Xpansiv, a number one supplier of market infrastructure for the worldwide vitality transition, has finalized a brand new capital elevate led by Aramco Ventures, a significant investor in low-carbon vitality and sustainability, together with current traders. This funding will assist additional develop Xpansiv’s world vitality and environmental markets infrastructure options and help the corporate’s funding and acquisition technique.

Strengthening Market Infrastructure for Sustainable Development

Xpansiv runs the biggest spot alternate for environmental commodities, together with carbon credits and renewable energy certificates. Because the premier supplier of registry infrastructure for vitality, energy, and environmental markets, Xpansiv additionally operates the biggest unbiased platform for managing and promoting photo voltaic renewable vitality credit in North America.

Aramco Ventures is the company venturing subsidiary of Aramco, the world’s main totally built-in vitality and chemical enterprise. Headquartered in Dhahran, Aramco’s investments primarily help Aramco’s operational decarbonization, new lower-carbon fuels companies, and digital transformation initiatives.

The funding from Aramco Ventures is a part of its Sustainability Fund, which focuses on firms that may help Aramco’s aim of attaining net zero Scope 1 and Scope 2 greenhouse gasoline emissions throughout its wholly owned and operated belongings by 2050. This aligns with Aramco’s broader sustainability goals and dedication to decreasing its carbon footprint.

In 2023, the oil main’s Scope 1 emissions decreased by 2.4% compared to 2022primarily as a consequence of decrease hydrocarbon manufacturing and a revised CO2 venting emissions methodology for gasoline processing operations, resulting in extra correct accounting.

Conversely, Scope 2 emissions elevated by 13.0% in comparison with the earlier yr. The corporate stated it’s primarily because of the inclusion of the Jazan Refinery within the 2023 greenhouse gasoline emissions stock.

As a part of its decarbonizing efforts, the oil large just lately invested in a US-based direct air seize (DAC) firm, CarbonCapture. Furthermore, consistent with Saudi Arabia’s Imaginative and prescient 2030 plan, Aramco partnered with ADNOC to launch bold lithium extraction initiatives.

Aramco Ventures additionally operates Prosperity7, the corporate’s disruptive applied sciences funding program. Daniel Carter, Managing Director at Aramco Ventures, emphasised the importance of strong market infrastructure in driving the worldwide vitality transition. He famous,

“We recognize the importance of markets to drive the global energy transition at pace, and further recognize Xpansiv’s core position as the innovator of new trading products, marketplaces, and institutional-grade market infrastructure to enable these vital markets to flourish and scale.”

Main the Cost in Environmental Commodities and Market Integration

John Melby, Chief Government Officer of Xpansiv, expressed his satisfaction with Aramco’s funding, stating:

“We are pleased to receive this investment from Aramco Ventures and existing investors, which not only represents significant support for our organic and acquisition-driven strategy, but also our shared belief in the pivotal role of market infrastructure in accelerating investment in the global energy transition.”

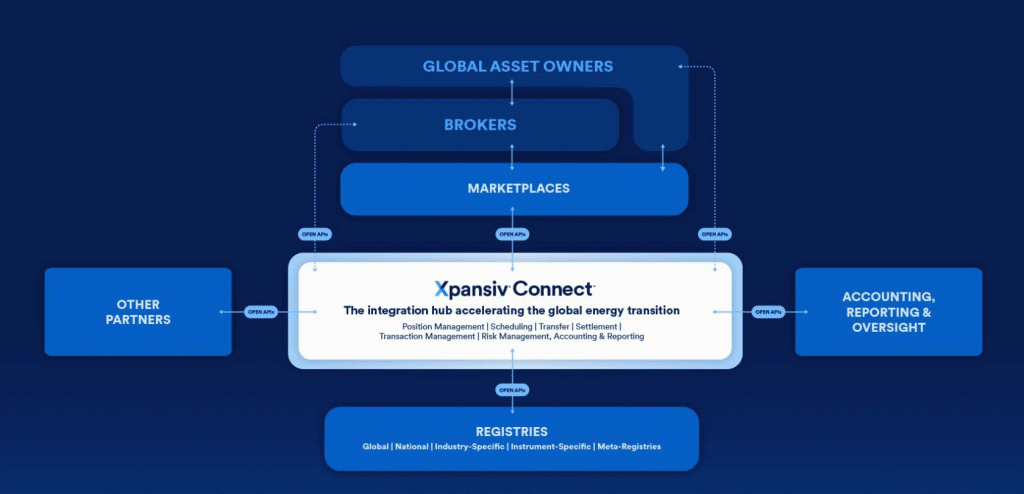

Xpansiv continues to develop its suite of options for the worldwide vitality transition markets. The corporate just lately launched its Xpansiv Connect™an open-access market infrastructure which facilitates environment friendly buying and selling and market operations. This strategic funding will allow Xpansiv to additional improve its capabilities and help the broader push in the direction of sustainable vitality options.

Xpansiv manages over 1 billion asset transfers yearly by means of its SaaS meta registry and portfolio administration system on the core of Xpansiv Join. This technique is built-in with 13 main carbon and renewable vitality registries worldwide.

Xpansiv manages over 1 billion asset transfers yearly by means of its SaaS meta registry and portfolio administration system on the core of Xpansiv Join. This technique is built-in with 13 main carbon and renewable vitality registries worldwide.

Xpansiv’s registry software program helps greater than 80% of worldwide carbon credit and 60% of North American renewable vitality certificates (RECs). This together with new environmental commodities resembling digital fuels. Its CBL spot alternate holds over 90% world market share of exchange-traded and settled carbon credit.

- In 2023, almost 2 billion metric tons of carbon and over 36 million megawatt hours of renewable vitality have been transacted by Xpansiv market intermediaries.

The corporate has accomplished 11 acquisitions and strategic investments just lately, together with a notable funding in Evident, a number one clear economic system registry supplier and certification physique. This funding highlights Xpansiv’s help for the rising international renewable energy certificate (I-REC) market and rising devices. These embody sustainable aviation gasoline (SAF), inexperienced hydrogen, biomethane, and carbon removals.

Xpansiv’s traders embody outstanding names resembling Aramco Ventures, Blackstone Group, Financial institution of America, Goldman Sachs, Macquarie Group Ltd., S&P World Ventures, Conscious Tremendous, BP Ventures, Commonwealth Financial institution of Australia, and the Australian Clear Vitality Finance Company.

By leveraging the brand new capital elevate, Xpansiv will proceed to steer within the environmental commodities sector, fostering innovation and effectivity in carbon credit and renewable vitality market options, essential for attaining sustainable vitality objectives and decreasing world carbon emissions.