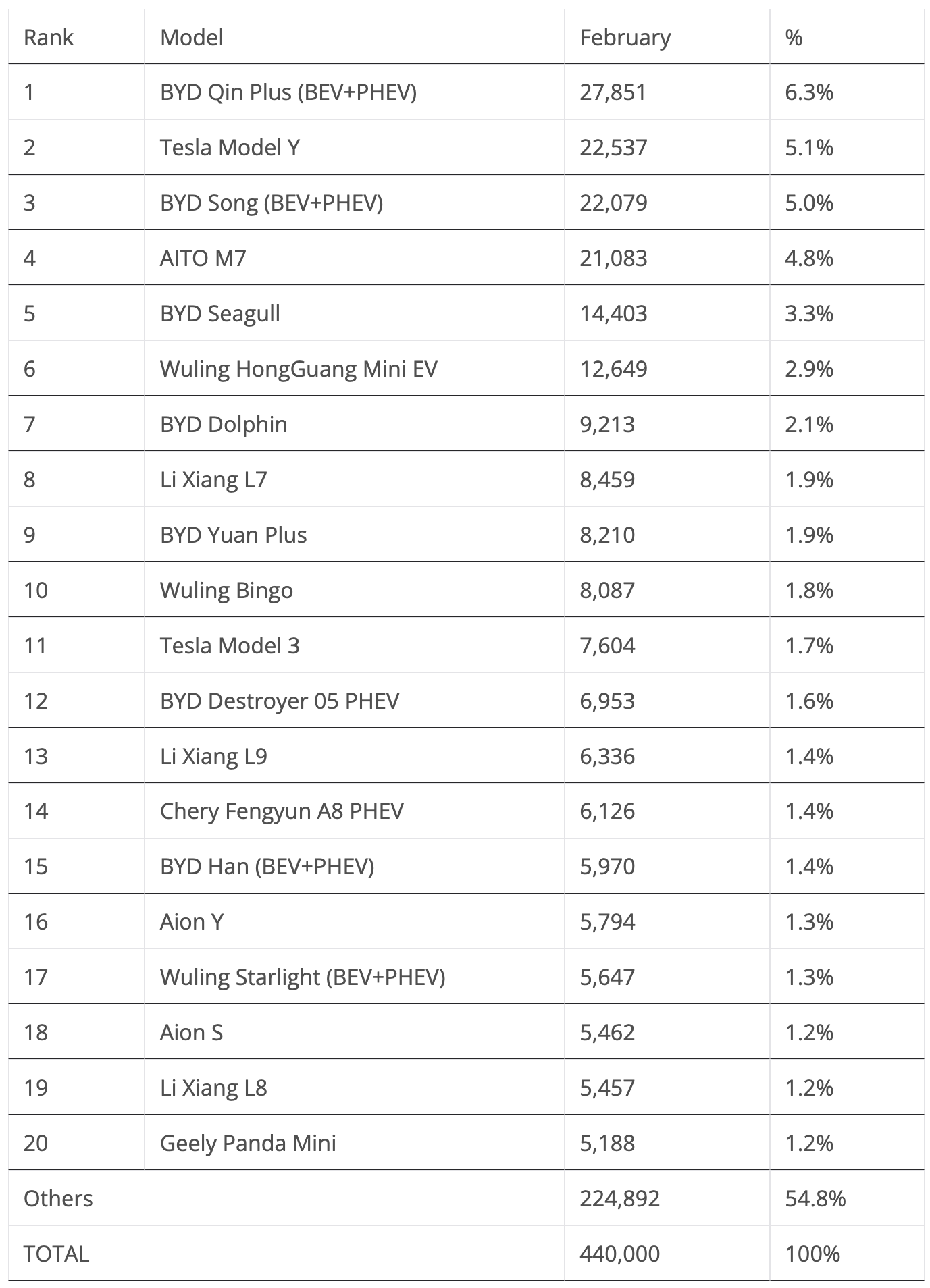

Concerning final month’s greatest sellers desk, the highest 4 greatest promoting fashions within the total desk precisely mirrored those within the EV desk. Which as soon as once more proves the merging course of that we’re witnessing between the 2 tables. Right here’s extra data and commentary on February’s high promoting electrical fashions:

