Going through unprecedented demand surges and unstable worth swings, the world’s lithium producers are revolutionizing the best way the commodity is purchased and bought. Miners are utilizing auctions to safe larger costs than these assessed by worth reporting businesses (PRAs) as demand for the battery steel will increase amid the vitality transition.

Historically, the lithium market relied on personal contracts, however the surge in demand has led to the introduction of public buying and selling platforms. PRAs now present worth assessments, and the London Steel Alternate and Guangzhou Futures Alternate have launched futures market.

Nonetheless, with a 2024 lithium price hunch affecting margins, producers flip to identify auctions that yield higher costs than PRA reviews.

A Beneficial Software for Lithium Value Discovery

In response to S&P Global Commodity Insightsmarket consultants and members count on auctions to proceed, as corporations purpose to realize favorable costs regardless of market downturns.

Albemarle Corp., a significant US lithium producer, acknowledged that auctions assist in accountable worth discovery. This advantages each patrons and sellers and contributes to a extra sustainable market.

For Przemek Koralewski, international head of market growth at worth reporting company Fastmarkets World Ltd., auctioning lithium costs serve two issues:

“It allows miners to get the price of the day and it means that the contracts on which most material is sold are truly reflective of market dynamics.”

Not like different commodities with a single benchmark worth, lithium costs are sometimes decided utilizing a variety of PRA assessments, incorporating knowledge from numerous market stakeholders.

In 2022, lithium corporations leveraged auctions to safe larger costs regardless of slowing demand for electrical automobiles and rising COVID-19 infections impacting market costs. Alice Yu, an analyst at Commodity Insights’ Metals and Mining Analysis group, acknowledged that “auction prices provide an extra means of price discovery and add to market transparency.”

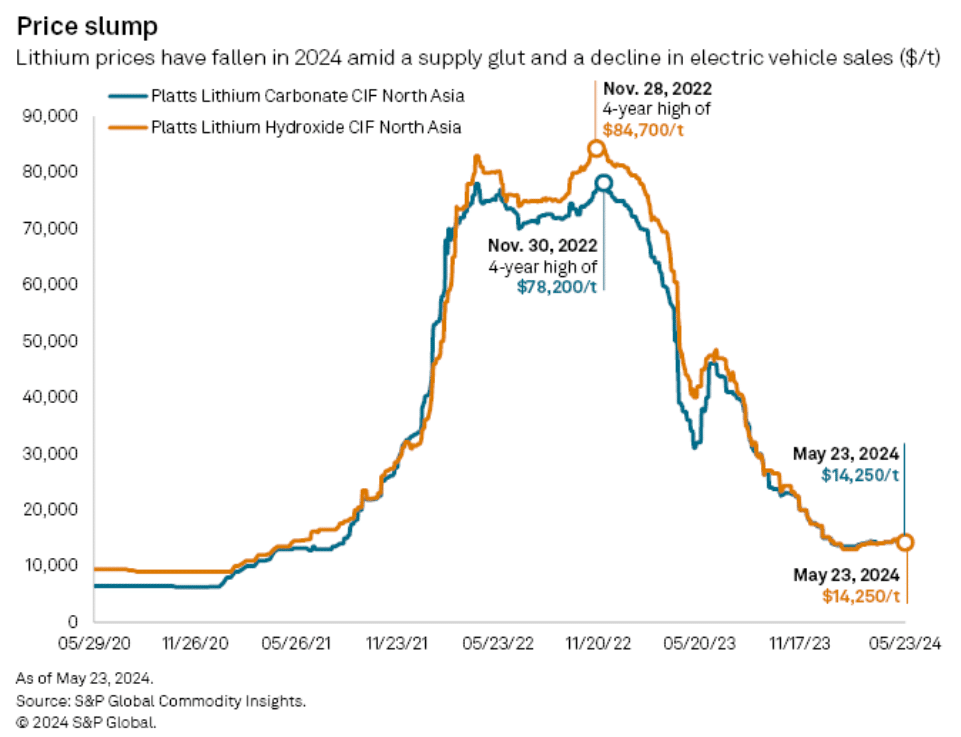

The usage of auctions decreased as pandemic results waned and costs surged amid the vitality transition. Nonetheless, a provide glut and international decline in EV gross sales have brought about lithium prices to drop once more.

On Could 23, Platts reported the lithium carbonate CIF North Asia worth at $14,250 per metric ton, down 81.8% from the four-year excessive of $78,200/t on Nov. 30, 2022. The lithium hydroxide CIF North Asia worth additionally fell 83.2% to $14,250/t from a peak of $84,700/t on Nov. 28, 2022.

Embracing Lithium Auctions for Higher Pricing

A number of lithium corporations at the moment are revisiting auctions, believing that worth reporting businesses have overstated the worth decline. Auctions have certainly yielded larger costs.

