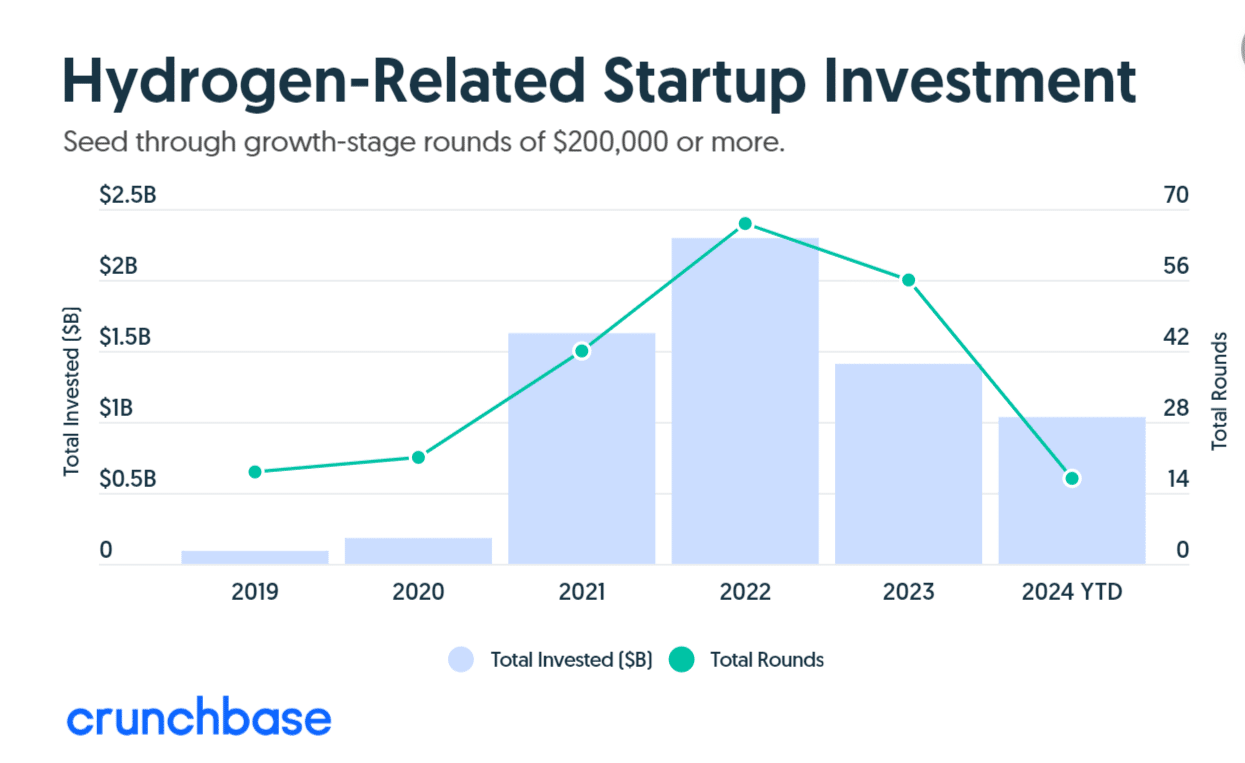

Hydrogen know-how startups have secured over $1 billion in enterprise funding previously 4 months, in line with Crunchbase knowledge. This already surpasses two-thirds of final 12 months’s whole, and the surge contains a number of important early-stage rounds, together with:

- Hysata: Final week, the Australian electrolyzer developer raised $110 million in a Collection B co-led by BP Ventures and Templewater.

- the dove: Denver-based Koloma, centered on geologic hydrogen sources, secured $246 million in a Collection B led by Khosla Ventures earlier this 12 months.

READ MORE: Bill Gates Backs Stealth Startup with $91M for Hydrogen Revolution

Hydrogen energy startup funding didn’t peak in 2021. As an alternative, funding reached its highest in 2022 and is on monitor to surpass that this 12 months.

Notable Hydrogen Startups and Funding

Crunchbase knowledge lists 13 well-funded hydrogen startups that raised important capital lately. Collectively, they’ve secured $3.66 billion in fairness funding, plus further grant and debt financing.

Key examples embrace:

- HysetCo: Primarily based in France, HysetCo operates hydrogen distribution stations and mobility companies. It raised $216 million in April, managing a fleet of over 500 hydrogen automobiles and distributing almost 30 tons of hydrogen month-to-month.

- Ohmium: The Nevada-based firm is manufacturing proton change membrane methods to supply pressurized, high-purity hydrogen. It secured $295 million in Collection C in April final 12 months.

- Tree Vitality Options: This Brussels-based firm closed a $150 million Collection C in April to make use of renewable vitality for producing green hydrogenwhich it combines with recycled CO₂ to create e-NG.