#1 — BID Qin Plus (BEV+PHEV)

Together with the Music, the BYD Qin has been a bread and butter mannequin for the Chinese language automaker for a very long time. The midsizer reached 27,851 registrations in February. This allowed it to be the perfect vendor within the total market, and with the sedan being the primary pawn launched by BYD in its latest “War on ICE” marketing campaign (aka worth cuts)count on it to be the primary mannequin to learn from the gross sales pickup, in all probability already in March. With the latest worth drop and costs now beginning at 80,000 CNY ($12,000), demand is sure to spike once more. Regardless of the sturdy inner competitors — a brand new, fancier Qin L is claimed to be launching quickly, count on BYD’s decrease priced midsize sedan to proceed posting sturdy outcomes at the price of the competitors, EV or ICE, all whereas conserving its most direct rivals — the Tesla Mannequin 3, Wuling Starlight, and GAC Aion S — at a secure distance.

#2 — Tesla Mannequin Y

Tesla’s star mannequin acquired 22,537 registrationswhich allowed it to land in 2nd within the total rating. It appears the US crossover has discovered its cruising pace within the Chinese language market, at round 25,000–30,000 items a month. Whereas that doesn’t make it the perfect vendor available in the market, it permits it and the Mannequin 3 to be the one two overseas EVs to run on the identical tempo because the home manufacturers (Volkswagen, take discover).

#3 — BYD Music (BEV+PHEV)

BYD’s midsize SUV is the uncontested chief within the Chinese language automotive market, however this time, the star participant needed to concede the management place to its Qin Plus sibling(s), scoring “just” 22,079 registrations. Will the Music proceed to rule within the Chinese language automotive market? Properly, it is determined by the competitors, particularly the interior competitors. Presently, the Music solely has the lately launched Music L as inner competitors, however the upcoming Sea Lion and the premium car-on-stilts Denza N7 (a automotive that sits someplace between the Tesla Mannequin Y and the Zeekr 001) are each additionally wanting a chunk of the pie. That is in all probability an excessive amount of competitors inside BYD’s midsize SUV portfolio for the Music to proceed clocking 40,000–50,000 gross sales/month, a mandatory threshold to proceed main the cutthroat Chinese language auto market.

#4 — GENUINE M7

After a shot within the arm by Huawei within the second half of final 12 months — a refresh and decrease costs — the three way partnership model between Seres Group and Huawei has discovered its mojo. The complete measurement SUV turned an instantaneous success. Whereas its first surging gross sales months final 12 months may need raised some eyebrows and raised the query of whether or not the three way partnership might replicate Li Auto’s profitable method (5-meter EREV SUVs with 40 kWh-ish batteries)it appears not solely can they replicate the startup’s success, however they will deliver a market disruptor to the sector and revolutionize the complete measurement class! I imply, a full measurement SUV ending within the total high 5? Wooooow. … Anticipate the competitors to launch copycats massive EREV SUVs quickly. In February, the AITO mannequin hit 21,083 registrations.

#5 — BYD Seagull

Issues proceed to go nicely for the hatchback mannequin, with the small EV securing one other high 5 presence due to 14,403 registrations. With a part of manufacturing now being diverted to export markets, it appears demand for the little Lambo is now at cruising pace in China. The perky EV is now in high 5 territory. Even with its consideration now diverted to different geographies, like Latin America and Asia-Pacific, count on the little BYD to proceed being a part of the BYD pack that populates the Chinese language high 10. What about export prospects to Europe? There are talks that the mannequin might be launched in Europe within the second half of the 12 months. After all, don’t count on the low costs in Europe that the Seagull has in China. When town EV lands, because the Dolphin Mini, European costs might be considerably increased for a variety of causes (tariffs, VAT, and so forth.), however I wouldn’t be stunned if it began to be bought right here at 17,999€ … which might nonetheless be a killer worth contemplating the direct competitors remains to be north of 20,000€.

the remainder of the perfect vendor desk, the spotlight comes from Wuling, which positioned three fashions within the desk. The naked fundamentals Mini EV was in sixth, the supermini Bingo was in tenth, and the brand new Starlight sedan was in seventeenth. The SAIC–GM model lineup is beginning to look fairly full. Now they solely want a compact greatest vendor, a form of … Bingo Plus?

