BP’s electrical car (EV) charging arm is seizing the chance offered by Tesla’s scaling again of its Supercharger group, pledging to take a position US$1 billion to increase its community throughout the US.

With plans to put in over 3,000 charging factors, together with large-scale hubs termed Gigahubs, BP goals to handle the rising demand for EV charging infrastructure.

BP’s Billion-Greenback Funding in EV Charging

Sujay Sharma, CEO of bp pulse Americas, emphasizes the corporate’s readiness to accumulate actual property and expertise, inviting stranded companions to succeed in out for collaboration alternatives. Tesla’s latest downsizing of its Supercharger group has created a gap for opponents to bolster their presence out there. The corporate stated that it:

“is aggressively looking to acquire real estate to scale our network, which is a heightened focus following the recent Tesla announcement.”

Final 12 months, the corporate entered into an settlement to obtain round $100 million value of Tesla Supercharger {hardware}, with deployment set to begin later this 12 months and in early 2025.

BP has downsized its electrical car charging enterprise by greater than 10% and exited a number of markets attributable to unsuccessful development expectations in industrial EV fleets. The 250-kilowatt chargers underneath the BP Pulse model will likely be adaptable to each Tesla’s North American Charging Customary (NACS) and Mixed Charging System (CCS) connectors, facilitating the charging of EVs from numerous producers.

As automakers more and more undertake Tesla’s NACS, it poses a problem to the rival CCS, doubtlessly positioning Tesla’s superchargers because the business commonplace.

BP pulse is a vital a part of bp’s technique to grow to be a web zero firm by 2050 or sooner.

Filling the Hole Left by Tesla’s Downsizing

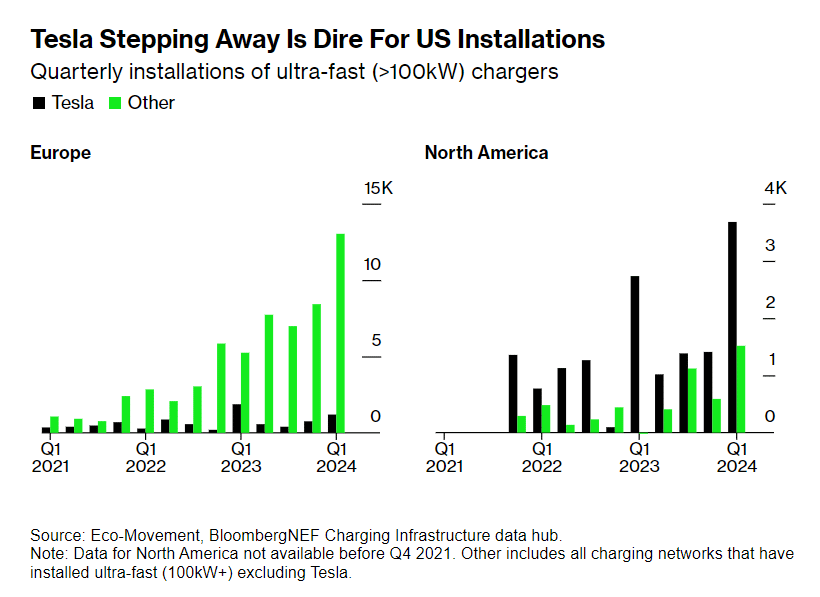

Elon Musk just lately made the choice to scale back Tesla’s Supercharger group, signaling a slower tempo of development for the EV charging community. This transfer raises issues concerning the progress of charging infrastructure and EV adoption in North America.

BloombergNEF estimates that the area would require 400,000 ultra-fast chargers by 2030 to accommodate 40 million EVs. Presently, Tesla holds a major share, accounting for 74% of all high-speed chargers in North America.

Two years in the past, Musk stated that Tesla aimed for a ten% revenue margin from its community. Lately, BNEF estimated that the corporate might doubtlessly attain $740 million in annual earnings from charging by 2030, representing round 8% of the corporate’s total revenue final 12 months.

Regardless of Tesla’s dominance within the high-speed charging sector, opponents like BP see a chance to fill the hole and achieve market share. BP’s proactive strategy consists of procuring Tesla supercharger {hardware} and searching for to onboard former Tesla staff to help its enlargement plans.

Different corporations, comparable to EVgoadditionally view Tesla’s slowdown as an opportunity to extend their market footprint. CEO Badar Khan sees this shift within the aggressive panorama as favorable for corporations like EVgo to step up and fulfill the rising demand for EV charging infrastructure.

Bp’s transfer aligns with the broader business plan of the Biden administration.

Accelerating EV Infrastructure within the US

The USA authorities is allocating a powerful $623 million to speed up the enlargement of EVs as a part of its efforts to remodel the transportation sector. These grants, made out there by the 2021 Bipartisan Infrastructure Legislation, are meant to facilitate the widespread adoption of EVs throughout the nation.

Regardless of there being over 4 million electrical autos presently on American roads, progress in creating the EV charging infrastructure has been sluggish. Solely New York and Ohio have operational charging stations, with Pennsylvania and Maine anticipated to launch their very own stations this 12 months.

Globally, round 11 million EV items had been bought final 12 months, and the EV market is projected to succeed in a outstanding $623 billion in gross sales in 2024, encompassing each battery electric autos and plug-in hybrids. This development trajectory is anticipated to proceed, with the market quantity reaching $906 billion by 2028, accommodating 17 million car items.

The grant goals to reinforce the accessibility, reliability, and comfort of EV chargers for American drivers, whereas additionally fostering job creation in charger manufacturing, set up, and upkeep sectors.

With Tesla’s Supercharger downsizing creating a gap out there, BP is stepping up its EV charging enlargement efforts within the US, backed by a considerable funding. The transfer goals to handle the rising demand for EV charging infrastructure. And it additionally aligns with broader authorities initiatives to speed up EV adoption and infrastructure growth.