The Australian Securities and Investments Fee (ASIC) has secured its first main court docket win towards Vanguard, a worldwide funding administration firm in Australia. The ruling marks a vital determination within the combat towards greenwashing throughout the monetary trade.

Let’s learn concerning the background, the allegations, and the worldwide ramifications of this case…

Backdrop of the Case: ASIC vs. Vanguard

On February 26, 2021, The Vanguard Ethically Aware World Mixture Bond Index Fund declared property beneath administration exceeding $1 billion. Vanguard serves as each the Accountability Entity and the Funding Supervisor for this registered funding scheme. It contains ETF, AUD Hedged, and NZD Hedged unit lessons.

Graph: Vanguard ESG Developed World All Cap Fairness Index Fund (GBP Acc): Efficiency Historical past for March 2024

supply: Morningstar

ASIC has put aside a number of guidelines and tips to assist the businesses managing funds and the trustees keep away from greenwashing whereas providing their sustainable merchandise. ASIC’s Data Sheet 271 titled “How to avoid greenwashing when offering or promoting sustainability-related products (INFO 271).” is a crucial reference materials for this.

Subsequently, ASIC’s Report 763, “ASIC’s recent greenwashing interventions,” particulars regulatory actions taken by ASIC between July 1, 2022, and March 31, 2023, in response to greenwashing issues.

Final 12 months, ASIC initiated a lawsuit towards Vanguard as a part of a collection of actions centered on greenwashing. These actions additionally included circumstances towards Marsh McLennan firm Mercer Superannuation and superannuation fund Lively Tremendous.

In line with media studies, ASIC Chair Joseph Longo issued a warning to suppliers of funding funds and monetary merchandise, stating that the regulator was intently monitoring deceptive sustainability claims. Longo emphasised that ASIC was guiding fund managers and issuers to keep away from greenwashing practices.

As talked about in ASIC media report, these representations had been made to the general public in a spread of communications. It included:

- 12 product disclosure statements

- a media launch

- statements printed on Vanguard’s web site

- a Finance Information Community interview on YouTube, and

- a presentation at a Finance Information Community Fund Supervisor Occasion which was printed on-line

The Allegations: Vanguard’s Deceptive Environmental Claims

The case towards Vanguard centered on its “Vanguard Ethically Conscious Global Aggregate Bond Index Fund”, which presupposed to put money into corporations aligned with environmental, social, and governance (ESG) ideas. It goals to offer buyers publicity to worldwide fixed-income investments and excludes corporations coping with fossil fuels, alcohol, and tobacco.

ASIC argued that Vanguard’s advertising supplies and product disclosures didn’t adequately disclose the fund’s methodology for choosing investments. Technically talking, the corporate made false claims concerning the exclusionary display utilized to investments in its Index Fund.

This made buyers consider that their cash was being allotted to environmentally accountable corporations extra extensively than it truly was. To call a couple of, Chevron Phillips Chemical and Abu Dhabi Crude Oil Pipeline.

The Fund held investments primarily based on an index referred to as the Bloomberg Barclays MSCI World Mixture SRI Exclusions Float Adjusted Index (Index).

ASIC’s investigation revealed that regardless of Vanguard’s claims of prioritizing ESG components in its funding selections, the fund concerned corporations coping with fossil gasoline extraction and deforestation. This misalignment between Vanguard’s advertising and the fund’s precise holdings constituted a breach of Australia’s shopper safety legal guidelines, based on the regulator.

Vanguard’s Confession earlier than the Court docket…

Throughout a listening to earlier than Justice O’Bryan on March 8, 2024, Vanguard confessed to conducting actions that would mislead the general public and acknowledged making false or deceptive statements.

Subsequently, on March 28, 2024, Justice O’Bryan concluded that Vanguard had violated the ASIC Act a number of occasions by disseminating inaccurate or misleading data concerning the ESG exclusionary screens utilized within the Vanguard Ethically Aware World Mixture Bond Index Fund.

The Court docket additional added,

“As ASIC’s first greenwashing court outcome, the case shows our commitment to taking on misleading marketing and greenwashing claims made by companies in the financial services industry. It sends a strong message to companies making sustainable investment claims that they need to reflect the true position.”

-

Following this go well with, the Court docket has scheduled one other listening to on August 1, 2024, throughout which it should decide the appropriate penalty for the conduct.

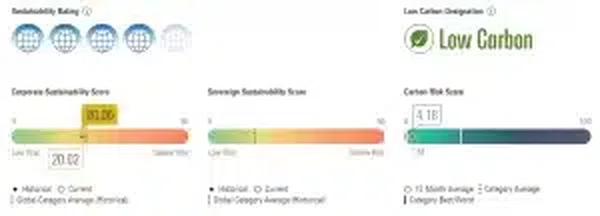

Picture: Vanguard’s Sustainability Index

supply: morningstar

World Implication of Vanguard’s Greenwashing Go well with

The worldwide ramifications of Vanguard’s greenwashing go well with are vital, sending the monetary trade right into a deep-thinking mode. It has impacted the arrogance of buyers concerned in investing in sustainable merchandise worldwide.

-

Vanguard’s case highlights the significance of sustaining transparency and integrity in ESG investments.

-

It emphasizes the necessity for better regulatory scrutiny and enforcement within the realm of sustainable finance.

ASIC’s profitable prosecution of Vanguard ought to incorporate a extra standardized strategy to ESG reporting and disclosure. It ought to present buyers with extra readability to cut back the chance of greenwashing. Vice versa, buyers should conduct thorough and unbiased analysis earlier than investing their ESG funds.

This historic win towards Vanguard is an eye-opener for international monetary establishments concerning the potential penalties of greenwashing. It may possibly trigger reputational harm, give rise to authorized repercussions, and impose monetary penalties as showcased within the Vanguard’s case.

All stated and executed, let’s await the ultimate verdict!