The sportier sibling of the BYD Qin Plus, the Destroyer 05, additionally had an amazing month, with 6,953 registrations, permitting it to finish the month in twelfth. That’s just under the class runner-up, the #11 Tesla Mannequin 3. Does this imply the Qin in sportier frock will turn into a daily face within the desk all through the remainder of the 12 months? To be continued….

However the greatest shock within the desk is in 14th, the Chery Fengyun A8 PHEV, a sedan destined to compete towards the BYD Qin-family. With roughly the identical measurement because the BYD sedan however increased beginning costs (120,000 yuan vs 80,000 yuan), and comparable EV specs (18kWh battery), it will likely be attention-grabbing to see how nicely the brand new Chery will do in a section (sedans) the place the model doesn’t have sturdy traditions. However with 6,126 items in solely its 2nd month available on the market, it has gotten off to a very good begin….

Outdoors the highest 20, there was one other latest mannequin shining, with the Cadillac Escalade sized AITO M9 registering 5,251 items in February, its third month available on the market. Will AITO’s new flagship yacht be as profitable in its class because the M7? Presently, the chief within the humongous SUV class is the Li Xiang L9 (thirteenth in February, 6,336 gross sales). So, the space isn’t that large….

Chip in just a few {dollars} a month to help support independent cleantech coverage that helps to speed up the cleantech revolution!

The 20 Greatest Promoting Electrical Automobiles in China — January–February 2024

Wanting on the 2024 rating, the main BYD Music is nicely above the competitors, however under it, there’s a lot to speak about.

The BYD Qin Plus switched positions with the AITO M7, with the BYD sedan leaping into the runner-up place, whereas the Huawei-backed SUV dropped to 4th.

The Wuling Mini EV was as much as sixth, whereas the Li Xiang L7 climbed one place, to ninth.

Within the second half of the desk, the highlights are the Tesla Mannequin 3 leaping three positions, to twelfth, whereas the flagship Li Xiang, the L9, was as much as seventeenth.

