Avoiding a local weather disaster presents important challenges, particularly in transitioning energy and transportation programs to renewable and clear power. This transition will vastly improve copper demand, surpassing present manufacturing ranges, and giving main shares an enormous raise.

Copper’s distinctive conductivity makes it essential for the power transition. Copper is present in most home equipment like toasters, air conditioners, microchips, automobiles, and houses.

- Fascinating reality: The common automotive accommodates 65 kilos of copper, whereas a typical house has over 400 kilos.

Developing superior grids for decentralized renewable sources and stabilizing their provide requires in depth copper wiring. Photo voltaic and wind farms, which cowl massive areas, demand extra copper per energy unit than centralized coal and fuel crops. Electrical automobiles (EVs) use over twice as a lot copper as gasoline automobiles.

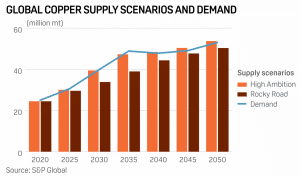

Assembly net zero carbon emission targets by 2035 could require doubling annual copper demand to 50 million metric tons. Even conservative estimates foresee a one-third demand improve over the subsequent decade.

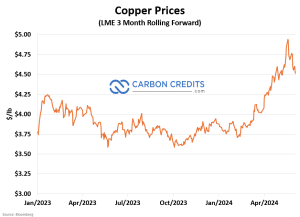

What extra is the current surge in copper prices beginning early this yr as you may see beneath. In Could 2024, it reached virtually $5 per pound in LME.

So, there may very well be no wiser transfer than investing in copper to experience alongside this rising demand. We imagine so, too, that’s why we now have thought of among the finest copper shares in 2024. Listed below are the highest three copper shares that might be worthy so as to add to your funding portfolio this 2024.

The World’s Largest Copper Reserve Holder: Southern Copper

Market Cap: US$85.24 billion

For traders looking for substantial publicity to copper, Southern Copper Corporation’s reliance on this steel will be interesting. The distinguished Mexican mining firm primarily focuses on copper manufacturing, boasting the most important reserves of the steel globally.

Nevertheless, its operations prolong past copper, producing precious by-products resembling silverzinc, and molybdenum. This diversification, whereas important, doesn’t overshadow its main reliance on copper, which accounted for about 79% of the corporate’s internet gross sales over the three years ending December 31, 2022.

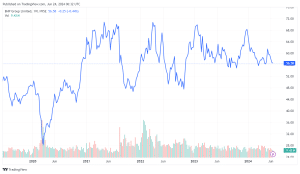

Southern Copper’s inventory has skilled notable volatility over the previous few years. After a stellar efficiency in 2020, the place the share worth surged over 50%, the corporate noticed a decline of greater than 7% over the following 2 years.

Nevertheless, 2023 marked a restoration, with the share worth climbing practically 25% within the first 9 months. And it additional skyrocketed at first of 2024 and reached the first-time excessive in Could.

The current uptick in copper costs has not solely bolstered the corporate’s market efficiency but additionally enabled it to extend dividend funds considerably. At its present share worth, the inventory affords a pretty dividend yield of 5.4%, making it interesting to income-focused traders.

Strategic Investments and Venture Improvement

Holding the most important copper reserves globally, Southern Copper can be working top-tier belongings in investment-grade international locations like Mexico and Peru.

The corporate’s dedication to increasing its portfolio and reserves is obvious by means of its important capital funding program, exceeding $15 billion, deliberate for this decade. It goals to reinforce and develop its operations throughout a number of high-potential initiatives, together with:

- Buenavista Zinc, Pilares, El Pilar, and El Arco Initiatives in Mexico: These initiatives are essential for the corporate’s progress technique. El Arco, specifically, advantages from important infrastructure investments aimed toward enhancing its competitiveness.

- Tia Maria, Los Chancas, and Michiquillay Initiatives in Peru: These initiatives additional diversify the corporate’s portfolio and strengthen its place within the international copper market.

:quality(75)/arc-anglerfish-arc2-prod-elcomercio.s3.amazonaws.com/public/ATNEGMPCWJHBZKBEGYCW4S4CXM.JPG)

Southern Copper’s operations in Mexico and Peru present a strategic benefit as a result of stability and investment-grade rankings of those international locations. This geographical diversification into areas with favorable mining rules and strong infrastructure helps the corporate’s long-term progress and sustainability.

BHP Group: Casting A Vast Web in Copper

Market Cap: US$142.99 billion

BHP Group is a world-leading assets firm engaged within the extraction and processing of minerals, oil, and fuel. As a significant participant within the international copper market, the Australian miner is dedicated to progressive practices and sustainability, aiming to provide important assets effectively and responsibly.

BHP owns and operates a number of copper mines in Chile and the Olympic Dam in South Australia.

Copper is BHP’s second-largest income generator after iron ore. This mineral section plowed over US$16 billion into the corporate’s revenue in 2023, with 1,716.5 kilotons of copper manufacturing.

-

The world’s largest mining firm seeks to forged a large internet in copper with its exploration venture within the excessive Arctic often known as Camelot Venture.

