By 2050, Japan intends to develop revolutionary methods poised to cut back atmospheric CO2 globally to “Beyond Zero”. The nation’s sustainable progress roadmap incorporates an efficient nature-positive technique aimed toward reaching financial progress and environmental safety.

In December 2022, on the fifteenth Convention of Events to the Conference on Organic Variety (COP15), delegates adopted the Kunming-Montreal International Biodiversity Framework, outlining world targets for 2030.

The Cupboard beneath the federal government of Japan authorised the Nationwide Biodiversity Technique 2023-2030 in March 2023 to meet its new worldwide dedication. The Transition Methods towards Nature-Optimistic Financial system have been subsequently outlined with the collective determination of the next ministries:

- Ministry of the Atmosphere

- Ministry of Agriculture, Forestry and Fisheries

- Ministry of Financial system, Commerce, and Trade

- Ministry of Land, Infrastructure, Transport and Tourism

Unleashing Japan’s Nature-Optimistic Technique

Japan goals to prioritize nature conservation and uplift its financial insurance policies to transition to a decarbonized future easily. Right here, we’ve summarized and defined the numerous factors from the technique plan proposed by the Ministry of Atmosphere, Japan.

1. Nature Optimistic Administration

The technique emphasizes the necessity for firms to shift in direction of nature-positive administration. The plan focuses on integrating nature preservation strategies into their worth creation processes. This in flip is predicted to open avenues for fostering new financial progress from pure capital.

Conservation and Restoration Efforts: Implementing measures to preserve and restore ecosystems, akin to forests, wetlands, and marine environments, to reinforce biodiversity and ecosystem companies.

Sustainable Useful resource Administration: Selling sustainable practices in useful resource extraction, agriculture, fisheries, and different sectors to reduce destructive impacts on nature.

The press launch from the Ministry of the Atmosphere, beneath the Authorities of Japan has elucidated the importance of nature capital to realize the specified outcomes.

The picture reveals forest restoration work in Japan.

The report explains that particular person firms should think about pure capital as materiality when it comes to each dangers and alternatives for enterprise actions to shift to nature-positive administration. Subsequently, traders will analyze the market to judge the efficiency of the businesses dealing with the pure capital. Based mostly on this efficiency, additional worth creation course of can be decided.

Merely put, the transition extends to a society the place customers and markets assess firms’ efforts. In NP administration, money movement reform includes collaborative efforts amongst authorities, residents, and built-in nature valuations.

2. Maximizing Enterprise Alternatives

The plan seeks to spice up company worth by disclosing TNFD (The Taskforce on Nature-related Monetary Disclosures) and different data, responding to dangers with the intent of disclosure. This method goals to reinforce the agency’s resilience and sustainability, which the market and society will consider. Consequently, this may entice non-public capital and elevate company worth.

The Ministry of the Atmosphere (MoE) has weighed numerous enterprise alternatives and their market sizes. They plan to create alternatives by means of sustainable approaches, akin to decarbonization, useful resource recycling, and leveraging pure capital.

One instance is adopting environment-friendly aquaculture know-how. It might assist implement compound and environment friendly feeding methods. The market dimension for this enterprise is estimated to be round 86.4 billion yen yearly.

3. Help from the Authorities

The ministries emphasised the importance of companies integrating pure capital conservation into their operations. The Japanese authorities has outlined the next initiatives:

- Going past company social duty (CSR) initiatives. It includes preserving pure capital for each societal and financial sustainability.

- Promote assessing the worth of initiatives by means of the Biodiversity Promotion Actions Promotion Act. Upgrading applied sciences associated to different supplies, biomimicry, and so on.

- Implementing governmental initiatives to facilitate the shift in direction of a nature-positive financial system. Specializing in biodiversity conservation and carbon credit score initiatives

- Encourage firms to reduce their carbon footprint and maximize their efforts on nature.

4. Inexperienced Infrastructure Growth

Japan’s nature-positive technique additionally focuses on investing in inexperienced infrastructure tasks that improve pure habitats, akin to city parks, inexperienced roofs, and permeable pavements.

Figuring out and creating OCEMs- Below the inexperienced infrastructure growth technique, some particular non-public lands bear certification as Different Efficient area-based Conservation Measures (OECM) websites. In Japan, numerous areas embody the satochi-satoyama, biotopes, conserved forests, and inexperienced areas in cities and factories. OCEMs incentivize efforts by firms and others, extending past protected areas.

Growing inexperienced infrastructure assures resilience to local weather change and quite a few advantages to society. Most significantly, it will assist generate strong carbon credit score.

Japan’s Inexperienced Finance Drive: Strengthening Sustainability Funding

The MoE has outlined tips for inexperienced finance to advertise disclosure based mostly on worldwide requirements akin to TCFD (Process Power on Local weather-Associated Monetary Disclosures) and ISSB (Worldwide Sustainability Requirements Board), and has promoted regional monetary investments for native decarbonization.

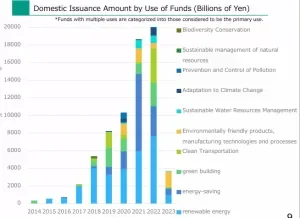

Graph: Information launched by the Ministry of Atmosphere reveals home funds for sustainable progress in Japan.

Japan has estimated 150 trillion yen decarbonization funding over the subsequent 10 years to fortify its home inexperienced finance. This determination would additional abridge home and international funds directed to Japan’s decarbonization targets.

The dramatic enhance in inexperienced bond issuance strengthens the financing of a sustainable society. Though using funds has been diversifying through the years, renewable vitality and vitality conservation nonetheless dominate most allocations.

Nonetheless, not too long ago, financing for sectors past local weather change mitigation, akin to biodiversity conservation and useful resource recycling has simply begun.

Boosting J-Credit by means of the nature-positive financial system

In response to media studies, Japan envisions,

“A transition to a “nature-positive” financial system which covers areas akin to carbon and biodiversity credit might create for Japan 47 trillion yen ($309.7 billion) in new enterprise alternatives yearly by 2030.”

Like different nations dedicated to internet zero and fascinating in carbon credit buying and selling, Japan additionally participates actively. The federal government points carbon credit score certificates, often known as J-credits. They are often bought in Japan for carbon offsetting. Boosting J-credits is one strategy to foster a nature-positive financial system.

- The technique goals to advertise the use and creation of forestry J-Credit. It primarily includes the agricultural sector and its function in preserving the biodiversity of Japan.

- J-Credit provide home GHG discount or removals, usable for numerous functions together with the voluntary emissions buying and selling scheme GX-League

- They promote the J-Blue Credit score system about blue carbon tasks that sequester carbon inside oceanic ecosystems.

J-Credit demand rises in 2024

Reported from offsel.internet:

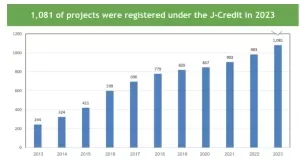

In response to the J-Credit score System knowledge for 2024, the variety of registered J-Credit score tasks hit a document excessive of 1,081. Moreover, the licensed quantity of CO2 emission reductions was 9.36 million t-CO2.

Supply: OFFSEL.internet

Supply: OFFSEL.internet

Japan additionally intends to have interaction in worldwide biodiversity credit score techniques to fulfill the demand from world industries dealing with sources outdoors its nationwide area.

Moreover, it has actively engaged with the UK and France within the Worldwide Advisory Panel on Biodiversity Credit to debate future targets for biodiversity credit score and offset insurance policies for the nation.

From the flowery data and studies, plainly Japan has a vivid future towards making a nature-positive financial system.