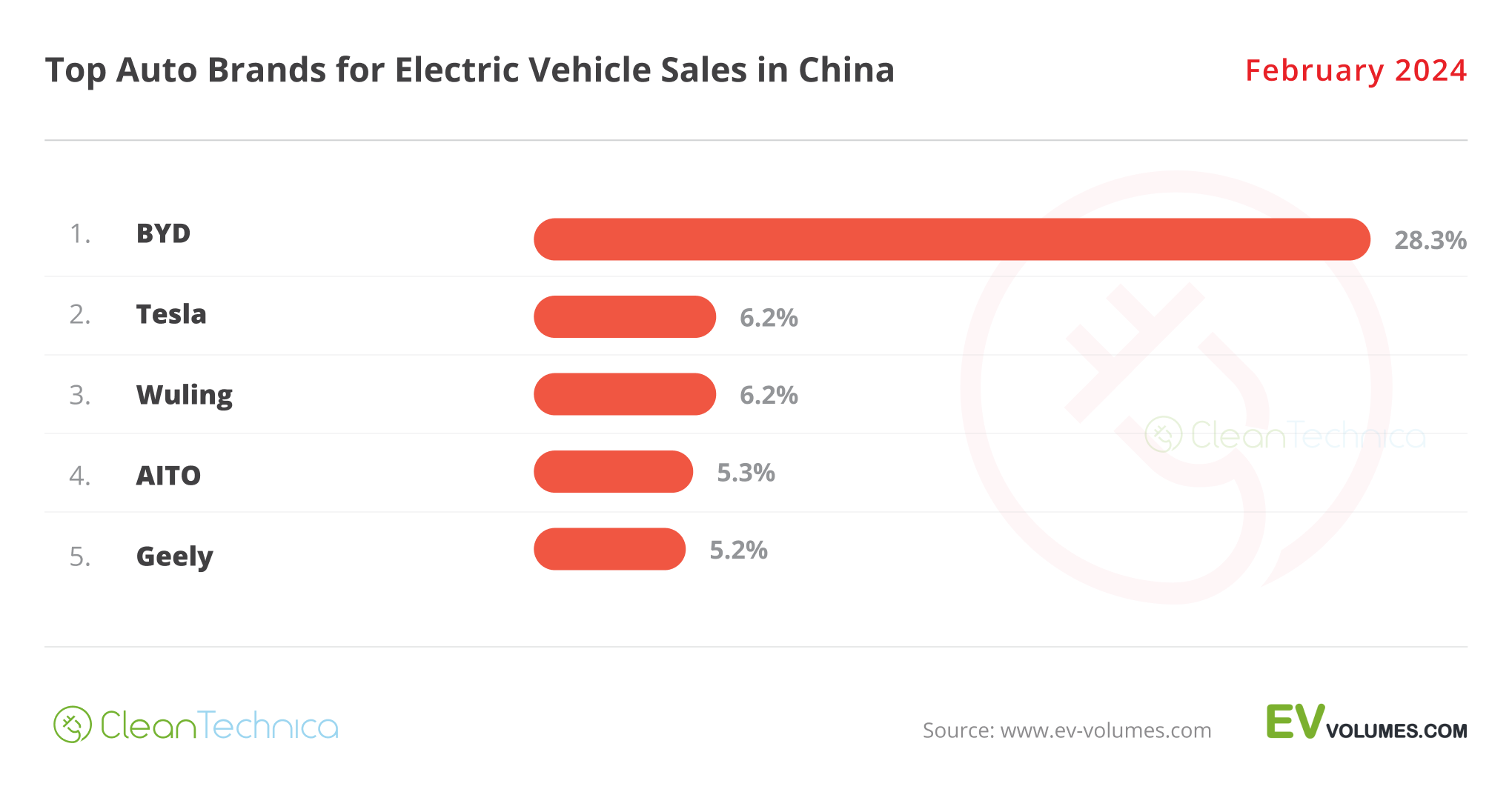

Auto Manufacturers Promoting the Most Electrical Automobiles in China

Wanting on the auto model ratingthere’s some main information, however not on the high. BYD (28.3%, down from 28.5%) stays as steady in its management place as ever.

Issues get extra attention-grabbing under, although. Tesla (6.2%) and Wuling (6.2%) are battling it out for the #2 spot, whereas Geely suffered from a gradual month in February (greatest vendor Panda Mini was solely twentieth) and dropped from #2 to #5.

AITO (5.3%) additionally had a very good month, leaping to 4th and kicking out Li Auto from the highest 5! So, the Huawei-backed startup is now the most well liked startup on the town! If AITO can replicate the M7 success with the lately launched M9, then the runner-up place might be a chance for the model….

