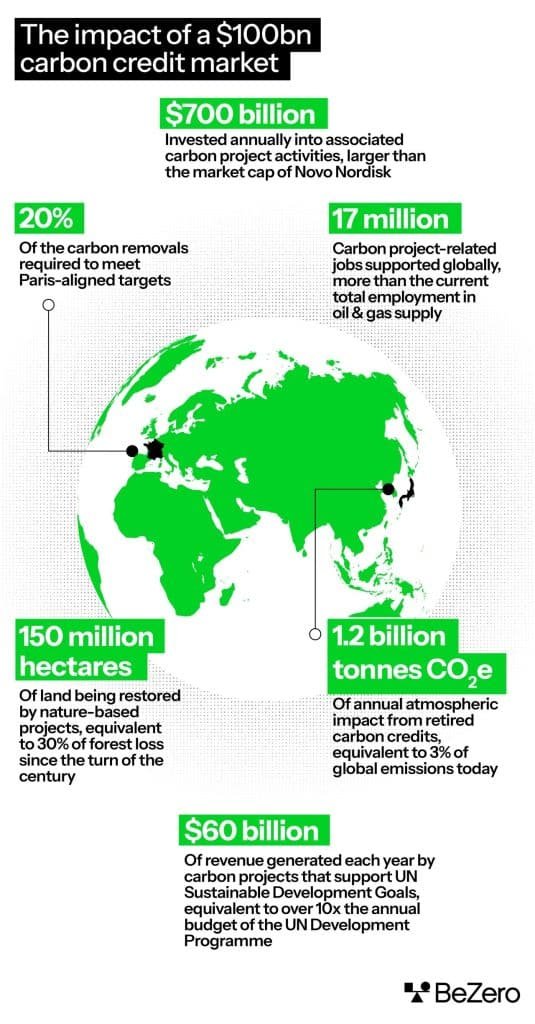

A brand new report from a carbon score firm, BeZero Carbon, reveals {that a} $100 billion carbon market may shield 150 million hectares of land, equal to the scale of Peru, and drive $700 billion annual investments in carbon initiatives.

The report, “$100bn for Planet and People,” highlights the potential environmental and financial advantages of a worldwide carbon market of this scale. BeZero additionally estimates that such a market may help 12.4 million jobs in forestry, practically 3 million in sustainable agriculture, 310,000 in renewables, and 50,000 in adjoining industries.

Tommy Ricketts, CEO and co-founder of BeZero Carbon, said:

“A $100bn project-based carbon market would deliver immense benefits for the planet and people. It means companies spending billions on new technologies and land restoration, supporting more jobs than the oil and gas sector while reducing our global footprint.”

From Forests to Farmlands: Various Actions Producing Carbon Credit

At the moment, over 50 varieties of actions generate carbon credit, starting from forestry and mangroves to methane seize and soil carbon sequestration. And the quantity is steadily growing.

Every carbon credit represents one tonne of carbon dioxide or one other greenhouse gasoline equal (CO2e) mitigated by a selected exercise over an outlined interval.

This increasing array of carbon credit-generating actions highlights the versatile approaches obtainable to fight local weather change. It underscores the rising significance of the voluntary carbon market (VCM) in international emission discount efforts.

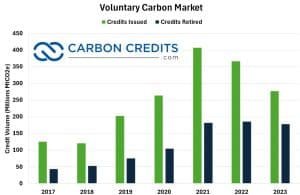

The market has seen large development in 2021 however considerations over carbon credit score integrity impacted the market. Issuances have dropped in two consecutive years as proven within the chart under.

Nonetheless, forecasts are constructive for the VCM’s development because the world strives to mitigate local weather change and reduce carbon emissions.

BloombergNEF initiatives that the worldwide carbon market will surpass $100 billion by the mid-2030s. The analyst additionally estimated demand for credit to succeed in 2.5 billion yearly at a median value of $40.

How a $100B Market Drives Emission Reductions

The report supplied a number of related insights into what the $100 billion carbon credit score market may supply. Listed here are some key findings that the complete sector ought to know.

- A $100B carbon credit score market within the mid-2030s may finance emissions removing initiatives delivering about 20% of the carbon removals wanted for a 1.5-degree Celsius pathway, in response to the Paris Settlement. Such a market would concentrate on initiatives like reforestation, Direct Air Capture (DAC)and Bioenergy with Carbon Seize and Storage (BECCS).

- The market may drive $700 billion in annual investments into carbon initiatives, a ratio of seven:1. The income from carbon credit makes these initiatives viable, unlocking important institutional capital, particularly for applied sciences that want substantial upfront and operational investments like DAC. With out carbon credit, these initiatives would wrestle to draw the mandatory funding to cut back and take away carbon emissions successfully.

- The report means that in a $100B market, retired carbon credit will cut back or take away round 1.2 billion tonnes of CO2e emissions yearly. This represents a major environmental affect, equal to about 3% of present international emissions. This is the same as Japan’s annual emissions and one-and-a-half instances that of the complete international aviation trade.

- The $100 billion carbon credit score market may finance nature-based initiatives protecting round 150 million hectaresequal to 30% of world forest loss since 2000 and bigger than Peru. These initiatives, comparable to afforestation in Brazil, blue carbon in Indonesia, and soil carbon initiatives within the US, help endangered species, shield coastal areas, and enhance soil well being.

By preserving and rebuilding numerous ecosystems, carbon credit contribute considerably to international environmental sustainability and biodiversity.

Furthermore, these credit, primarily based on conservative threat changes, guarantee real emissions reductions and removals. As such, this underscores their position in mitigating local weather change by successfully offsetting substantial quantities of greenhouse gasoline from varied sectors.

Clearing The Path to Growth

However to realize a $100 billion market, fast enlargement is required, addressing latest points with carbon credit score initiatives and enhancing verification and certification providers. The report requires integrating voluntary carbon credit into compliance marketsclear regulatory definitions, and operationalizing worldwide carbon markets below Article 6 of the Paris Settlement.

The Science Based mostly Targets Initiative (SBTI) is contemplating permitting carbon credit for corporations’ Scope 3 emissions, doubtlessly impacting six gigatonnes of CO2e. If authorized, this might worth the worldwide carbon market at $100 billion yearly.

The report additionally urges corporates to undertake inner carbon costs and venture builders to boost high-quality venture supply.

Whereas supporters imagine this strategy may enhance funding in carbon removal projects, critics fear it might undermine the integrity of science-based targets and cut back strain on corporations to chop provide chain emissions.

The potential of a $100 billion carbon credit score market extends far past simply financial advantages. By defending 150 million hectares of land and creating tens of millions of jobs throughout varied sectors, such a market may drive substantial environmental and social progress. Addressing verification and certification challenges, integrating carbon credit into compliance markets, and enhancing high-quality venture supply are essential steps towards realizing this imaginative and prescient.