In line with a current report by the World Financial institution, American video streaming firm Netflix, expertise big Apple, and British oil multinational Shell are among the many distinguished international firms tapping into Kenya’s voluntary carbon market (VCM).

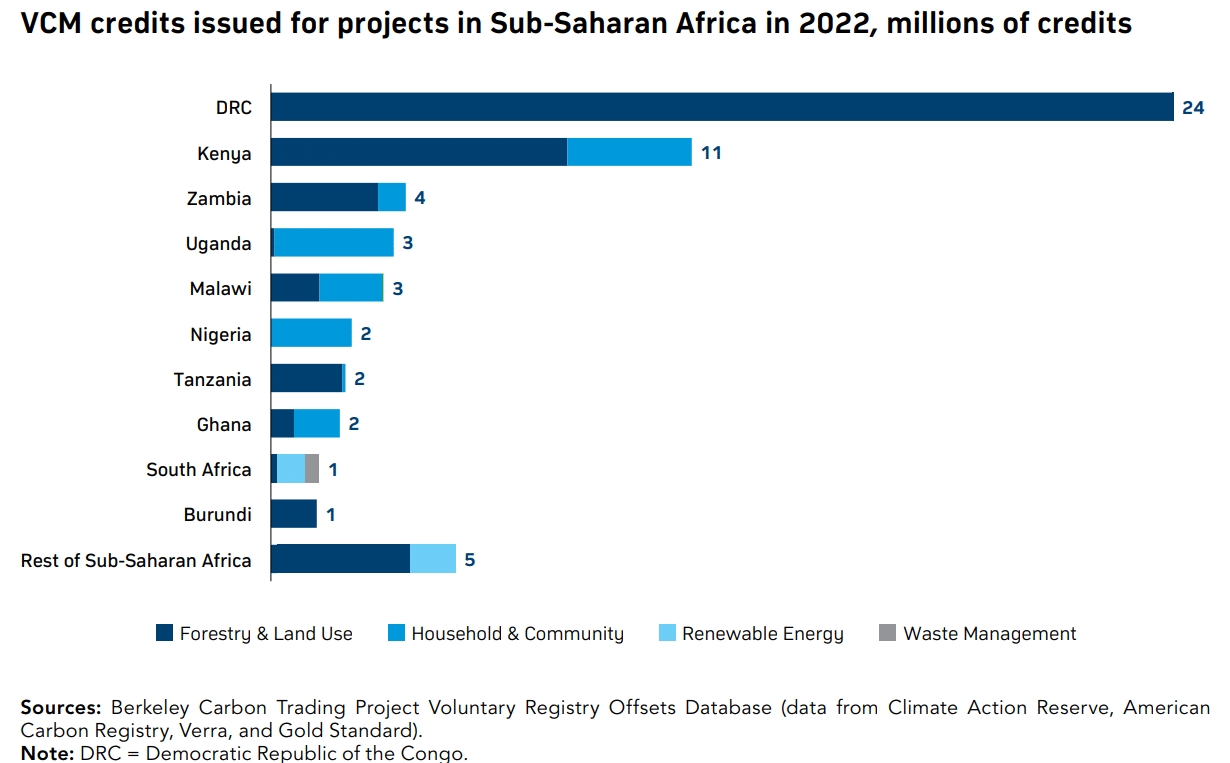

The report, titled ‘Carbon Market Guidebook for Kenyan Enterprises,’ reveals that in 2022, Kenya ranked because the second largest issuer of VCM carbon credit in Africa, trailing solely the Democratic Republic of the Congo.

Because the launch of the African Carbon Markets Initiative (ACMI) in 2022, Africa’s enormous carbon credit score potential has been unlocked. ACMI goals to mobilize local weather finance for the continent, specializing in clear power entry and sustainable growth. By leveraging carbon markets, the ACMI directs funds to emissions discount initiatives, addressing power poverty and selling renewable power.

