With the pressing must mitigate local weather change, the function of fossil gasoline giants in exacerbating this disaster can not be overstated. Concrete actions have to be taken to handle the environmental and social impacts attributable to these entities. One such measure gaining traction is imposing taxes on fossil gasoline corporations.

This month, a groundbreaking report, titled “Climate Damages Tax” revealed a proposed tax on fossil gasoline extraction able to mobilizing almost $720 billion by 2030. This tax affords a considerable monetary enhance to the world’s most weak nations going through extreme local weather disaster.

Let’s deep dive into this new taxation rule and its affect on fossil gasoline giants and the economic system at giant.

David Hillman, director of Stamp Out Poverty and co-author of the report, emphasised the report’s name to motion.

“The richest, most economically powerful countries, with the greatest historical responsibility for climate change, need look no further than their fossil fuel industries to collect tens of billions a year in extra income”.

He elaborated that this sturdy strategy might considerably increase the funds for the lately established “Loss and Damage Fund”, a key consequence of the COP28 summit in Dubai.

Stamp Out Poverty: Advocating for International Finance Options

Stamp Out Poverty, based in 2006, advocates for brand new finance sources to fight poverty and local weather change globally. It established the Make Polluters Pay coalition in 2021, collaborating with worldwide companions to safe an settlement for organising a Loss and Harm Fund at COP27.

Emergence of the Loss and Harm Fund

The Loss and Harm Fund emerged from strain from low-income international locations in search of help in mitigating local weather threats. Many growing nations missing assets to handle local weather challenges or enhance renewable vitality capacities additionally supported this transfer.

The fund’s function is to help international locations globally in combating local weather change. Representatives from 24 nations now must decide the fund’s construction, contributor international locations, and allocation standards.

Abu Dhabi hosted the primary board assembly of the International Local weather Fund for Loss and Harm on Might 9, 2024.

The assembly targeted on financing progressive options from COP28, held in Dubai’s Expo Metropolis in late 2023, and the agreements outlined within the “UAE Consensus.”

Abdullah Balala, Assistant Minister of Overseas Affairs for Power and Sustainability emphasised the board’s essential function in ambitiously implementing this dedication, reflecting the UAE’s resolute to making a sustainable future for all.

Stamp Out Poverty’s new Local weather Damages Tax report

The Local weather Damages Tax (CDT) is a charge on the extraction of every tonne of coal, a barrel of oil, or cubic meter of fuel, calculated at a constant fee based mostly on how a lot CO2e is embedded throughout the fossil gasoline.

Thus, the tax report proposes

- Taxing main fossil gasoline corporations based mostly in a number of the world’s wealthiest international locations might elevate billions of {dollars} to handle local weather change.

- It could additional promote renewable vitality initiatives in low-income nations worldwide.

Moreover, The Paris Settlement assigns larger duty to wealthier nations for addressing local weather change attributable to document excessive carbon emissions. Wealthy international locations made commitments at COP summits however took restricted motion afterward.

Media experiences state that they haven’t raised sufficient funds or began new initiatives to help low-income nations in combating local weather change. Introducing a tax on oil and fuel producers in prosperous international locations such because the U.S., the U.Okay., Japan, Spain, and Canada might finance growing nations and entice extra funding to the Fund.

Income Potential

- As already talked about, the wealthiest Organisation for Financial Co-operation and Growth (OECD) international locations might yield as much as $720 billion in local weather funding by 2030.

- A fee of $5 per tonne of CO2 beginning this 12 months in OECD international locations and growing by $5 a tonne every year would offer $900 billion in funding by 2030.

In an optimist’s opinion, taxing fossil gasoline giants might enhance local weather finance by $900 billion by the top of the last decade. The authors of the report suggest allocating $720 billion of this to the Loss and Harm Fund, aiding international locations most affected by local weather change. The remaining funds might help the wealthy nations transitioning to the inexperienced revolution.

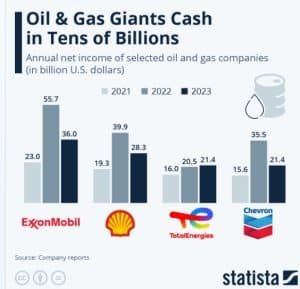

A number of media experiences say that latest revenue ranges for corporations like ExxonMobil, Chevron, BP, and Shell have seen exponential progress. The trade, with its substantial assets, can afford greater taxation. Given the businesses’ historic duty and monetary capability, imposing larger taxes on the fossil gasoline sector must be a precedence.

Funding Alternatives

The funds generated from taxing fossil gasoline corporations might be allotted strategically to handle essentially the most urgent climate-related challenges. Precedence areas for funding embody:

Infrastructure Resilience

Constructing infrastructure to face up to the impacts of maximum climate occasions corresponding to floods, hurricanes, and wildfires is essential. Investments in resilient infrastructure may also help communities bounce again faster from climate-related disasters.

Pure Useful resource Administration

Defending and restoring ecosystems corresponding to forests, wetlands, and coastal areas sequesters carbon and enhances resilience to local weather change. Funds might be directed in the direction of conservation efforts and sustainable land administration practices.

Group Resilience

Susceptible communities disproportionately bear the brunt of local weather change impacts. Thus, investing in community-based adaptation initiatives, corresponding to early warning methods, heatwave preparedness, and social security nets, can improve resilience and cut back vulnerability.

Analysis and Innovation

Continued analysis and innovation are important for growing cutting-edge applied sciences and options to handle local weather challenges. Funding analysis initiatives targeted on renewable vitality, CCS, and climate-smart agriculture can speed up the transition to a low-carbon future.