- ZeroAvia: The California-based developer of hydrogen-electric engines for zero-emission flight raised $116 million in a Collection C in September. Airbus is the lead investor, together with United Airways and Alaska Air Group.

- Electrical Hydrogen: This Massachusetts firm raised $380 million in a Collection C final October. It manufactures electrolyzers to supply hydrogen on the lowest value and is the inexperienced hydrogen business’s first unicorn.

Per week in the past, the US Division of Vitality revealed its R&D priorities to chop clear hydrogen value manufacturing, probably at $1 per kilo by 2031.

READ MORE: DOE Sets Eyes on Cutting Clean Hydrogen Cost, $1/Kilo by 2031

World Initiatives Driving Inexperienced Hydrogen Development

Buyers’ rising curiosity in inexperienced hydrogen is pushed by authorities incentives, technological developments lowering prices, and favorable market circumstances. This mix of things suggests a promising future for low-emission hydrogen applied sciences, probably marking a pivotal second for the business.

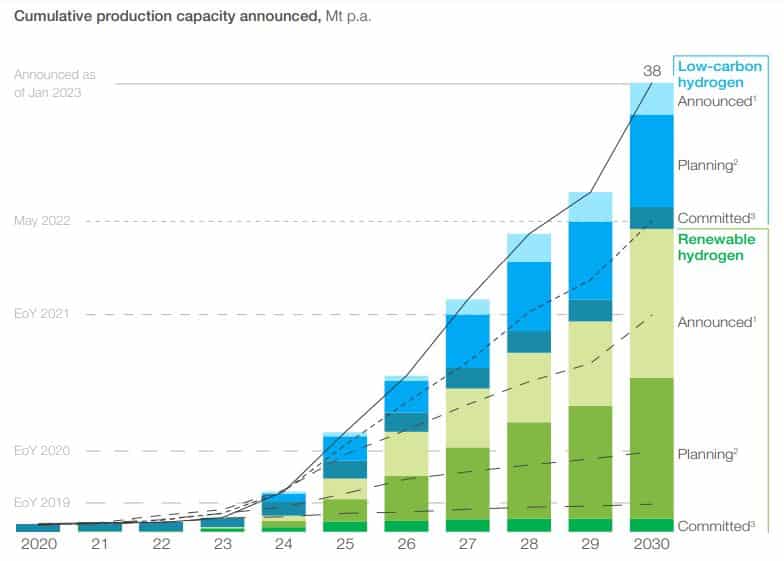

Knowledge from Mckinsey & Firm under exhibits that the hydrogen manufacturing capability introduced elevated by 2030 (over 40%). This capability is about 50% the quantity essential to be on monitor to internet zero emissions.

In April, the EU Commission approved a $380 million German scheme to boost renewable hydrogen manufacturing. This groundbreaking initiative might be administered completely by means of the European Hydrogen Financial institution’s “Auctions-as-a-Service” software.

The scheme helps the aims of REPowerEU and The European Inexperienced Deal. It outlines a complete technique to cut back reliance on fossil fuels and transition to a internet zero economic system.

By fostering renewable hydrogen manufacturing, the scheme goals to lower dependence on Russian fossil fuels and contribute to the EU’s inexperienced vitality future.

India, the world’s third largest polluter plans to be the biggest producer and exporter of inexperienced hydrogen by setting bold milestones. In keeping with the Indian Ministry of New and Renewable Energythe important thing objectives embrace:

- Manufacturing Capability: Establishing a capability to supply at the least 5 Million Metric Tonnes (MMT) of inexperienced hydrogen yearly by 2030.

- World Demand: Aiming to drive world demand for inexperienced hydrogen and its derivatives, equivalent to inexperienced ammonia, to just about 100 MMT by 2030. India targets capturing 10% of the worldwide market, with an annual export demand of about 10 MMT of inexperienced hydrogen/inexperienced ammonia.

- Decarbonization: Mitigating 50 MMT of CO2 emissions yearly by means of the implementation of inexperienced hydrogen initiatives.

Within the Gulf area, Oman Vitality Growth’s subsidiary, Hydromhosted a second-round public public sale for inexperienced hydrogen growth within the Dhofar Governorate. Hydrom presents three prime blocks starting from 340km² to 400km² within the Dhofar Governorate for inexperienced hydrogen manufacturing. The public sale will leverage the area’s considerable renewable vitality sources to construct a sturdy inexperienced hydrogen business within the sultanate.

The surge in enterprise investments in hydrogen know-how startups highlights the sector’s rising momentum. With important early-stage funding rounds and strong world initiatives, the future of green hydrogen seems to be promising.