The potential merger between BHP and Anglo American has been a big matter within the mining trade, with the potential for creating the biggest base metallic firm globally. Nevertheless, the merger has confronted a number of rejections and challenges.

Listed here are the important thing factors of the merger proposal:

- Preliminary and Revised Proposals:

- BHP initially proposed a $38.8 billion all-share provide to accumulate Anglo American, which included plans to demerge Anglo American’s platinum and iron ore belongings in South Africa.

- The revised proposal elevated the merger change ratio by 15%, providing Anglo American shareholders 16.6% possession within the mixed entity, up from 14.8% within the preliminary proposal.

- Rejections and Considerations:

- Anglo American’s board has persistently rejected BHP’s proposals, citing that they considerably undervalue the corporate and contain a extremely advanced construction with vital execution dangers.

- The construction requires Anglo American to demerge its holdings in Anglo American Platinum and Kumba Iron Ore, which the board finds unattractive and dangerous for its shareholders.

- Give attention to Copper:

- Each corporations are closely centered on copper on account of its essential function within the vitality transition, with BHP aiming to turn into the world’s largest copper producer by means of this merger.

- The mixed entity would management vital copper belongings, together with main mines in South America, enhancing BHP’s place within the copper market.

The merger faces potential regulatory scrutiny, notably regarding market focus within the copper sector and the impression on South African operations. BHP has proposed a number of socioeconomic measures to handle these considerations, together with sustaining employment ranges and supporting native procurement in South Africa.

In the end, BHP has pulled its bid as of Might 29th. With or with out the deal, every mining large has been figuring laborious how one can cope with their carbon emissions.

