The Regional Voluntary Carbon Market Firm (RVCMC) introduced its partnership with Xpansiv, a number one market infrastructure supplier within the international power transition. The aim is to facilitate the technological spine for RVCMC’s forthcoming carbon credit score trade in Saudi Arabia. It can launch later this 12 months.

RVCMC and Xpansiv Forge Path to Sustainable Buying and selling

Established in October 2022, RVCMC was based by the Public Funding Fund (PIF) and the Saudi Tadawul Group Holding Firm. PIF holds an 80% stake within the firm, whereas Tadawul Group holds the remaining 20% stake.

With a shared imaginative and prescient, RVCMC is swiftly and ambitiously constructing a reputable voluntary carbon market with international significance. Central to its mission is the prioritization of high-quality carbon credits and proactive local weather motion.

RVCMC is spearheading the event of an ecosystem that encompasses numerous elements important for efficient local weather mitigation. This ecosystem consists of the next monetary automobiles and companies:

- An funding fund devoted to financing local weather mitigation tasks,

- An trade tailor-made for the buying and selling of carbon credit, and

- Advisory companies aimed toward aiding organizations in navigating the complexities of decarbonization.

The choice to enlist Xpansiv stems from RVCMC’s endeavor to furnish merchants with institutional-grade infrastructure, making certain swift and safe transactions.

Xpansivfamend for working CBL, the world’s largest spot carbon credit score market, will furnish the brand new trade with its open-access market infrastructure. This features a totally automated, same-day settlement platform and a portfolio administration system, each seamlessly built-in with main international registries.

RVCMC will impose stringent standards for the trade to completely listing high-integrity carbon credit score tasks. All of them are validated by impartial normal setters, thereby fortifying the worldwide power transition.

Contracts can be meticulously crafted to align with trade greatest practices, incorporating a gradual transition in direction of carbon removal initiatives.

Fueling Local weather Motion: RVCMC’s Function in World Carbon Markets

To satisfy the goals outlined within the Paris Settlement and attain international internet zero greenhouse fuel emissions targets, rising markets, and growing nations necessitate an annual funding of $2.4 trillion in local weather motion by 2030.

