In line with the Bloomberg EV Outlook Report, the worldwide electrical automobile (EV) market in 2024 exhibits diverse progress throughout completely different areas and segments. Most notably, whereas total EV gross sales are rising, some markets are slowing, and plenty of automakers have delayed their EV targets.

We crunched the report and have the next key takeaways, essential for everybody within the trade to know.

Which Areas Are Charging Forward in EV Gross sales?

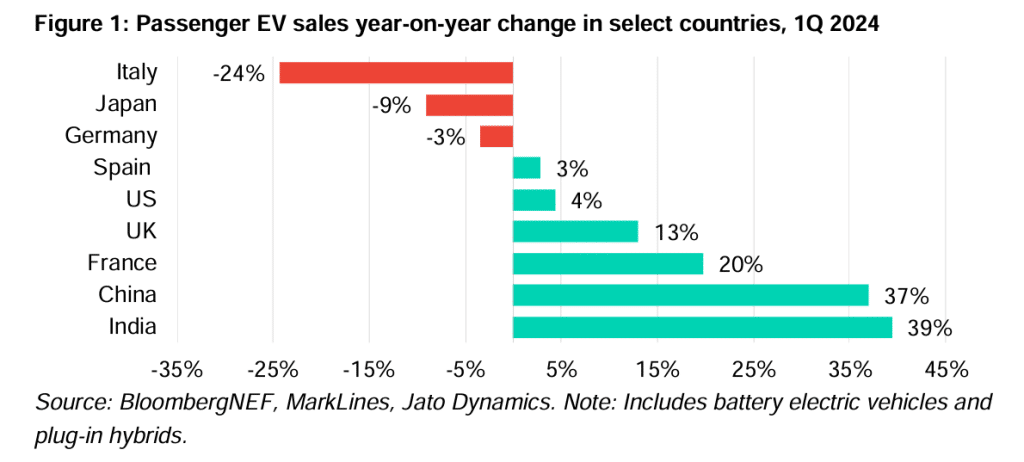

The EV sales development slowdown varies globally. China, India, and France proceed to see wholesome development, whereas Germany, Italy, and the US face challenges. In the meantime, Japan’s market is hampered by a scarcity of EV dedication from main carmakers and no new mini-car fashions.

Regardless of the slowdown, world development in 2024 aligns with BNEF’s forecasts. Some automakers have decreased their electrification targets, citing excessive manufacturing prices, whereas others, like Come on and Volvopresent sturdy outcomes.

- Kia goals for 1.6 million EV gross sales by 2030 and plans to launch an inexpensive EV3 SUV. Remarkably, Volvo’s EV gross sales surged 53% in April 2024, pushed by the EX30 mannequin.

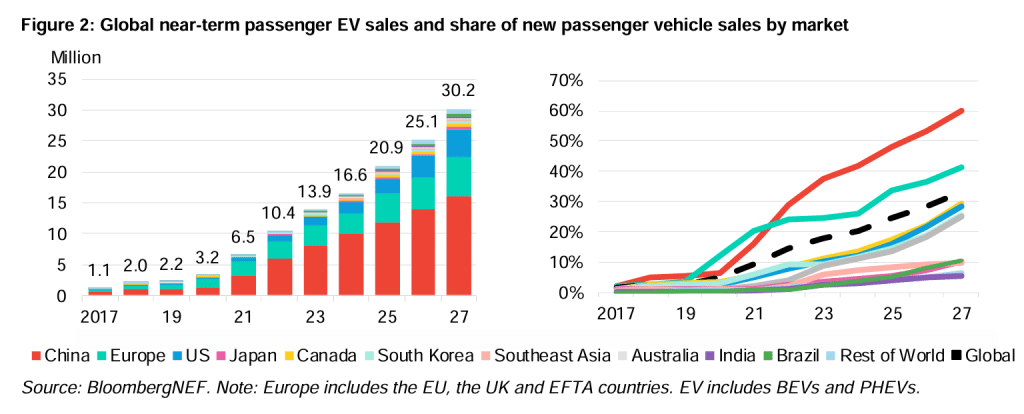

BNEF tasks that world passenger EV gross sales will develop, although at a slower tempo, rising from 13.9 million in 2023 to over 30 million by 2027. The annual development fee will common 21%, down from 61% between 2020 and 2023.

By 2027, EVs will comprise 33% of worldwide new passenger automobile gross sales, with China and Europe main at 60% and 41%, respectively.

The Nordics will attain 90%, whereas Germany, the UK, and France exceed 40%. The US will see 29% EV gross sales, slowed by election-related uncertainties. Japan lags behind, however rising economies like Brazil and India will expertise fast development.

