Xpansiv voluntary carbon credit score buying and selling information noticed a big divergence in costs for nature-based and technology-based carbon credit. The report is from Xpansiv Knowledge and Analytics, which gives a complete database of spot agency and indicative bids, gives, and transaction information.

Xpansiv delivers intensive market information from CBL, the world’s largest spot environmental commodity trade. It offers each day and historic information on bids, gives, and transactions for carbon creditscompliance and voluntary renewable energy certificatesand Australian Carbon Credit score Items (ACCUs) traded on the CBL platform.

The trade just lately secured a significant capital increase from Aramco Ventures to additional improve its environmental markets infrastructure options.

The spot information is additional enhanced by ahead carbon prices from prime market intermediaries, together with aggregated registry statistics and rankings from main suppliers.

Nature-Primarily based Credit Surge Whereas Power Sector Costs Drop

Final week noticed massive blocks of Verified Carbon Normal (VCS) Nature Group Eligibility (N-GEO)-eligible and Local weather Motion Reserve (CAR) nature credit driving the 20-day transferring common of recent-vintage AFOLU (Agriculture, Forestry, and Different Land Use) credit to $12.05, a 125% week-over-week improve. Conversely, a big block of Asian renewable credit pushed the power sector common value down by 60% to $0.76.

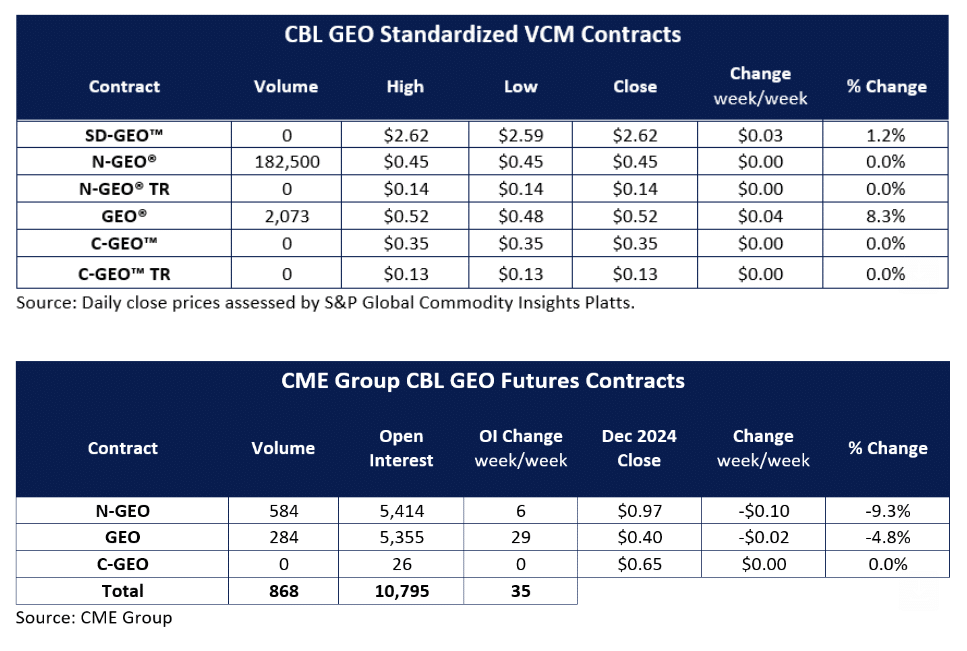

These blocks accounted for a lot of the 316,124 metric tons traded on CBL final week. That is composed of 224,730 nature credit and 91,394 power credit. CME Group’s emissions futures additionally mirrored this development, buying and selling 584,000 tons by way of CBL N-GEO and 284,000 through CBL GEO futures contracts.

Particular credit score trades on CBL included classic 2019:

- VCS 1477 Katingan credit at $6.00,

- ACR 556 industrial course of credit at $2.85,

- ACR 658 credit at $2.30, and

- Classic 2020 VCS 1753 Indian photo voltaic credit at $1.25.

Who Leads the CBL REC Markets?

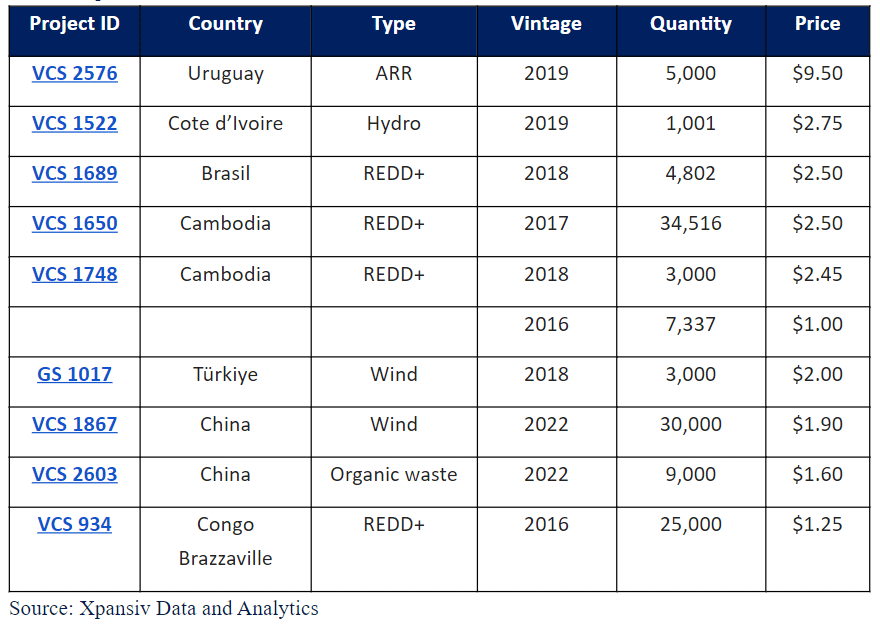

Final week, a $9.50 provide for five,000 tons of classic 2019 VCS Afforestation, Reforestation, and Revegetation (ARR) credit from Uruguay was reposted. New and renewed gives for VCS and Gold Normal renewable power and REDD+ (Lowering Emissions from Deforestation and Forest Degradation) credit ranged between $1.00 and $2.75.

Mission-Particular Credit score Affords on CBL

REC buying and selling exercise on CBL was gentle however included bigger blocks of bilaterally traded PJM credit settled through the trade, together with smaller PJM and NEPAL trades matched on display screen.

REC buying and selling exercise on CBL was gentle however included bigger blocks of bilaterally traded PJM credit settled through the trade, together with smaller PJM and NEPAL trades matched on display screen.

- Virginia Credit: 2024 Virginia credit traded at $0.25, closing the week at $35.25.

- New Jersey Photo voltaic Credit: Over 1,400 2023 New Jersey photo voltaic credit had been matched at $207.50, $1.50 greater than the earlier week’s shut, with an extra 1,500 credit cleared through reported commerce.

- New Jersey Class 2 Credit: 355 classic 2024 RECs had been matched at $37.50.

- NEPOOL Credit: 189 Massachusetts Class 2 non-waste credit had been matched at $31.50.

In associated information, the White Home launched new voluntary carbon credit guidelines to advertise high-integrity emissions reductions and assist nature-based initiatives and carbon elimination applied sciences.

Xpansiv’s information highlights a stark distinction within the carbon credit score market: with nature-based credit experiencing a big value surge whereas power sector credit see a pointy decline. This divergence underscores the rising demand for high-integrity, nature-based options within the voluntary carbon market.

As corporations try to fulfill their internet zero targets, understanding these market dynamics will probably be essential for making knowledgeable funding and sustainability choices.