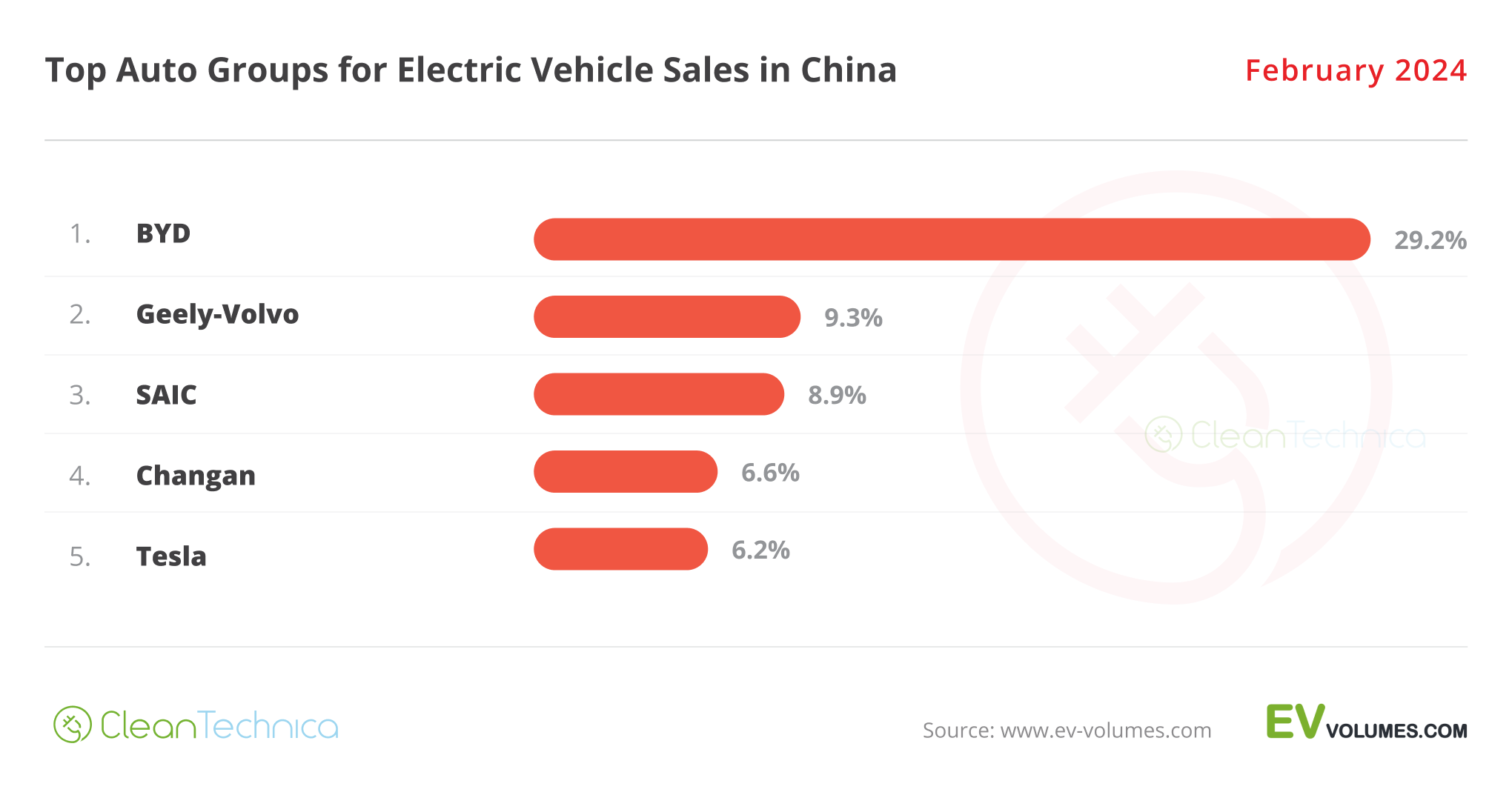

Auto Teams Promoting the Most Electrical Automobiles in China

OEMs/automotive teams/alliancesBYD is comfortably main, with 29.2% share of the market, whereas Geely–Volvo is a distant runner-up, with 9.3% share, and is being threatened by a rising SAIC (8.9%), now in third (benefitting from the great second of its Wuling model).

Changan had a gradual month and dropped to 4th, with 6.6% share. The OEM was unable to put any mannequin within the February high 20.

Tesla (6.2%, up from 6%) is in fifth, and the US make expects to remain among the many high 5 throughout the remainder of the 12 months. Although, given market dynamics and Tesla’s lack of contemporary metallic, it will likely be a tough activity to satisfy.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.