BHP’s Carbon Campaign and Internet Zero Ambitions

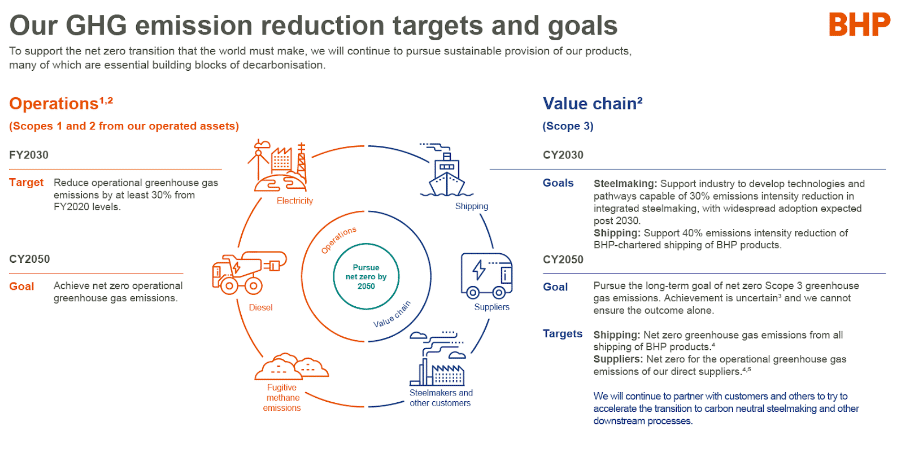

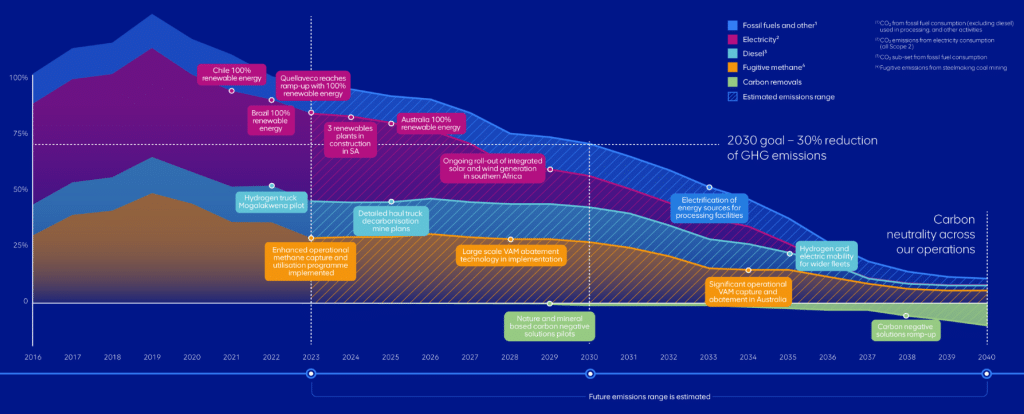

BHP has dedicated to reaching web zero operational (Scope 1 and a couple of) emissions by 2050. Their medium-term goal is a 30% reduction from adjusted FY2020 ranges by FY2030, involving an funding of round $4 billion. Key initiatives embody transitioning from diesel to battery-powered haul vehicles, that are extra environment friendly, and investing in renewable vitality sources to energy their operations, particularly in Western Australia and Chile.

For instance, BHP plans to construct 500 megawatts of renewable energy and storage capacity to fulfill elevated energy demand from their operations as they transition to electrical haul vehicles.

Whereas BHP prioritizes inside GHG emission discount, they acknowledge the momentary function of high-integrity carbon credits. The mining titan doesn’t plan to make use of carbon credit for operational GHG emission discount medium-term targets. Nevertheless, if abatement initiatives don’t obtain the anticipated GHG reductions, BHP retains the pliability to make use of high-integrity carbon credit towards their 2030 local weather targets.

