Xpansiv’s CBL voluntary carbon market (VCM) exercise noticed important block trades at each the start and finish of the week. The week began with a block commerce of 175,000 N-GEO Trailing contracts settling at $0.35, marking the most important commerce of the week on the lowest unit value.

The info introduced within the report is from the Xpansiv Knowledge and Analytics database. It gives a complete assortment of spot agency, indicative bids/gives, and transaction information.

Xpansiv supplies intensive market information sourced from CBL, acknowledged because the world’s largest spot environmental commodity trade. This consists of every day and historic info on bids, gives, and transactions for varied environmental property:

- Voluntary carbon credit,

- Compliance carbon, and

- Voluntary renewable power certificates.

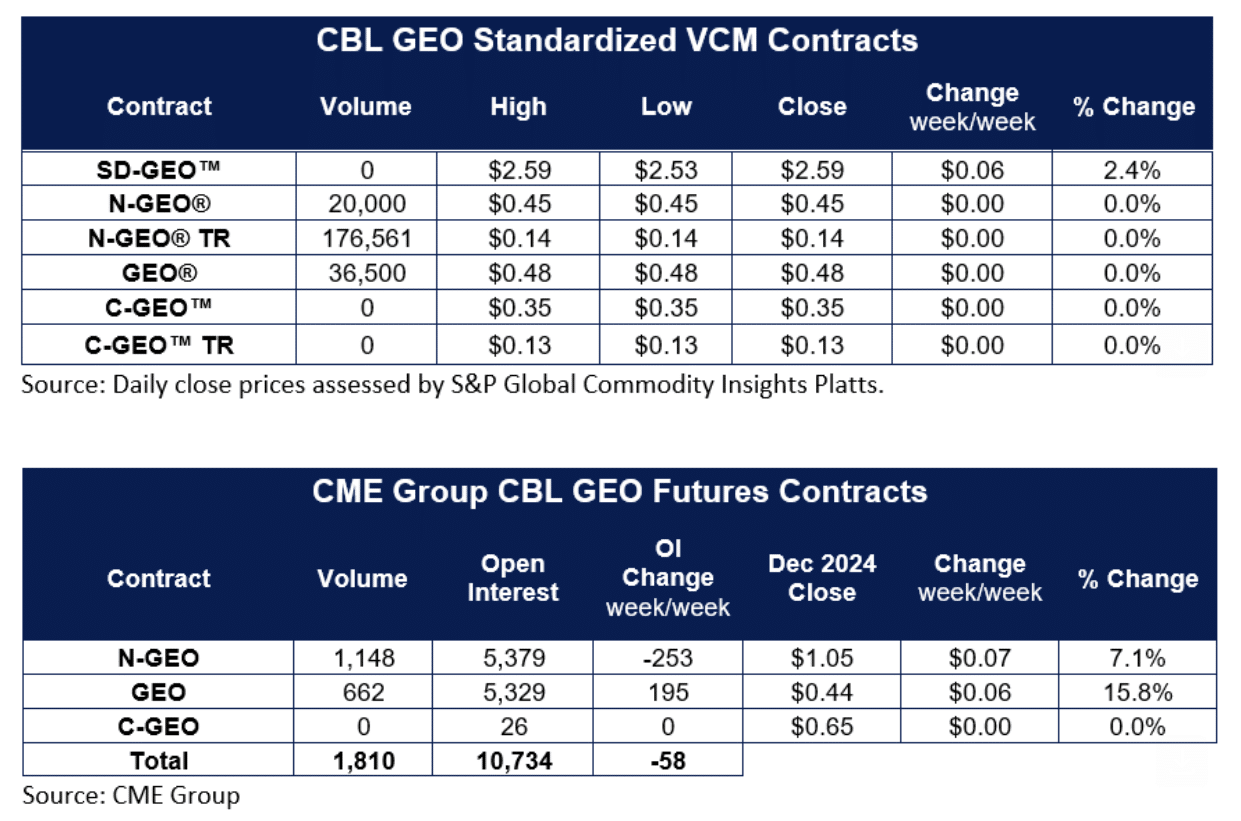

On Friday, block trades of 1.2 million metric tons of CBL N-GEO and CBL GEO December futures occurred at $0.99 and $0.44, respectively, driving weekly value positive aspects of seven% and 16% within the contracts.

