In current developments inside the world nickel market, the trajectory of costs has undergone a big downturn, reflecting a fancy interaction of financial components and strategic choices.

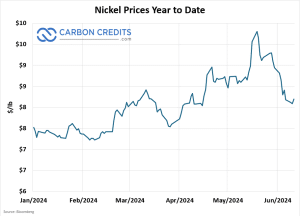

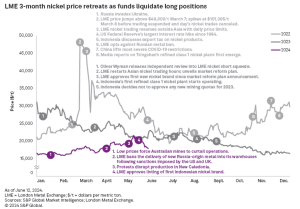

As reported by S&P World Commodity Insights, the London Steel Change (LME) three-month closing nickel price skilled a notable decline from $19,830 per metric ton on the finish of Could to $17,891 per ton by June 10. This motion marks a pivotal shift, as it’s the first time since mid-April that nickel costs have dipped beneath the $18,000 per ton threshold.

Nickel Worth Motion and Market Influences

The retreat in nickel prices might be largely attributed to decisive actions taken by funding funds. These buyers opted to liquidate their lengthy positions amid a backdrop of strengthening US greenback and less-than-stellar manufacturing knowledge rising from China. These components collectively exerted downward strain on nickel costs, overturning earlier positive factors made in Could when costs surged to a nine-month excessive of $21,615 per ton.

Throughout that interval, issues over potential provide disruptions and elevated investor optimism within the base metals sector had fueled a bullish pattern. Nevertheless, as financial indicators shifted, buyers reevaluated their positions, resulting in a swift reversal in nickel costs.

This worth drop occurred regardless of bullish headlines, together with the next main market occasions:

- European Central Financial institution’s rate of interest reduce,

- Ongoing manufacturing standstill in New Caledonia, and

- Potential allow terminations for ferronickel and nickel pig iron vegetation in Indonesia.

The sharp worth decline mirrored a contraction in funding funds’ internet lengthy positions on the LME, indicating substantial liquidation of lengthy positions.

Nickel Provide Chains in Focus

Past these market dynamics, the strategic maneuvers of key world gamers have additionally influenced nickel’s worth trajectory.

Notably, america has expressed a strategic curiosity in forging a partnership with the Philippines, the world’s second-largest nickel producer, to safe nickel provides important for its burgeoning battery sector. This strategic transfer comes at a time when the US is grappling with the fact of its restricted home nickel reserves in comparison with main producers like Indonesia.

The Philippines exported 39.9 million metric tons of nickel ore to China, underscoring its significance within the world provide chain. The US anticipates a considerable improve in nickel demand for EV batteries, with an anticipated progress of 211,000 metric tons between 2023 and 2028. This demand surge underscores the necessity for a dependable nickel provide chain.

Moreover, Indonesia’s important processing capability falls below the US authorities’s “foreign entities of concern” (FEOC) steerage, making Indonesian nickel doubtlessly ineligible for sure US EV tax credit. This has led the US to enter trilateral talks with the Philippines and Japan.

Discussions are underway to reinforce infrastructure and manufacturing capabilities within the Philippines. This market growth alerts a possible shift in world nickel commerce dynamics because the US seeks to fortify its provide chains for EV manufacturing.

Quick-Time period Stoop, Lengthy-Time period Promise: Nickel’s Twin Outlook

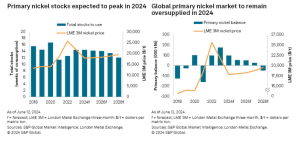

Trying ahead, analysts at S&P World Commodity Insights predict that the worldwide main nickel market will proceed to face challenges pushed by oversupply circumstances all through the rest of the yr. Regardless of bullish sentiments, the underlying imbalance between provide and demand is predicted to restrain nickel costs.

Quick-Time period Worth Outlook:

The sharp worth drop noticed in June aligns with S&P World’s earlier expectations of a possible correction. Regardless of a powerful shopping for surge in Could, investor confidence in nickel stays weak as a result of basic oversupply available in the market.

The S&P analysts anticipate that weak world main nickel market fundamentals will proceed to exert downward strain on costs. Particularly, they forecast that whole main nickel shares, measured by way of weeks of consumption, will attain a 4-year excessive in 2024. This anticipated improve in shares will probably restrict any important worth restoration for the rest of the yr.

Lengthy-Time period Issues:

Whereas short-term worth actions are pushed by speculative actions and fast market circumstances, the long-term outlook for nickel stays constructive, primarily as a result of its vital position within the energy transition.

Growing demand from the electrical automobile (EV) sector, renewable energy applied sciences, and power storage options will drive long-term demand progress for nickel. Nevertheless, for the remainder of 2024, the oversupply and excessive inventory ranges will cap worth positive factors.

Key Nickel Insights to Digest:

- Provide Dynamics. World nickel manufacturing is predicted to proceed rising, pushed by expansions in main producing nations and elevated output from new initiatives. Nevertheless, the tempo of progress might differ relying on geopolitical developments, regulatory modifications, and technological developments in nickel extraction and processing.

- Demand Traits. Demand for nickel is projected to rise, notably from the EV and power storage sectors. Nickel’s position as a vital part in lithium-ion batteries positions it as a key beneficiary of the worldwide shift in direction of electrification and renewable power.

- Worth Projections. Whereas costs might stay subdued within the quick time period as a result of oversupply, the medium to long-term outlook suggests potential worth restoration as demand catches up with provide. Market individuals will carefully monitor components comparable to technological developments in battery chemistry, coverage help for clean energyand macroeconomic circumstances.

Nickel costs have lately declined as a result of market recalibrations and strategic choices by key world gamers. Stakeholders ought to brace for continued market volatility with restricted fast worth restoration.