Howden, a London-based insurance coverage middleman group, has launched the primary carbon credit guarantee and indemnity (W&I) insurance coverage coverage. This coverage covers the sale of carbon credit for Mere Plantations’ reafforestation challenge in Ghana, which rehabilitates degraded forest lands. A number one managing normal agent underwrites the coverage.

This milestone is pivotal for the voluntary carbon marketbecause it considerably boosts belief within the high quality of carbon credit. It could actually probably entice extra buyers into the market.

Insurance coverage’s Function in Local weather Finance

The insurance coverage sector, one of many largest swimming pools of non-governmental capital globally, is essential for funding infrastructure tasks. In 2017, insurance coverage firms confronted $140 billion in climate-related infrastructure losses.

A local weather coverage skilled, Dr. Leah Stokes projected that the US alone would incur $500 billion in local weather catastrophe prices in 2021. Lloyds of London reported that sea degree rise elevated Superstorm Sandy’s New York insurance coverage losses by 30%.

Moreover, over $500 billion of US coastal property could possibly be underwater by 2100. These dangers name for sector reform, redirecting trillions in direction of local weather affect discount. With out a carbon discount plan, property could not qualify for insurance coverage protection.

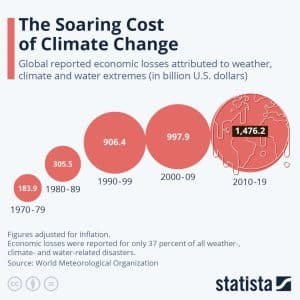

Moreover, the worldwide financial losses attributed to climate and local weather change are exploding. As seen beneath, it reached virtually $1.5 billion between 2010 and 2019 timeline.

The monetary world is now recognizing the worth of insuring climate-related tasks. In 2022, Howden launched the first-ever carbon credit score insurance coverage to spice up confidence in carbon markets.

The most important European dealer believes the VCM has a significant function on the planet’s transition to a low-carbon economic system. It simply introduced its first carbon credits Guarantee and Indemnity (W&I) insurance coverage coverage for the forestry challenge of Mere Plantations. The UK-based firm manages a teak plantation with 3+ million timber in Ghana, West Africa.

By using insurance coverage as a governance instrument, the W&I coverage enhances the credibility and worth of carbon credit. Mere Plantations can now guarantee patrons that their credit meet stringent environmental, social, and monetary requirements, supported by an insurance coverage coverage that ensures their authenticity.

Charlie Pool, Head of Carbon Insurance coverage at Howden, emphasised that insurance coverage ensures the credibility of carbon credit, attracting larger values and inspiring additional challenge improvement. He additional remarked that:

“The carbon markets are the best tool we have for putting a price on emissions. Traditionally held back by poor governance, the voluntary market can now be improved using market-based mechanisms.”

Leveraging Underwriting Experience for Inexperienced Tasks

The coverage additionally permits challenge builders to leverage the underwriting experience of the M&A insurance coverage market, making certain confidence of their carbon credit score tasks’ methodology and implementation. Recognizing this added safety and the top quality of the credit, patrons are keen to pay a premium in comparison with different reafforestation tasks.

Uniserve, a UK-based logistics firm, is the primary to buy these credit.

This improvement follows different Howden-led initiatives, together with the primary voluntary carbon credit score insurance coverage product in 2022. It has additionally an insurance coverage product protecting carbon dioxide leakage from commercial-scale carbon capture and storage amenities in January 2024.

Mark Hogg, CEO of Mere Plantations, highlighted their mission to make reestablishing degraded forest land a viable business enterprise with out assist or authorities intervention. He famous that this insurance coverage supply unlocks the carbon market’s potential, aiding their mission.

Gary Cobbing, Uniserve’s Group Chief Industrial and Working Officer, expressed confidence within the partnership with Mere Plantations, saying:

“Mere Plantations shares Uniserve’s commitment to sustainability and integrity, making them an ideal source for our investment in carbon credits as part of our ongoing carbon reduction plan.”

The Rising Carbon Credit score Insurance coverage Market

Howden isn’t the one huge participant within the burgeoning carbon credit score insurance coverage house.

A UK-based carbon credit score insurance coverage startup Kita Earth gives insurance policies for carbon removing credit. And market consultants foresee new gamers becoming a member of quickly propelled by the projection that it’ll turn out to be a billion-dollar market.

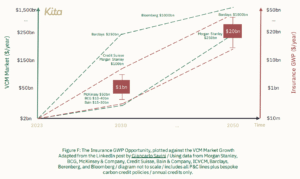

Based on an industry reportthe carbon credit score insurance coverage market may attain round $1 billion in annual Gross Written Premium (GWP) by 2030, probably rising to $10-30 billion by 2050.

Nonetheless, this will underestimate the market’s potential because it focuses solely on the VCM and excludes the compliance market. In 2023, world compliance carbon markets had been valued at over $900 billion, influenced by coverage adjustments and geopolitical components.

The VCM was valued at $2 billion in 2022, however Abatable estimated $10 billion value of offers that yr, suggesting funding was 5x the worth of issued carbon credit. A Barclays Particular Report predicts the VCM may develop to $250 billion by 2030, though estimates differ broadly from $10 billion to $250 billion.

The report means that insurance coverage can supply 4 key advantages to carbon markets:

- Balancing danger and innovation,

- Boosting confidence,

- Assessing challenge dangers, and

- Encouraging risk-taking.

Certainly, the quickly evolving carbon markets current a posh panorama with distinctive dangers and vital challenges. Introducing insurance coverage mechanisms like that of Howden’s W&I coverage can successfully handle these dangers, improve investor confidence, and stimulate elevated funding. This can allow the markets to scale on the vital price to align with world carbon emission discount targets.