Based on a brand new evaluation by Calyx World, a carbon credit score scores platform, the standard within the voluntary carbon market (VCM) exhibits promising indicators of improved integrity. The report combines market development knowledge with Calyx World’s scores of over 500 tasks to supply insights into the continued efforts to reinforce carbon market integrity.

Discovering higher-rated carbon credits within the VCM stays difficult as a result of dominance of mega-projects, resembling REDD (Lowering Emissions from Deforestation and Forest Degradation) and large-scale grid-connected renewable vitality tasks, which usually don’t obtain greater scores (A and B).

Calyx World’s co-founder, Donna Lee, emphasizes the necessity for higher-quality carbon credits to revive confidence available in the market.

“We wanted to start tracking quality, recognizing that the voluntary carbon market is starting to mature. The quicker we improve carbon credit quality and restore confidence, the more effective companies can be at addressing climate change.”

The report, “The State of Quality in the Voluntary Carbon Market”identifies main traits and beneath are the important thing findings.

Lower in Low-High quality Carbon Credit Issued

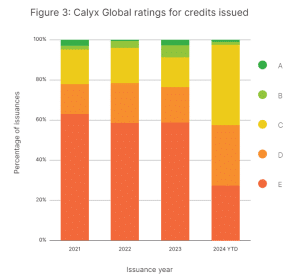

Since 2021, media scrutiny over the voluntary carbon market has intensified, coinciding with an increase in carbon credit score issuances. Each market quantity and media criticism peaked in 2023. Nonetheless, there was a notable shift within the high quality of credit score issuances, particularly from the start of 2024.

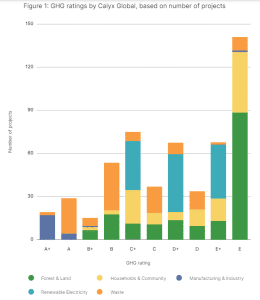

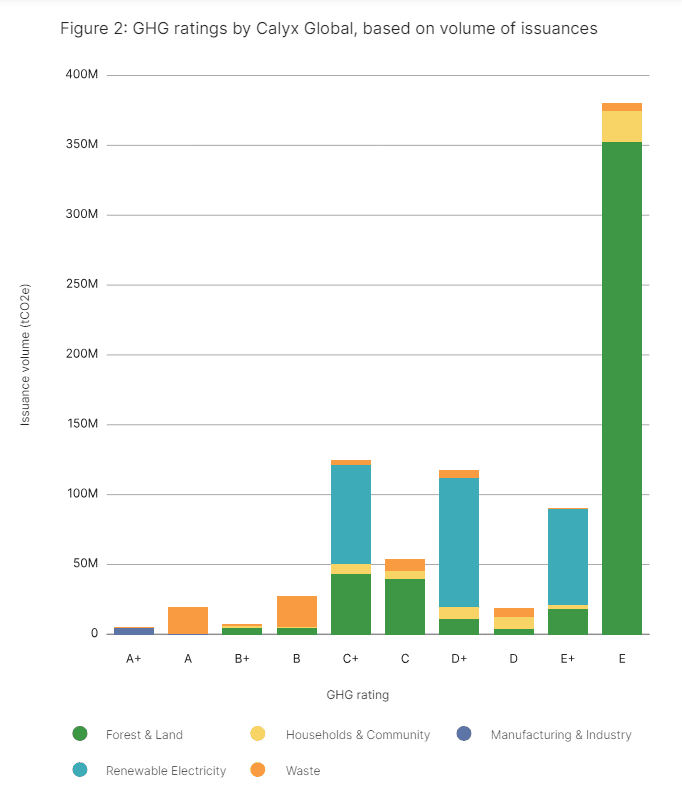

High quality within the VCM extremely varies, with each poor-quality and high-quality credit in each sector analyzed by Calyx World. So far, tasks within the Manufacturing and Trade sector has the very best GHG integrity.

Based on the evaluation, which has rated over half of all credit issued up to now 5 years, solely about 20% of those credit fall into the highest half of their score scale (C+ and above).