Total, the worldwide EV fleet will increase to over 132 million by 2027, up from 41 million in 2023.

- The long-term market outlook for electrical autos is constructive regardless of near-term challenges.

Financial enhancements are anticipated to drive continued development, with EVs reaching 45% of worldwide passenger automobile gross sales by 2030 and 73% by 2040. Nevertheless, Southeast Asia, India, and Brazil will lag behind the worldwide common and require stronger regulatory assist.

Decarbonizing Business Autos

Relating to decarbonizing business autos, together with vans, vans, and buses, electrification can also be accelerating.

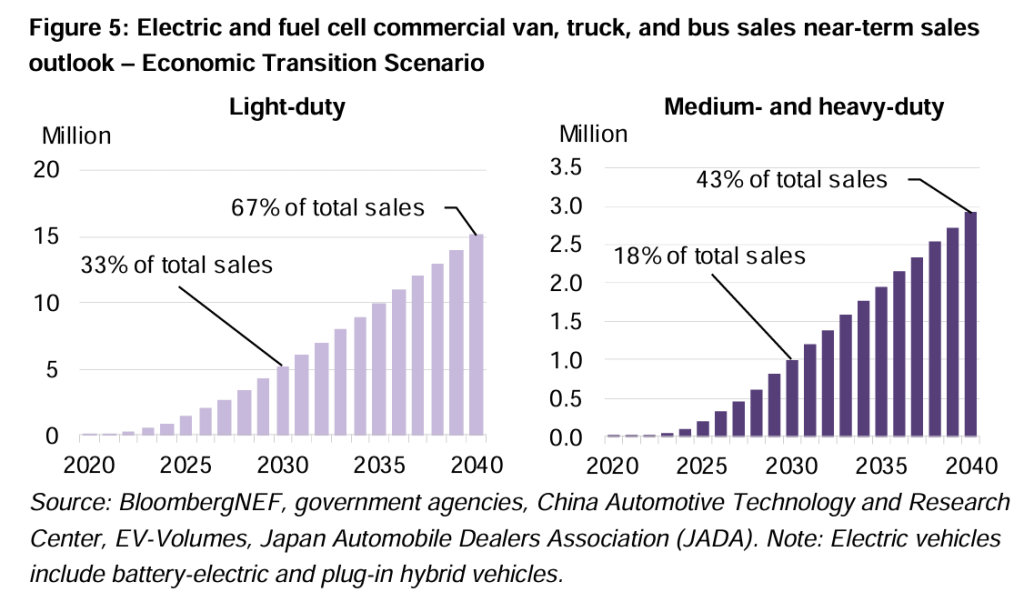

Electrical light-duty supply vans and vans are shortly gaining market share in China, South Korea, and components of Europe, whereas the US nonetheless lags. As seen under, the worldwide e-van market will close to one-third of gross sales by 2030, reaching two-thirds by 2040.

Electrical heavy vans will turn out to be economically viable for many makes use of by 2030, with preliminary adoption in city areas and later growth to long-haul routes.

However, fuel cell trucks will stay viable for some purposes, although their future is much less sure. Zero-emission vans will make up 18% of worldwide gross sales by 2030 and 43% by 2040.

Who Will Drive the Way forward for Electrical Vehicles?

New environmental insurance policies in Europe and the US will drive the adoption of electrical and fuel-cell vans. EU CO2 targets counsel excessive electrification charges by 2030. As an illustration, municipal buses are quickly electrifying, anticipated to exceed 60% of gross sales by 2030 and 83% by 2040.

