Lithium, a vital aspect in vitality storage, holds immense significance in powering varied industries. With steel costs hovering, the demand for lithium has surged over latest years.

This text delves into the intricate world of lithium dynamics, exploring the elements influencing lithium priceslatest traits, and future projections.

Key Elements Impacting Lithium Costs

Provide and Demand

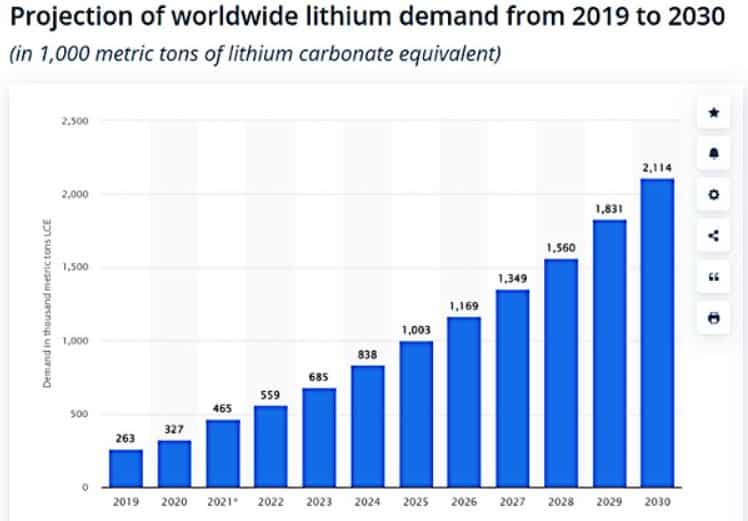

International production of lithium has seen a exceptional improve. In 2020, the whole demand for lithium worldwide was 292 thousand metric tons of lithium carbonate equal.

Forecasts point out a considerable rise to over 2.1 million metric tons by 2030, highlighting the business’s exponential development. This surge is primarily as a result of rising battery demand for electrical autos, which is anticipated to succeed in 3.8 million tons by 2035.

Information from the US Geological Survey reveals that international lithium manufacturing reached 180,000 metric tons in 2021, with about 90% coming from simply three international locations.

Market Demand

Regardless of strong demand for lithium, development skilled a decline year-on-year in 2023 attributable to financial slowdowns, significantly affecting the electrical car market in China. Moreover, accelerated capability expansions led to an oversupply scenario. These fluctuations underscore the fragile stability between provide and demand that considerably impacts lithium costs globally.

Financial Elements

Financial elements comparable to inflation charges and foreign money fluctuations additionally affect lithium costs significantly. These macroeconomic indicators instantly impression manufacturing prices and subsequently have an effect on pricing methods inside the lithium market.

Main Traits in Lithium Pricing

Current Value Traits

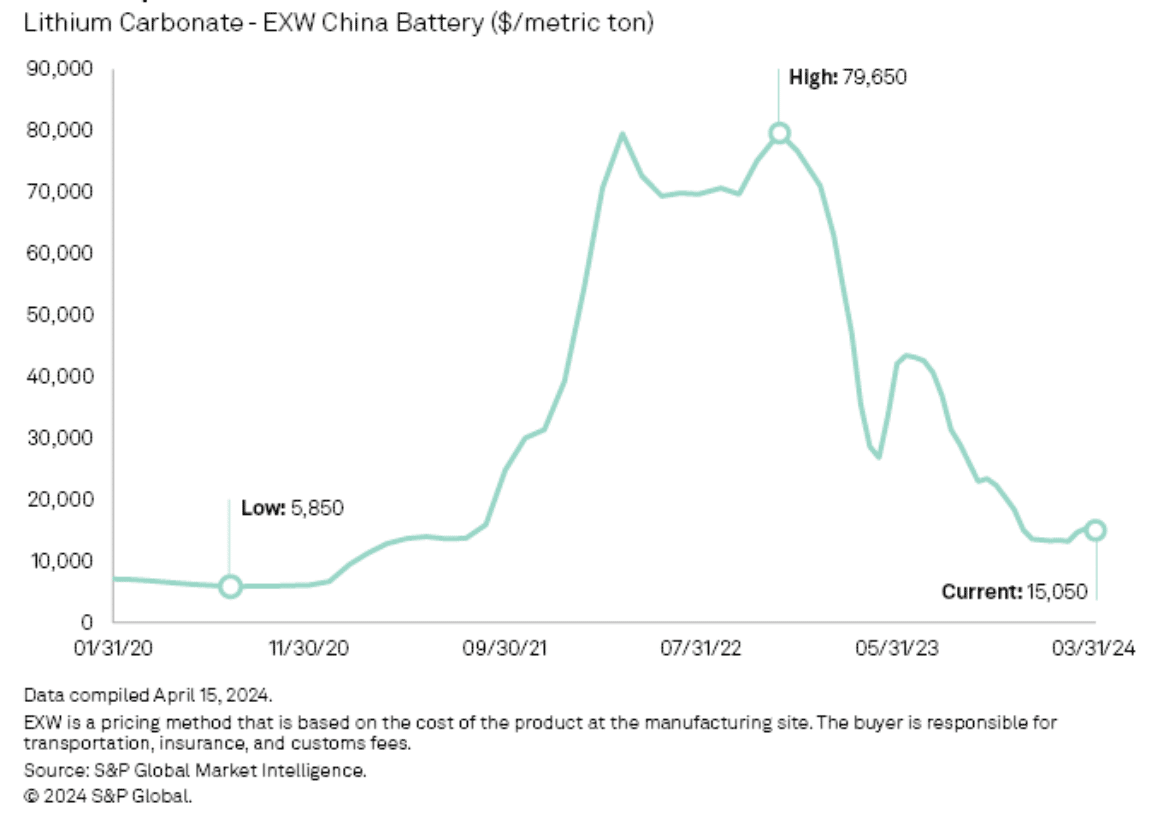

Lithium prices have lately skilled a notable downward trajectory. As of December 18, costs plummeted by 80% inside a 12 months, and as of Might 7, CIF North Asia value at $14,600/t. This decline has sparked discussions concerning the sustainability of this development.

Professional insights counsel that low costs could result in lowered provide and hesitant new investments amidst sturdy demand and cautious predictions.

Impact on the EV Sector

The lithium price drop has a significant impact on the EV sector. Diminished enter prices current alternatives for producers to recalibrate pricing methods, doubtlessly driving down EV prices and growing shopper adoption charges. This shift highlights the interconnected nature of commodity pricing and its far-reaching penalties on numerous industries.

What’s the Way forward for Lithium Costs?

Because the lithium market navigates vital fluctuations, business specialists present worthwhile insights into future value trajectories. By inspecting knowledgeable predictions and analyzing market alternatives and challenges, stakeholders can comprehensively perceive the dynamic panorama forward.

In a latest interview, business analyst Joe Lowry predicts that the lithium chemical provide is nearing equilibrium, with costs anticipated to rise by mid-2024 as inventories rebuild in key markets like China. Equally, Andy Leyland emphasizes that the lithium market’s stability is delicate and {that a} projected surplus of 24,000 tonnes LCE in 2024 might shortly change attributable to market dynamics.

Staying knowledgeable about lithium carbonate and hydroxide costs is essential for business members to capitalize on alternatives and navigate challenges. Monitoring real-time lithium prices and commodity traits offers invaluable insights for strategic positioning amidst market uncertainty.