Trades and Developments from the CBL’s VCM Report

Blocks of N-GEO-eligible carbon credits have been settled at prices as much as $5.50. That is according to the $5.40 month-to-month common for recent-vintage, spot AFOLU credit score transactions on the trade. Pilot-phase CORSIA GEO-eligible credit score blocks traded as much as $1.35, barely beneath CBL’s $1.98 month-to-month common value for expertise credit. Moreover, 111 OTC-matched ACCU credit have been settled through the buying and selling platform.

On-screen matched trades included 500-ton a number of GS 11134 classic 2022 Rwandan power effectivity credit traded at $6.50. And VCS 1477 classic 2016 Cambodian Mai Ndombe AFOLU credit traded at $1.25.

- A complete of 275,167 tons have been traded through the CBL spot trade. Plus, an extra 1,810,000 tons have been traded through CME Group’s CBL GEO Emissions futures advanced.

New gives within the voluntary carbon buying and selling platform included VCS REDD, ARR, and cookstove carbon credits at costs as much as $11.00. A request-for-quote (RFQ) in search of bids for 30,000 MWh of South African photo voltaic I-RECs generated in 1H 2024 was additionally circulated at an indicated provide value of $1.00/MWh.

Within the North American Compliance Marketthere was important exercise with over 70,000 PJM credit exchanged through CBL. This exercise was primarily attributable to counterparties settling bilateral transactions by CBL’s post-trade infrastructure.

Particularly, 25,000 classic 2023 Virginia credit have been settled, together with 3,574 classic 2024 DC photo voltaic credit and 14,643 classic 2023 Maryland photo voltaic credit.

Display screen buying and selling was concentrated in tier 1 PJM markets, the place Pennsylvania classic 2024 credit noticed an increase to $35.00 on 9,551 credit traded. Equally, classic 2023 Maryland credit skilled a $0.25 improve to $28.00. Lastly, there have been 6,851 classic 2024 Virginia credit traded on the CBL at $35.00.