As an illustration, Albemarle’s two lithium spodumene auctions on March 26 and April 24 elevated the spot spodumene worth by about 10% every time. Inspired by these outcomes, Albemarle plans to proceed with auctions.

In late March, Australia-based Mineral Sources Ltd. bought lithium spodumene focus at $1,300/t by digital auctions. This was 13%-20.4% larger than the Platts lithium spodumene 6% FOB Australia worth of $1,080/t to $1,150/t throughout that interval. The corporate goals to proceed utilizing auctions for worth transparency.

Joshua Thurlow, CEO of Mineral Sources, highlighted the market’s recognition of future lithium demand for the worldwide vitality transition, noting delays or failures in long-awaited provide tasks.

Equally, Brazil-headquartered Sigma Lithium Corp. reported reaching larger costs by an “auction-price discovery process” in comparison with the normal PRA method.

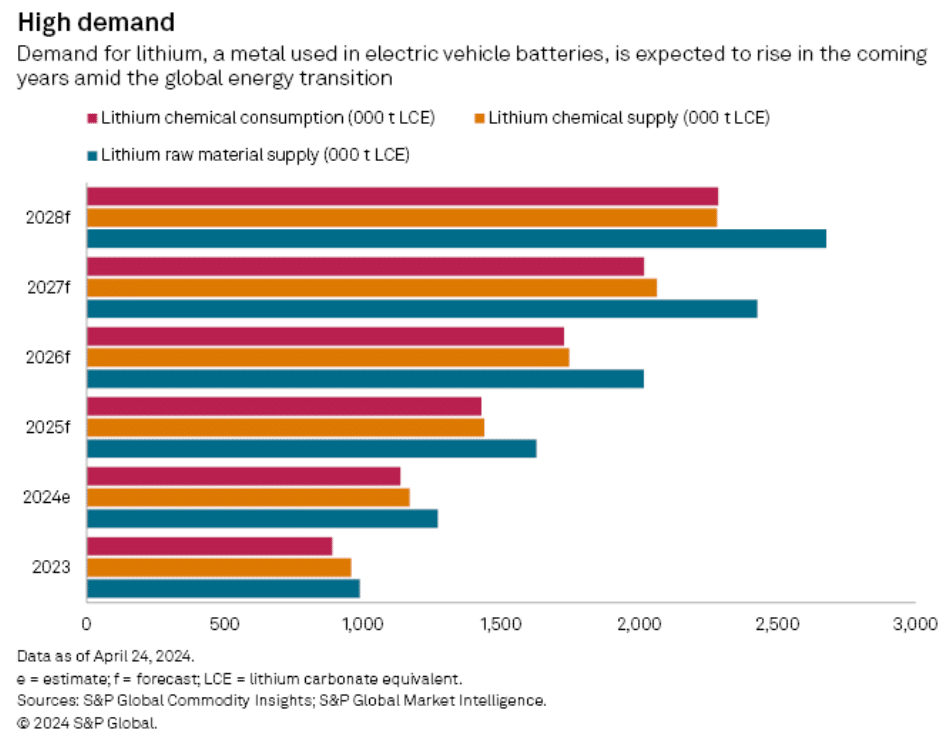

These developments point out that auctions have gotten a beneficial software for lithium producers to safe favorable costs and improve market transparency. That is significantly essential as demand for lithium, a critical element of EV batterieswill rise once more amid the vitality transition.

A Dynamic Pricing Method for A Resilient Lithium Market

Lithium costs have skilled a dramatic fall and the market remains to be adjusting to inflated inventories from the growth interval. There’s additionally a rising divergence between completely different lithium merchandise as the provision chain matures.

Traditionally, long-term contracts have been linked to the downstream chemical substances market quite than the uncooked materials, spodumene, which has change into vital solely previously decade. This has led to a disconnect between the costs of those two supplies.

Ana Cabral, CEO of Sigma Lithium Corp., famous that lithium producers are gaining extra management over pricing beforehand influenced by lithium chemical substances. She emphasised the necessity for a risk-reward system aligned with the pricing mechanism, highlighting that these producing the uncooked focus bear a lot of the danger.

Lithium producers face not solely explosive demand progress but in addition geopolitical and regulatory adjustments that might create regional market divisions. The West goals to cut back dependence on provide chains involving China, with rising consideration to the carbon footprints of varied sources.

Chris Berry, president of Home Mountain Companions LLC, likened the present lithium market evolution to that of the iron ore market. He famous that auctions and rising liquidity in lithium futures are optimistic developments.

Common, open spot pricing by bids and presents permits market members to react swiftly to produce and demand adjustments, making certain extra environment friendly market clearing throughout each growth durations and downturns. This dynamic method permits the market to adapt extra successfully to fluctuating circumstances.