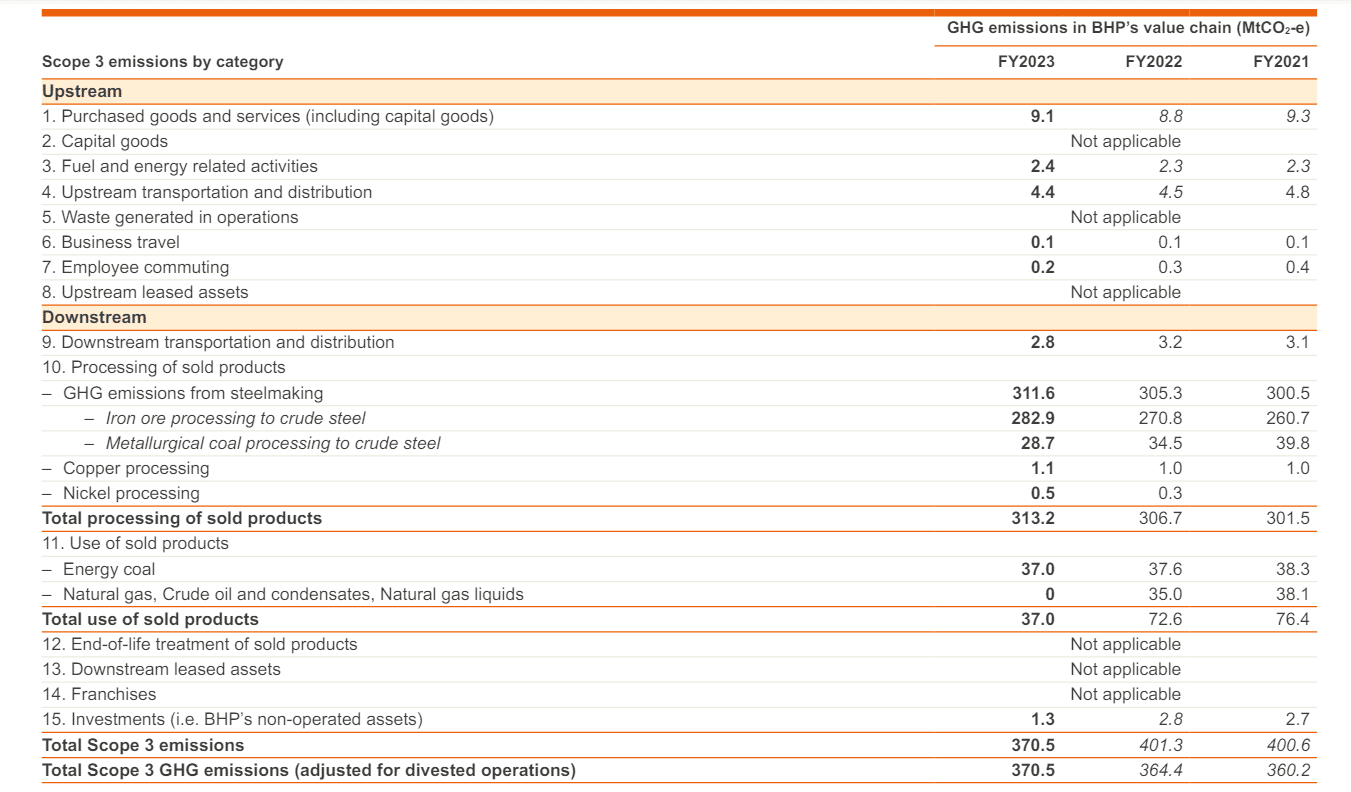

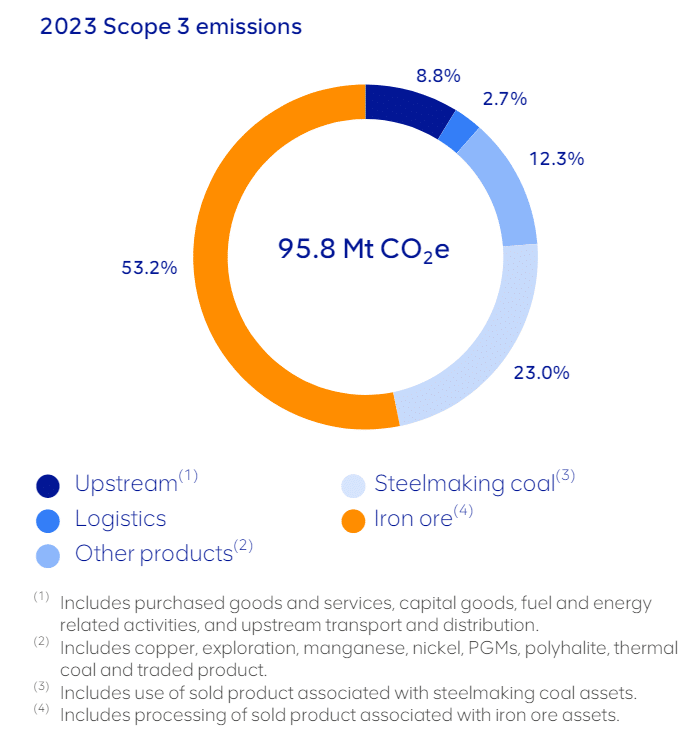

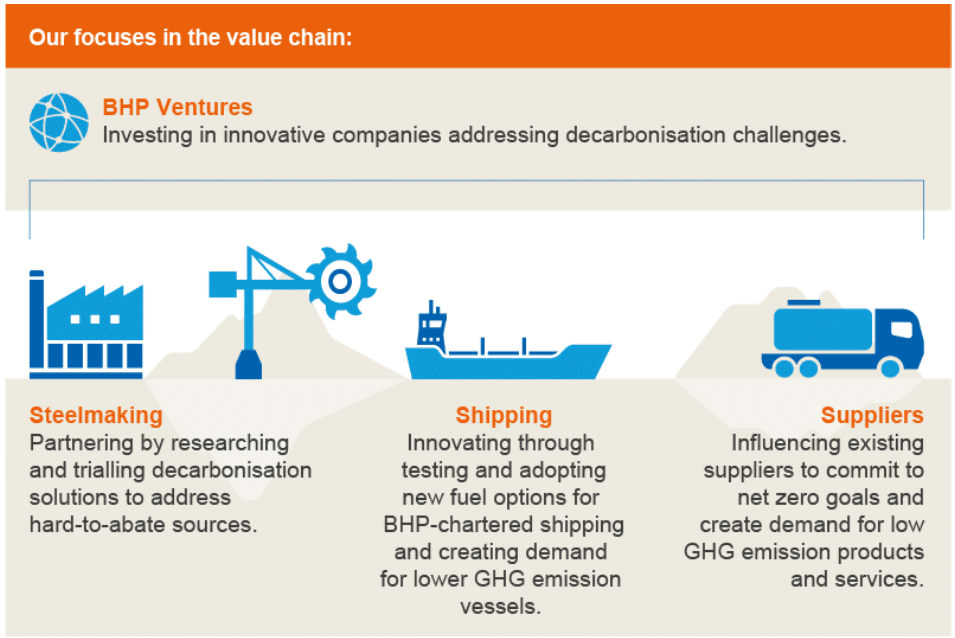

BHP’s Scope 3 emissionswhich account for 97% of their complete emissions, are predominantly from the usage of their merchandise by clients. Whereas BHP goals to realize web zero Scope 3 emissions by 2050, this stays an aspirational objective slightly than a strict goal.