Xpansiv Join™ to Revolutionize Market Infrastructure

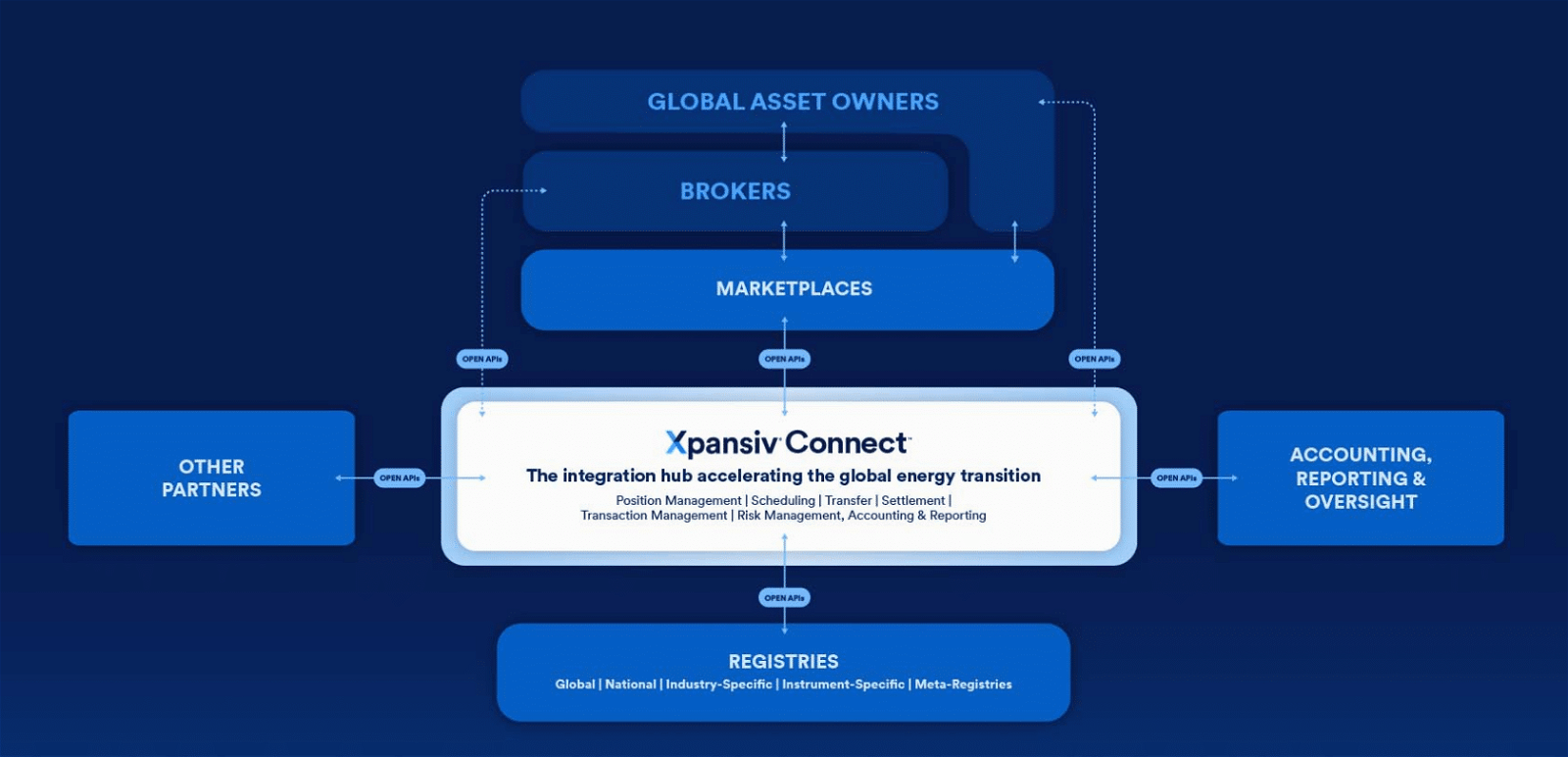

Following their report, Xpansiv® has launched Xpansiv Connect™an open-access infrastructure designed to facilitate the scaling of the worldwide power transition. This initiative consists of integration with main multi-registry environmental asset administration and automatic settlement methods.

Xpansiv Join™ gives all stakeholders seamless entry to the corporate’s subtle buying and selling, post-trade settlement, meta-registry, and portfolio administration platforms. These embrace finish customers, brokers, banks, exchanges, and different service and platform suppliers.

The platform comes absolutely built-in with 13 main international registries. Furthermore, Xpansiv Join™ helps 5 voluntary carbon credit score marketplaces and an unlimited community of tons of of direct market contributors.

Xpansiv is collaborating with outstanding market contributors globally to develop and improve options and providers utilizing the platform. These collaborators embrace Trafigura, MSCI Carbon MarketsGoNetZero™, and Patch.

John Melby, Chief Govt Officer of Xpansiv®, emphasised the significance of launching this new system, saying that:

“We believe opening access to our proven, institutional-grade technology infrastructure will best support the ecosystem of interoperable technology and market solutions needed to achieve a timely and equitable global energy transition.”

Partnerships and Collaborations for a Sustainable Power Transition

The launch of Xpansiv Join marks a major milestone because it opens up Xpansiv’s automated settlement and multi-asset, multi-registry portfolio administration system to exterior buying and selling platforms and exchanges for the primary time.

- This transfer extends the accessibility of Xpansiv’s superior infrastructure, which processes over 1 billion asset transfers yearly, to a broader ecosystem of stakeholders.

Among the many companions exploring alternatives to leverage Xpansiv Join are the Mercantile Change of Vietnam and insurers Oka and We. Moreover, present companions comparable to BeZero Carbon, Sylveraand the Commonwealth Financial institution of Australia are additionally supporting Xpansiv Join.

Remarkably, the carbon market developed by the Regional Voluntary Carbon Market Firm (RVCMC) within the Kingdom of Saudi Arabia will implement Xpansiv Join comprehensively.

Leveraging this infrastructure, RVCMC goals to combine its unbiased trade matching engine with post-trade settlement and portfolio administration system capabilities. The voluntary carbon credit score market goals to turn out to be operational by the ultimate quarter of 2024, facilitated by the implementation of Xpansiv Join.