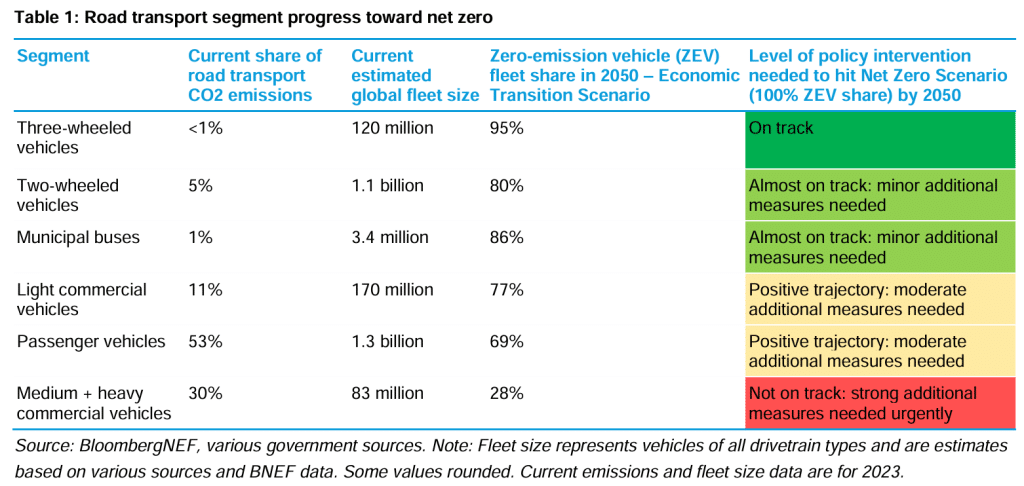

Nevertheless, world street transport shouldn’t be but on a web zero trajectory, and protectionist insurance policies may hinder progress. To attain zero emissions by 2050combustion automobile gross sales should finish by round 2038, with main markets phasing out earlier, per BNEF evaluation.

The Nordic international locations are the one ones projected to completely section out combustion autos earlier than 2038 within the Financial Transition State of affairs (ETS). Subsequently, governments must steadiness industrial methods with sustaining competitors and affordability within the EV market. Stronger regulatory pushes are essential to bridge the hole between the Financial Transition State of affairs and the Internet Zero State of affairs.

- Vital spending is required for each eventualities.

The cumulative worth of EV gross sales throughout all segments will attain $9 trillion by 2030 and $63 trillion by 2050 within the Financial Transition State of affairs. Within the Internet Zero State of affairs, this worth jumps to over $98 trillion by 2050.

Governments are fiercely competing to develop native provide chains, with EVs and batteries remaining central to industrial insurance policies for many years.

How Lithium Batteries Are Revolutionizing the EV Market

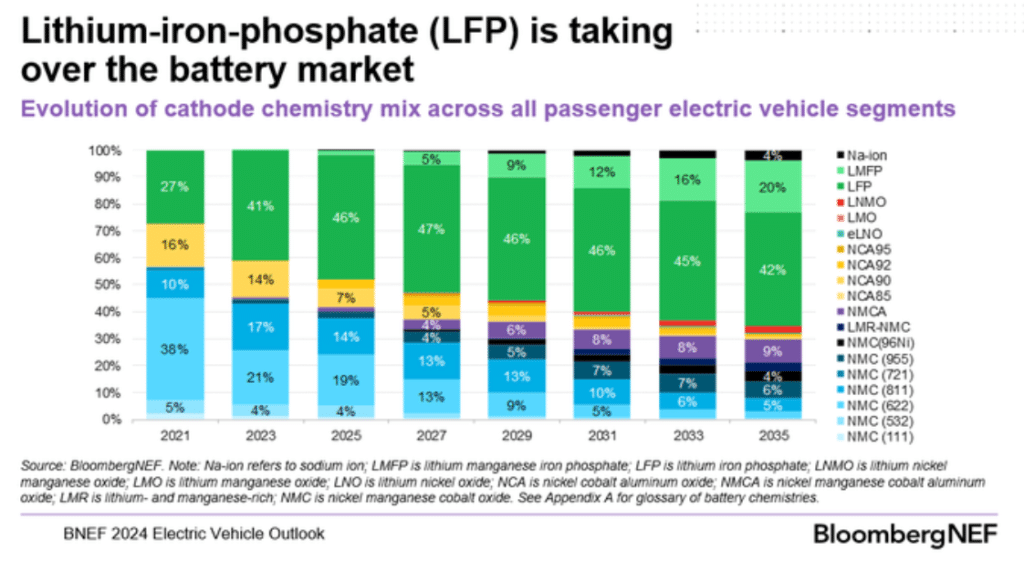

Lithium-iron-phosphate (LFP) batteries are dominating the EV market, lowering the necessity for metals like nickel and manganese. Aggressive pricing is driving enhancements in LFP expertise, together with super-fast charging, chilly temperature efficiency, and better vitality densities.

