The press launch from Japan Local weather Transition Bonds Framework beneath the Ministry of Finance (MoF) states that on July 2, 2024, Japan will launch its inaugural JPY1.6 trillion (USD 11 billion) Local weather Transition Bond, devoted to funding the nation’s intensive Inexperienced Transformation (GX) program.

The GX Plan goals to mobilize JPY150 trillion (USD 1 trillion) in private and non-private investments over the subsequent decade, focusing on cutting-edge, sustainable applied sciences to mitigate home emissions. This initiative aligns with Japan’s dedication to reaching its 46% greenhouse fuel (GHG) discount targets by 2030 and turning into carbon impartial by 2050.

Key Initiatives in Japan’s GX Promotion Technique

As per Climate Transition Bond FrameworkIn FY 2021, Japan’s vitality self-sufficiency fee was 13.3%. It has been closely reliant on imported oil, coal, and liquefied pure fuel for the reason that Nice East Japan Earthquake occurred in 2011.

Attaining Inexperienced Transformation (GX) necessitates addressing high-emission sectors.

Emission discount efforts are essential for vitality transformation within the following sectors:

- Heavy industries like metal and chemical compounds, considerably contribute to emissions after distribution.

- On a regular basis life sectors – households, transportation, industrial, and academic amenities.

Precedence will probably be given to applied sciences that effectively and successfully cut back emissions in every sector. The prime focus will probably be on those who forge industrial competitiveness and drive financial progress.

- Japan’s GX promotion technique establishes two key initiatives to fulfill worldwide commitments, guarantee a secure vitality provide, and understand financial progress.

1. Secure Vitality Provide and Decarbonization:

- Promote vitality conservation measures.

- Transition energy sources to enhance vitality self-sufficiency, specializing in renewable vitality and nuclear energy.

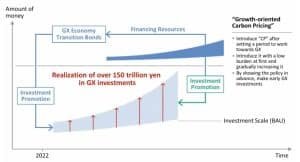

2. Development-Oriented Carbon Pricing Idea:

- Implement and execute daring upfront funding assist utilizing devices similar to GX Financial system Transition Bonds.

- Present incentives for GX funding by carbon pricing.

- Make the most of new monetary mechanisms to assist the transition.

These initiatives guarantee a secure vitality provide whereas advancing towards decarbonization and financial progress.

Picture: GX promotion technique

supply: Japan Local weather Transition Bond Framework

Japan’s Local weather Transition Bonds Set New Requirements in Sustainable Finance

The press launch discreetly mentions that Japan’s Local weather Transition Bonds are licensed beneath the Local weather Bonds Commonplace. It assures buyers’ adherence to world greatest practices in environmental targets.

Sean Kidney, CEO, of Local weather Bonds Initiative, mentioned:

“Transition is the theme for the year: corporates, cities and countries need to do transition plans in line with global emission reduction targets; under the Paris Climate Agreement countries are working on ambitious new Nationally Determined Contributions (NDCs) – transition plans – to be tabled at next year’s COP. “This bond shows clearly how governments, and others, can raise funds to invest in that transition. It marks a significant milestone in transition finance.”

The First 55.5% Share

A considerable 55.5% of the bond’s proceeds will fund R&D initiatives. It could concentrate on renewable vitality and hydrogen utilization in steelmaking, to assist restrict world temperature will increase to 1.5°C.

The Second 44.5% Share

The remaining 44.5% will assist subsidies for actions like manufacturing electrical energy storage batteries and implementing energy-efficiency measures in buildings. Notably, the bond explicitly excludes funding for gas-fired energy era or ammonia co-firing in coal-fired crops.

The unbiased verification report, ready by the Japan Credit score Ranking Company (JCRA), a Local weather Bonds Permitted Verifier, reinforces the bond’s credibility.

Atsuko Kajiwara, Managing Govt Officer and head of the Sustainable Finance Analysis Group at JCRA, mentioned:

“Since 2020, JCR has been contributing to the government’s efforts to develop Japan’s transition pathway toward net zero by 2050 and alignment with the Paris Agreement. JCRA hopes the government’s strong initiative will help various Japanese corporates that struggle to find a way to attain both carbon neutrality and business expansion in the coming decades.”

We will elaborate on the historical past and extra particulars of this bond within the subsequent paragraphs.

The event of Local weather Transition Bonds (JCTBs) in Japan, IEA Stories

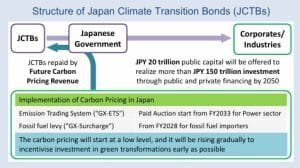

In February 2024, Japan made historical past by issuing the world’s first sovereign transition bonds—Japan Local weather Transition Bonds (JCTBs). The issuance included two tranches of JPY 800 billion (USD 5 billion) every, with tenors of 5 and 10 years. Licensed by the Local weather Bonds Initiative, these bonds are grounded in Japan’s nationwide transition technique.

supply: IEA Report 2024

Unlocking the Key Options of JCTBs

Funding Plan

Japan’s Fundamental Coverage for the Realization of Inexperienced Transformation, printed in February 2023, outlines an in depth funding plan for 22 industrial sectors to realize carbon neutrality by 2050.

- Envisions JPY 20 trillion (USD 130 billion) of public capital

- Goals to generate over JPY 150 trillion (USD 1 trillion) in funding by private and non-private financing by 2050

- Contains sector-specific transition roadmaps developed by professional committees

Give attention to Nascent Applied sciences

Over half of the proceeds from JCTBs will probably be allotted to rising applied sciences essential for the transition.

Revolutionary Carbon Pricing Method:

- Makes use of future carbon pricing income for quick bond compensation

- Permits for quick deployment of capital primarily based on assumed future income from carbon taxes

Potential for Rising Markets and Growing Economies (EMDE):

- Credit score Middleman Function: The federal government acts as a credit score middleman, enhancing the creditworthiness of corporates and simplifying financing for small-scale tasks.

- Credit score Enhancements: For international locations with sub-investment-grade credit score rankings, further credit score enhancements similar to ensures from Improvement Finance Establishments (DFIs) could facilitate entry to worldwide capital markets.

Japan’s local weather transition bonds set a brand new commonplace for sovereign transition bonds. This mannequin can information different nations, particularly in rising markets. Consequently leveraging future carbon pricing revenues and appeal to important funding for inexperienced transformations.