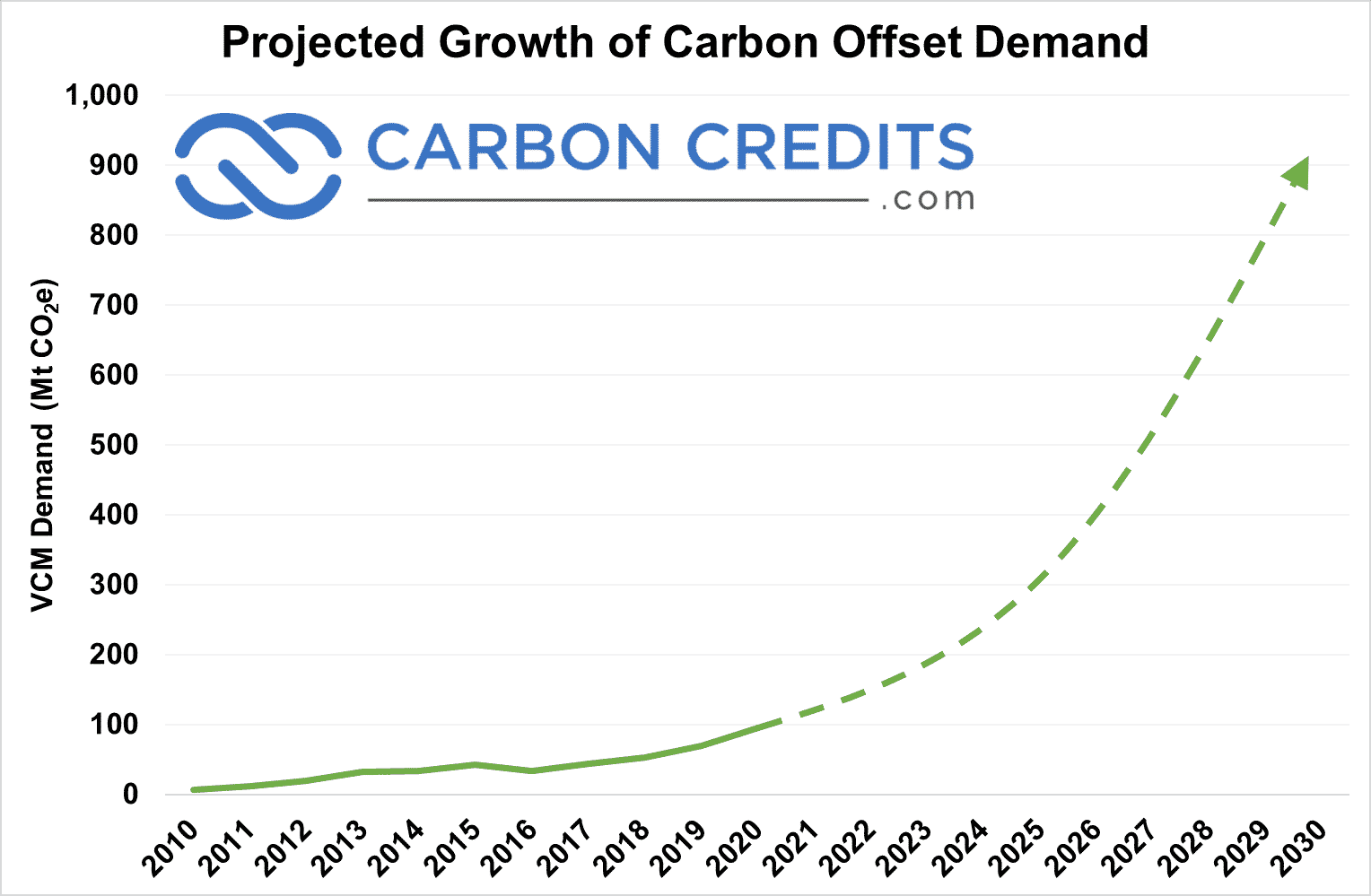

The worldwide VCM, forecasted to achieve $3 billion by 2024’s finish, performs a pivotal position in bridging this funding hole. Projections point out that the market may develop to $100 billion by 2030, underscoring its significance in advancing local weather mitigation efforts.

RVCMC’s previous voluntary carbon credit score auctions have considerably spurred demand within the area. They noticed the sale of 1.4 million tonnes in 2022 and a couple of.2 million tonnes in 2023,

The forthcoming launch of the brand new RVCMC trade will assist amplify carbon credit score buying and selling in Saudi Arabia and past.

Such growth aligns with the Kingdom’s dedication to preventing local weather change as outlined within the Saudi Green Initiative and Imaginative and prescient 2030. This initiative goals to direct local weather funding to areas the place it’s most urgently wanted. It addresses local weather issues sustainably in 3 ways: lowering emissions, increasing forestation, and safeguarding land and sea areas.

Riham ElGizy, RVCMC CEO, emphasised the significance of a carbon credit score buying and selling trade in attaining their aim to be one of many greatest VCMs worldwide by 2030. He additional added that:

“Our work with Xpansiv will help us build the infrastructure the market needs for a thriving, transparent and increasingly liquid market, one that can maximize the role of carbon offsets in tackling climate change across the Global South.”

John Melby, CEO of Xpansiv, echoed this sentiment, stating:

“We look forward to supporting the company’s mission to develop a marketplace that will channel carbon finance at scale, which is essential to realizing the global energy transition at an accelerated pace.”

Xpansiv is on the forefront of advancing the world’s power transition by means of its sturdy market infrastructure. The corporate’s Platform Options group operates the biggest spot trade for environmental commodities, encompassing carbon credit and renewable energy certificates.

Xpansiv Registry and Power Options stands because the premier supplier of registry infrastructure for power, energy, and environmental markets. Moreover, Xpansiv Managed Options can also be the biggest impartial platform for managing and promoting photo voltaic renewable power credit throughout North America.

With a shared imaginative and prescient of selling high-quality carbon credit and proactive local weather motion, RVCMC and Xpansiv decide to foster a clear, liquid market that accelerates the worldwide power transition. Because the world strikes in direction of attaining net zero emissionsinitiatives like RVCMC’s trade play an important position in mobilizing funding and driving impactful local weather mitigation efforts.