Notably, lower than 10% of the rated credit obtained a B score or greater. This highlights the problem in sourcing high-integrity carbon credits within the present market panorama.

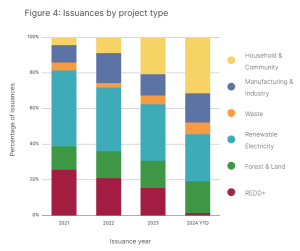

The issuance of low-rated credit (E-rated) has considerably declined, dropping by practically 50%. This lower is primarily attributable to a discount in credit issued from REDD+ tasks. These credit have traditionally been skewed in direction of decrease scores.

The decline in REDD+ credit has been partially offset by a rise in issuances from family and neighborhood tasks, resembling cookstove credits. These tasks are inclined to have extra credit within the “C” score vary.

Regardless of the general enchancment in credit score high quality, high-rated credit (A and B scores) stay uncommon. This rarity is as a result of smaller variety of such tasks actively issuing credit available in the market at this time. Moreover, these higher-rated tasks are usually smaller in scale in comparison with mega-projects like REDD and large-scale renewable energy projects.

Gradual Adoption of High quality Updates

Regardless of current shifts in direction of greater high quality within the VCM, a transparent and constant development has but to emerge.

Over 75% of recent listings on main registries—American Carbon Registry (ACR), Local weather Motion Reserve (CAR), Gold Normal, and Verified Carbon Normal (VCS)—come from the Forest & Land and Family & Group sectors. These sectors present combined leads to Calyx World’s score system.

The Forest & Land sector is dominated by improved forest administration (IFM) and afforestation/reforestation (AR) tasks, that are present process methodological modifications aimed toward enhancing their effectiveness and integrity.

Within the Family & Group sector, cookstove tasks make up nearly all of new listings. And efforts are underway to refine cookstove methodologies to enhance their high quality and influence.

It might take time for low-quality credit to be utterly phased out of the system. Some low-quality credit are nonetheless tied up in ahead contracts, delaying the total influence of improved high quality requirements. Though there have been enhancements within the guidelines and necessities for generating carbon creditsthese updates nonetheless must be totally built-in into the energetic market.

A Tradeoff: GHG Integrity vs. SDG Influence

Whereas patrons are interested in advantages “beyond carbon,” resembling social and environmental co-benefits, the first driver of market traits is the seek for greater greenhouse fuel (GHG) integrity.

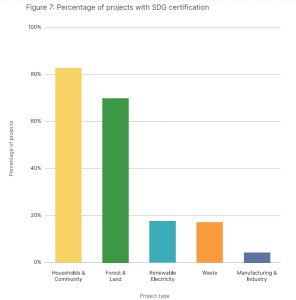

Round 54% of rated tasks for GHG integrity have Sustainable Improvement Targets (SDG) contributions verified by a 3rd celebration. This development is particularly prevalent amongst nature-based tasks, which regularly search further SDG certification by means of packages like Verra’s Local weather, Group, and Biodiversity (CCB) Requirements and the Sustainable Improvement Verified Influence Normal (SD VISta), leading to verified SDG contributions.

In distinction, waste and renewable vitality tasks steadily don’t pursue further SDG certification. Or they’re registered below packages that don’t require SDG claims to be verified.

Some argue that the perfect carbon credit score ought to possess each excessive GHG integrity and important SDG influence. Nonetheless, such credit are at the moment difficult to search out, per Calyx World findings. There seems to be a tradeoff between GHG integrity and SDG influence within the present market.

This tradeoff is partly as a result of many tasks that ship the very best SDG impacts, resembling REDD+ and cookstove tasks, have points with over-crediting.

Family-based tasks usually have verified SDG contributions, largely due to the Gold Standard‘s requirement to report, monitor, and confirm at the very least three SDGs per challenge. Verra has now launched an analogous requirement.

Calyx World concludes that the VCM continues to evolve and is transferring in direction of model 2.0. This evaluation is essential for instilling belief in carbon credit and allow them to successfully contribute to local weather change mitigation.