Australian uranium mining big Paladin Vitality Ltd. has introduced a C$1.14 billion ($833 million) all-stock supply to amass Canadian mining agency Fission Uranium Corp. Utilizing uranium in nuclear energy considerably contributes to reaching local weather objectives by offering dependable vitality that reduces the worldwide carbon footprint. Thus, this deal can convey a paradigm shift in uranium mining.

In accordance the Paladin’s press launch, the Transaction is focused to shut within the September 2024 quarter on assembly all of the situations beneath the Settlement. Paladin CEO Ian Purdy, is very optimistic, noting,

“The rationale is very compelling. We see this as a fantastic asset. Regardless of where the uranium cycle is or how the industry’s doing, the combination of these two companies just makes fundamental sense.”

He additional added that Fission is a pure match for Paladin’s portfolio with the shallow high-grade Patterson Lake South (PLS) undertaking situated in Canada’s Athabasca Basin. The addition of PLS creates a number one Canadian improvement hub alongside Paladin’s Michelin undertaking, with exploration upside throughout all Canadian properties.

supply: Bloomberg

Paladin and Fission Merger Benefits

The merger of Paladin and Fission will set up a number one clear vitality firm, offering these advantages to shareholders of each corporations:

- Enhanced undertaking improvement pipeline.

- Multi-asset manufacturing projected by 2029.

- Diversified presence throughout high uranium mining areas in Canada, Namibia, and Australia.

- Elevated publicity to favorable long-term uranium market fundamentals.

- Expanded scale and international profile for Paladin with a TSX itemizing.

Moreover, Fission shareholders are poised to profit instantly from the JV. They are going to get a beautiful 30% premium to Fission’s 20-Day Quantity-weighted common value (VWAP) and the chance to take part in Paladin’s future enlargement plans.

Uranium Powerhouse- Paladin’s Path to World Management

Paladinan ASX 200-listed premier uranium firm based mostly in Perth, Western Australia, holds a 75% stake within the Langer Heinrich Mine (LHM) in Namibia. This mine has generated over 43 Mlbs of U3O8 and is poised for a sturdy return to manufacturing. The preliminary volumes are scheduled to be processed on 30 March 2024. After the Transaction closes, Fission shareholders will maintain a 24.0% stake in Paladin. It’s anticipated to have a market worth of round US$3.5 billion.

The corporate boasts a diversified, high-quality uranium exploration and improvement portfolio in high mining areas, together with Canada and Australia.

Paladin is devoted to decreasing carbon emissions and adopting nuclear vitality. It helps sturdy nuclear safeguards for the peaceable use of nuclear materials to generate zero-emissions electrical energy.

Because the Langer Heinrich Mine (LHM) resumes manufacturing, it’s going to measure, monitor and report its emissions. Paladin strongly emphasizes sustainability managing their Scope 1 and Scope 2 carbon emissions.

Notably, Paladin doesn’t face the Scope 3 emissions problem, as nuclear energy vegetation produce no greenhouse gasoline emissions throughout operation. Additionally they predict that LHM’s uranium manufacturing will forestall roughly 1.3 BT of CO2 emissions, in comparison with equal coal-fired electrical energy era.

Ian Purdy has considerably highlighted that the price of uranium has spiked <3x previously 5 years. It surged additional following the Russia-Ukraine struggle, highlighting the pressing want for different reactor gas sources. Thus, he anticipates extra uranium offers forward.

Fission’s Athabasca Basin, a Geographical Bounty

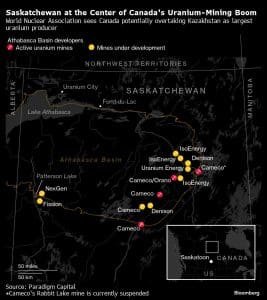

Fission is amongst a number of junior mining corporations, akin to NexGen Vitality Ltd. and Denison Mines Corp., growing initiatives within the Athabasca Basin. This space has turn into a mining hotspot because of rising provide considerations and growing international curiosity in nuclear energy as a sustainable different to fossil.

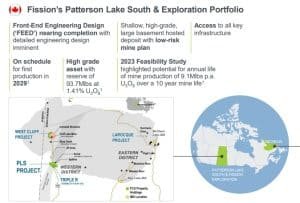

Positioned in Saskatchewan’s Athabasca Basin, PLS is dwelling to the Triple R deposit. It’s acknowledged because the area’s largest high-grade uranium reserve near the floor. We found from the corporate’s Feasibility Examine that Triple R has the potential to turn into one of many lowest-cost uranium mines globally. It additionally unveils its distinctive strategic place alongside all-weather Freeway 955. It traverses the UEX-AREVA Shea Creek deposits and results in the historic Cluff Lake uranium mine. These benefits make it one of many world’s best uranium mining areas.

Supply: Paladin

Supply: Paladin

Attributable to its shallow nature, the PLS undertaking affords flexibility for improvement by means of underground mining, open pit mining, or a hybrid strategy. Contemplating sustainability, , Fission has chosen to pursue an underground-only mining technique after deep session with native communities. This strategy permits the corporate to completely extract the deposit whereas benefiting from diminished CAPEX and a minimized environmental impression.

Fission CEO Ross McElroy mentioned that whereas the area holds excessive concentrations of uranium. Just a few corporations have the experience to discover and develop such initiatives. Undoubtedly, Paladin is certainly one of them.

He additional commented,

“Having worked the majority of my geology career in the Athabasca Basin, I can tell you that it takes a great deal of expertise to properly explore and make discoveries like this one.”