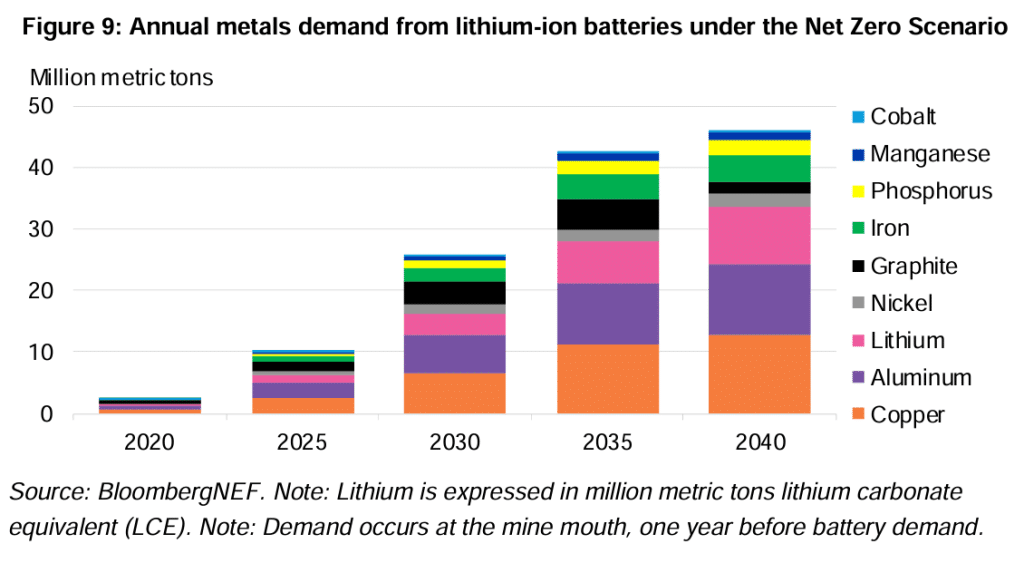

LFP is projected to seize over 50% of the worldwide passenger EV market inside two years, notably in China, the place many LFP cell producers are primarily based. This shift leads to lower-than-expected consumption of nickel and manganese, with 2025 estimates for nickel at 517,000 metric tons and manganese at 131,000 metric tons.

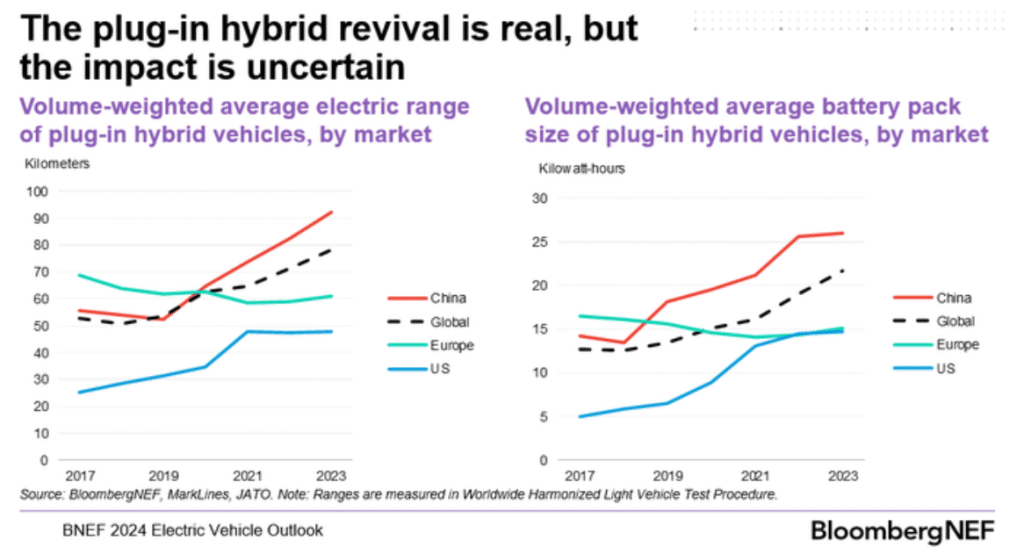

Plug-in hybrids (PHEVs) are experiencing a resurgence, pushed primarily by China, which grew to become the most important PHEV market in 2022. The common electrical vary of PHEVs reached 80 km in 2023, with some fashions in China exceeding 100 km.

Chinese language PHEV battery packs are practically twice the dimensions of these within the US and Europe, usually designed to satisfy gas economic system rules. Whereas PHEVs are seen as a bridge to a zero-emission future, their effectiveness is questionable. In the event that they substitute BEVs and aren’t absolutely utilized in electrical mode, they may enhance oil demand, undermining their environmental advantages.

Charging into the Future: What Does a Totally Electrical Fleet Imply?

A completely electrical automobile world fleet may devour twice the electrical energy the US did in 2023, per BNEF market outlook. By 2050, within the Internet Zero State of affairs, an all-electric automobile fleet would require about 8,313 TWh of electrical energy, double the US’s 2023 consumption.

Regardless of the rise, EVs can assist vitality system electrification via sensible charging and versatile pricing. The EV charging trade should quickly mature, requiring $1.6 to $2.5 trillion in infrastructure, set up, and upkeep funding by 2050.

The adoption of EVs and electrification of economic autos are on the rise, pushed by new insurance policies and technological developments in battery expertise. Nevertheless, important investments in infrastructure and regulatory assist are essential to maintain this momentum and obtain long-term environmental objectives.