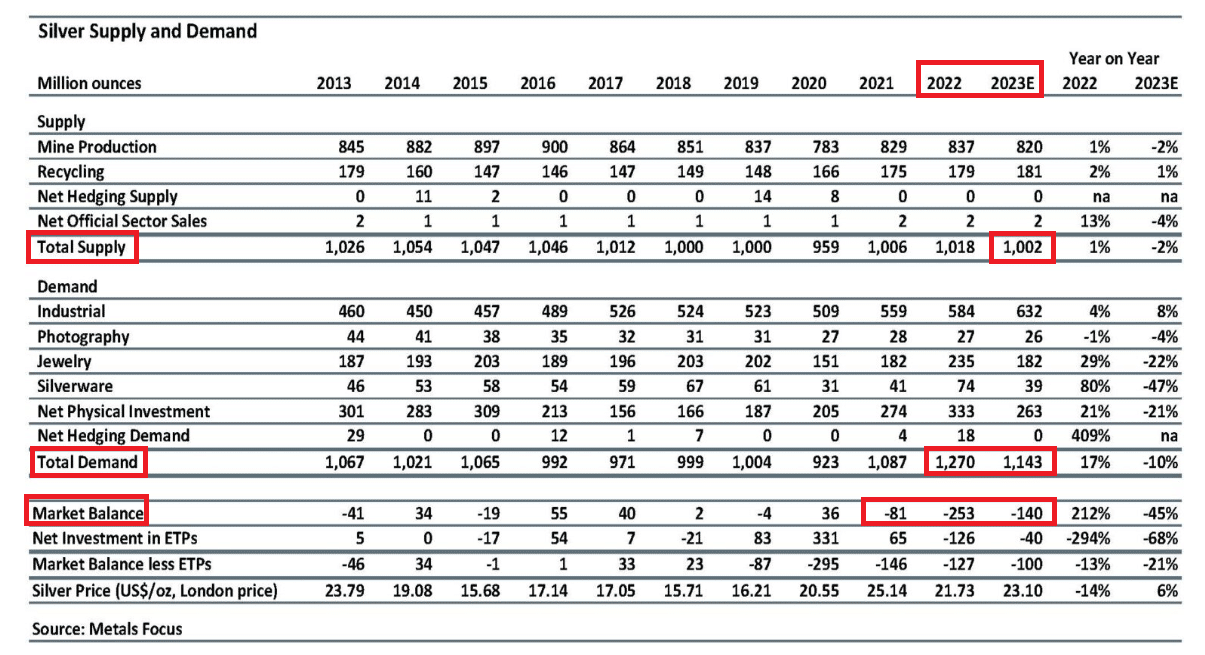

The worldwide silver deficit is anticipated to extend by 17%, reaching 215.3 million ounces in 2024. This rise is attributed to a 2% development in demand primarily pushed by strong industrial consumption, coupled with a 1% decline in complete provide, as reported by the Silver Institute business affiliation.

Balancing Demand and Provide Dynamics

Silver, utilized in numerous industries together with jewellery, electronics, electrical automobiles, and photo voltaic panels, in addition to for funding functions, is going through its fourth consecutive yr of a structural market deficit.

Philip Newman, managing director at consultancy Metals Focusemphasised that the deficit within the silver market serves as a powerful help and basis for the worth. Regardless of a 30% lower within the deficit final yr, it remained substantial at 184.3 million ounces.

-

Whereas international provide has remained comparatively steady across the 1-billion-ounce mark, industrial demand witnessed notable development of 11%.

Nevertheless, regardless of the scarcity, seen silver inventories and vital steel shares held by people and traders proceed to defend the silver market from fast strain.

Newman highlighted that whereas identifiable silver inventories and off-exchange steel holdings stay appreciable, a few of these reserves could also be tightly held. Consequently, the affect of ongoing deficits available on the market stays to be seen.

Reportedly, shares held in commodity alternate depositories and London vaults skilled a 5% decline final yr, amounting to almost 15 months of worldwide provide by the top of 2023. The vast majority of the lower in reported shares occurred in China, the place speedy industrial demand development of 44% is reshaping native provide/demand dynamics.

Spot silver costs, experiencing an 18% enhance year-to-date, reached $29.79 per ounce final week, marking their highest degree in over three years, amidst a rally in gold costs and robust copper prices.

Shining Vivid within the Photo voltaic Revolution

The surge in photo voltaic installations and electrical car manufacturing not solely represents a present pattern but additionally serves as a compelling indicator for heightened silver demand. Silver’s unparalleled conductivity and its essential function in photovoltaic cells place it as a cornerstone within the transition in direction of renewable vitality sources.

The demand for silver within the photo voltaic business has skilled a notable uptrend, accounting for round 5% of the whole silver demand in 2014 and increasing to about 14% by the top of 2023.

Based on estimates by BloombergNEF, every gigawatt of photo voltaic capability requires roughly 12 tonnes of silver. Utilizing this determine as a foundation, the demand for silver in photo voltaic panels may witness a considerable surge of practically 169% by 2030.

This surge would translate to an approximate requirement of 273 million ounces of silver, constituting roughly ⅕ of the whole silver demand based mostly on present pattern projections.

A lot of this development is attributed to China, which is poised to surpass the whole photo voltaic panel installations in america this yr.

Gregor Gregersen, founding father of Silver Bullion, emphasizes that the solar industry exemplifies the inelastic demand for silver. Though developments have enabled the photo voltaic sector to change into extra environment friendly in its silver use, rising developments are shifting this dynamic.

In the meantime, provide is exhibiting indicators of pressure. Regardless of a virtually 20% enhance in demand final yr, silver manufacturing remained flat, in keeping with knowledge from The Silver Institute. This yr, estimates counsel that manufacturing will enhance by 2%, but industrial consumption will climb by 4%.

Silver Squeeze: Assembly Demand Amidst Provide Challenges

Nevertheless, boosting provide isn’t a simple process, given the restricted availability of major mines. Round 80% of silver provide comes from lead, zinc, copper, and gold tasks, the place silver is a by-product. This pressure on provide has led to considerations about future shortages.

A examine from the College of New South Wales means that the photo voltaic sector alone may deplete between 85–98% of worldwide silver reserves by 2050.

Research are ongoing for different applied sciences utilizing cheaper metals however their viability stays unsure. Regardless of present worth fluctuations, specialists anticipate that substitution will change into extra interesting as silver costs rise, in the end resulting in a market equilibrium at increased worth ranges.

As the worldwide silver deficit expands and demand surges, the market faces a posh panorama. The present surge in silver costs displays market dynamics influenced by industrial consumption and investor sentiment. Nevertheless, the journey forward requires strategic planning to deal with provide challenges and maintain the silver market’s very important function within the transition to renewables and web zero.