From Hollywood to Oil Fields: Huge Gamers Enter Kenya’s Carbon Market

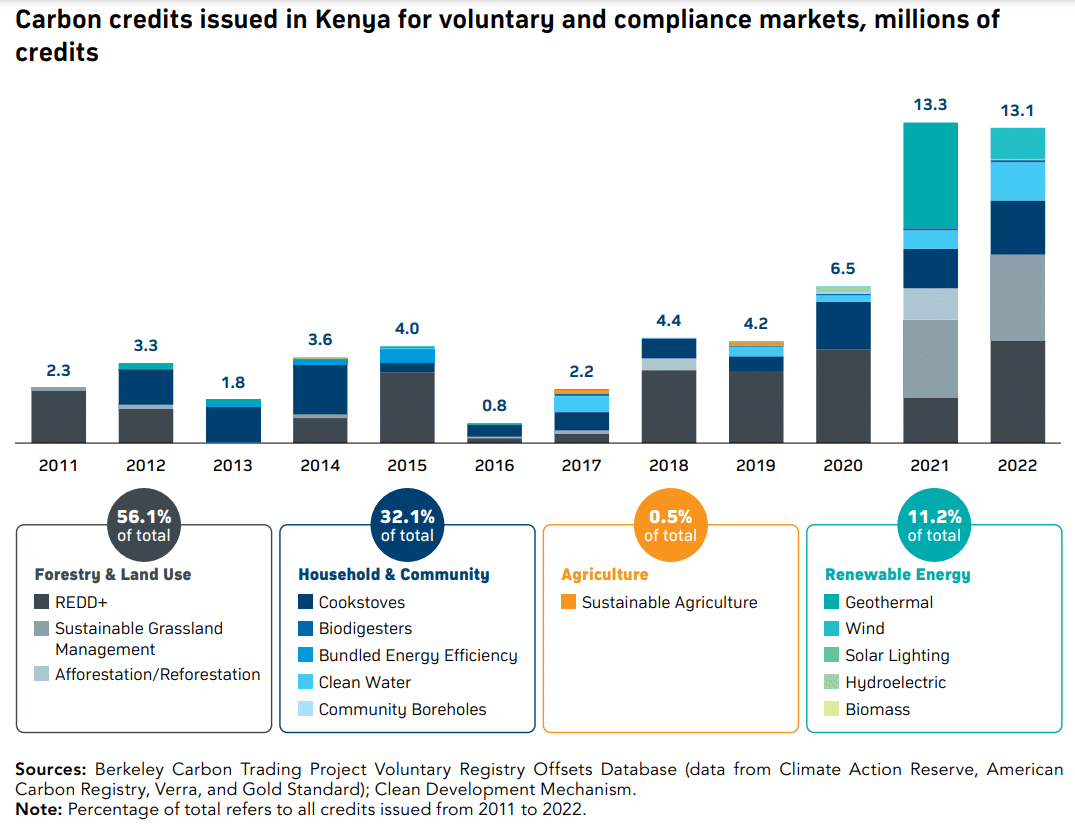

Since 2011, Kenya has issued over 59 metric tons of carbon credits to varied initiatives. Eighty three % of those credit come from voluntary markets.

Many of the voluntary carbon credits issued in Kenya stem from nature-based initiatives. Nonetheless, the report additional highlights that tech-based initiatives are starting to emerge out there.

In a carbon credit score market, organizations and people buy credit generated by way of emission discount initiatives to offset their carbon footprint. Firms whose enterprise operations pollute pay important sums to help initiatives geared toward eradicating or absorbing CO2 from the environment.

Every credit score represents the discount or removing of 1 tonne of CO2 from the air, usually achieved by way of initiatives centered on combating deforestation, notably in growing nations.

The first purchasers of VCM credit in Kenya have been main companies resembling Netflix, Apple, ShellAir France-KLM, BHP, Delta Air Linesand Kering, the report notes. Different notable firms collaborating in Kenya’s carbon credit market embody Nedbank from South Africa, Nespresso from Switzerland, and Zenlen Inc.

Unveiling Kenya’s Carbon Credit score Panorama

The report highlights that a lot of the carbon credit generated from Kenya in voluntary markets have been attributed to forestry and land use initiatives. Particularly, these credit have been issued to 4 builders, three of that are based mostly in Kenya:

- Wildlife Works Carbon,

- Chyulu Hills Conservation Belief, and

- Northern Rangelands Belief.

These organizations have contributed to carbon credit score era by way of initiatives geared toward lowering emissions from deforestation and forest degradation (REDD+). In addition they concentrate on implementing sustainable grassland administration initiatives to help native environmental conservation efforts.

Moreover, family and community-based credit, notably these associated to cookstovessymbolize one other important kind of credit score generated within the nation.

Nonetheless, there’s restricted transparency relating to the costs paid for these credit. They’ve primarily been offered by way of bilateral negotiations over-the-counter, making it difficult to find out the precise costs. The enterprises liable for these credit are extra fragmented and infrequently depend on carbon credit score income to attain profitability.

A small portion of credit generated in Kenya have additionally been offered in compliance markets, issued by way of the Clear Growth Mechanism.

The World Financial institution has beforehand estimated the price of eliminating a ton of carbon dioxide to be between $40 and $80 based mostly on the Paris Local weather Settlement. But, the precise costs paid for these Kenyan credit stay undisclosed.

Carbon Credit score Rush: Kenya Emerges as Africa’s Contender

In 2021, a number of main firms bought carbon credit from Kenya and Uganda. Delta acquired a complete of 1,164 kilotons of Carbon equal (KtCO₂e) from each nations, whereas Netflix and BHP bought 699 and 200 KtCO₂e from Kenya alone.

In 2022, 11 million VCM credit had been issued to Kenya, making it the second-largest issuer of carbon credit in Africa after the Democratic Republic of the Congo, which issued 24 million credit.

Zambia, Uganda, and Malawi issued 4, 3, and three million credit, respectively.

The decision for carbon credit as a big income supply for Kenya comes amid rising consciousness of the environmental influence of industries resembling fossil fuels, agriculture, trend, and transportation. President William Ruto has been advocating for carbon credit to mitigate emissions and generate revenue for the nation.

On the twenty eighth United Nations Local weather Summit (COP28) held in Dubai in December final 12 months, Kenya joined different nations in emphasizing the significance of carbon markets as complementary to emission discount efforts. The nations careworn the necessity for transparency and high-integrity requirements to maximise the effectiveness of those markets.

In response to this, the Ministry of Setting in Kenya revealed draft rules that will regulate the carbon market. Among the many proposals is the stipulation that 25% of the income generated by personal firms from the sale of carbon credit can be directed to the federal government.

Moreover, the ministry plans to ascertain a nationwide carbon registry that will function a database for all issued or acknowledged carbon credit. Personal firms need to register with this registry and pay a price to start accumulating carbon credit.

These measures purpose to make sure market accountability and transparency whereas offering a framework for income era and conservation efforts.

Kenya’s voluntary carbon market is gaining traction amongst international gamers, with tech giants and oil firms leaping into the fray. With Africa’s carbon credit score potential unlocked, Kenya goals to harness this market to fight local weather change and drive sustainable growth.