BHP launched this program early this yr, masking the Queen Elizabeth Islands within the Northwest Territories and Nunavut. The venture goals to evaluate the potential for copper throughout six areas, spanning hundreds of sq. kilometers. Exploration websites embrace Ellesmere Island, roughly 800 kilometers from the North Pole, Melville Island, Ellef Ringnes Island, and Axel Heiberg Island.

In response to the surge in copper pricesmining corporations are scrambling to extend provide together with BHP. The Australian mining large lately introduced a strategic partnership with Ivanhoe Electrical to discover copper and different important minerals.

Their collaboration goals to determine new sources of those crucial assets, pushed by the worldwide shift in direction of clean energy and the electrification of varied industries.

The exploration settlement with Ivanhoe Electrical is structured in two levels. The primary part focuses on venture era, involving exploratory actions by each corporations. If profitable, the following part might result in the formation of joint ventures to develop and function mining initiatives.

Extra lately, BHP has made a daring transfer to develop its copper publicity by making a $39 billion bid for Anglo American. Nevertheless, the provide was postpone the desk, delaying the corporate’s goal to cement its dominance within the copper market. Nonetheless, the Australian miner continues to discover important copper initiatives and discover methods to deepen its involvement within the sector.

Coppernico Metallic: Pioneering Copper-Gold Exploration in South America

Coppernico Metals Inc. is an exploration firm devoted to producing worth for its shareholders and stakeholders by means of meticulous venture analysis and exploration excellence. The corporate goals to find world-class copper-gold and nickel deposits in South America, leveraging its skilled administration and technical groups’ confirmed monitor document in elevating capital, discovery, and monetization of exploration successes.

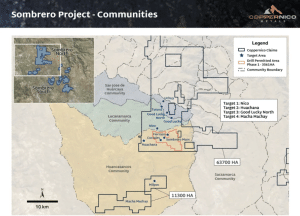

Coppernico is at the moment centered on two main initiatives in Peru: the Sombrero and Takana initiatives. The corporate both owns or has the appropriate to buy as much as 100% management of the concessions.

The Sombrero district, specifically, is a significant focus on account of its promising geological prospects. It options important copper-gold values from floor samples and historic drilling, focusing on skarn, porphyry, and epithermal deposits.

Takana hosts high-grade copper-nickel occurrences with multi-kilometer mineralization developments. Preliminary dialogues have already began with communities close to the Takana venture, exhibiting promising indicators for future entry agreements within the coming months.

Strategic Enlargement, Analysis, and Itemizing Plans

In its quest to supply diversified upside for shareholders, Coppernico has evaluated quite a few exploration alternatives throughout South America. The corporate has narrowed its focus to fifteen precedence initiatives, aiming to determine further belongings that complement the invention potential of Sombrero.

Past Peru, Coppernico can be concentrating on exploration alternatives in Ecuador. The area has seen appreciable success with a number of corporations, together with Solaris Assets, SolGold, Cornerstone, Dundee Valuable Metals, and Lundin Mining.

The junior exploration firm is an unlisted reporting issuer actively looking for listings on Canadian and U.S. inventory exchanges. It plans to pursue a inventory trade itemizing software as soon as it fulfills the necessities, a transfer that’s a part of Coppernico’s broader technique to reinforce its visibility and entice a broader investor base.

In Could this yr, the corporate efficiently closed its $19.37 million non-public placement financing. The financing included participation from Teck Assets Restricted, a distinguished Canadian mining firm, below a subscription settlement.

With its strong venture pipeline, strategic evaluations, and plans for inventory trade listings, Coppernico is well-positioned to capitalize on its exploration successes and ship substantial worth to its shareholders.

What Comes Subsequent for Copper?

Copper’s pivotal function in attaining internet zero emissions is more and more acknowledged, particularly in renewable energy applied sciences and electric vehicles (EVs). Nevertheless, projections point out a possible supply-demand hole, necessitating substantial investments in manufacturing and recycling to satisfy rising demand and sustainability objectives.

Key industries driving copper consumption embrace tools manufacturing, building, infrastructure, and rising sectors like EVs and inexperienced applied sciences. With the rising adoption of EVs, photo voltaic panels, and different clear power applied sciences, copper demand is anticipated to double by 2035.

In mild of formidable internet zero targets for 2035, business estimates recommend that annual copper demand may have to achieve 50 million metric tons. Even conservative projections anticipate a one-third improve in demand over the subsequent decade, propelled by important investments in decarbonization initiatives from each private and non-private entities.

Assembly this escalating demand presents challenges, resembling declining ore grades and environmental issues round mining. Addressing these requires important investments, probably driving copper costs increased.

Analysts predict continued worth progress on account of supply-demand imbalances and growing demand from the inexperienced power sector.

Uncertainties surrounding China’s financial restoration and the US Federal Reserve’s financial coverage add complexity to future copper worth trajectories. Nevertheless, analysts stay optimistic about copper’s long-term prospects, pushed by the power transition and growing demand from sectors like EVs and renewable energy.

As nations compete for restricted future copper provides, securing home or pleasant sourcing and refining capabilities turns into a strategic crucial. Strategic investments in copper manufacturing and recycling are essential to satisfy rising demand and obtain net zero emissions amidst the increasing renewable power infrastructure and EV adoption.