They’re specializing in creating low-carbon applied sciences in collaboration with the steelmaking trade, comparable to hydrogen-based Direct Decreased Iron (DRI) crops. BHP additionally helps carbon seize and storage (CCS) applied sciences, though these have confronted criticisms for his or her limited effectiveness and low capture rates.

BHP Carbon Emissions:

- Scope 1 emissions (direct emissions from operations) in FY2023: 7.5 million tonnes CO2e

- Scope 2 emissions (oblique emissions from bought electrical energy/vitality) in FY2023: 5.0 million tonnes CO2e

- Scope 3 emissions (oblique emissions from worth chain) in FY2023: 95.8 million tonnes CO2e

READ MORE: BHP to Spend $4B to Decarbonize by 2030, Carbon Emissions Spikes Up Near-Term

Anglo American’s Eco Revolution: Slashing Emissions in Model

Anglo American goals to realize carbon neutrality throughout its operations by 2040. Interim targets embody lowering these emissions by 30% by 2030. Their FutureSmart Mining™ program is central to this effort, leveraging expertise and digitalization to reinforce sustainability.

Notable initiatives embody securing 100% renewable electricity for operations in Brazil, Chile, and Peru, and creating hydrogen fuel cell and battery hybrid vehicles, that are set to interchange diesel vehicles throughout their international fleet from 2024.

Anglo American has set an bold goal to scale back Scope 3 emissions by 50% by 2040. This can be achieved by working with clients and expertise companions to decarbonize the metal trade and by making modifications of their product portfolio.

They’re additionally centered on bettering efficiencies and controlling emissions inside their provide chain and logistics, notably in transport.

Anglo American carbon emissions:

-

- Scope 1 emissions in 2023: 7.5 million tonnes CO2e

- Scope 2 emissions in 2023: 5.0 million tonnes CO2e

- Scope 3 emissions in 2023: 95.8 million tonnes CO2e

The British mining large is making vital progress in lowering emissions from Scope 3 sources. Processing iron ore stays the biggest contributor, with steelmaking accounting for 50.9 Mt CO2e, or 47% of complete emissions in 2023. The emissions depth of the corporate’s iron ore has decreased by 5% in 2023 in comparison with the 2020 baseline.

Anglo American plans to scale back its Scope 3 emissions by prioritizing 7 initiatives over 4 themes, as laid out in its Climate Change Report 2023.

Chopping-Edge Clear Vitality and Decarbonization Initiatives

BHP is investing in a number of clear vitality and decarbonization initiatives. They’re trialing “dynamic charging” for electrical haul vehicles, permitting them to be charged whereas in operation. As well as, they’re creating carbon capture projects with steelmakers and exploring numerous renewable vitality initiatives to energy their operations.

Regardless of these efforts, BHP has acknowledged that short-term emissions could enhance on account of manufacturing development earlier than vital reductions are realized.

Equally, Anglo American is actively participating in clear vitality initiatives as a part of their decarbonization technique. Their partnership with EDF Renewables goals to make sure that all electrical energy utilized by 2030 will come from zero-emission sources.

They’ve already achieved a 100% renewable electrical energy provide for his or her operations in a number of nations and are creating hydrogen-powered haul trucks to interchange diesel ones. These initiatives are anticipated to considerably scale back their carbon footprint and contribute to their web zero targets.

The potential merger between BHP and Anglo American could have confronted vital challenges, however each corporations stay steadfast of their dedication to lowering carbon emissions and advancing in direction of web zero targets. Each miners are leveraging expertise and strategic partnerships to drive their decarbonization efforts.