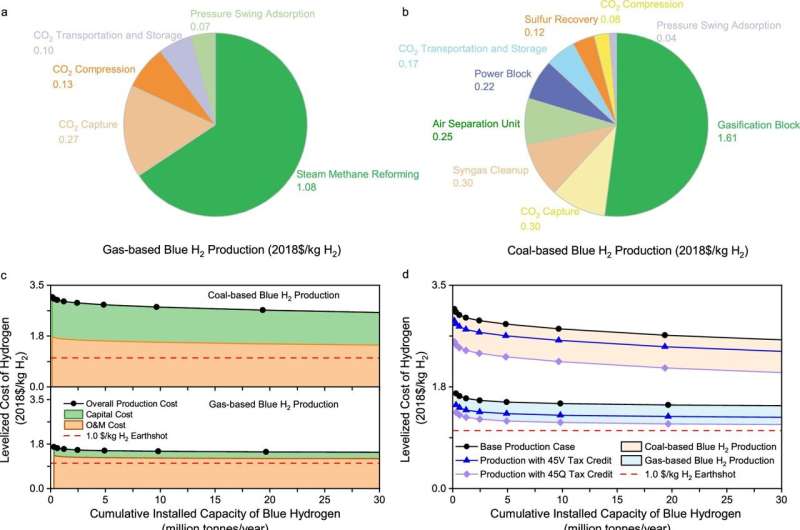

Preliminary and future prices of blue hydrogen manufacturing with out and with tax incentives. a Distribution of preliminary levelized price for gas-based H2 manufacturing. b Distribution of preliminary levelized price for coal-based H2 manufacturing. c Studying curves for coal-based and gas-based H2 manufacturing capital and working and upkeep (O&M) prices with out tax incentives. d Studying curves for general levelized price of coal-based and gas-based H2 manufacturing with out and with tax incentives. e Future price reductions for coal-based and gas-based H2 manufacturing with tax incentives. Credit score: Nature Communications (2024). DOI: 10.1038/s41467-024-50090-w

A brand new evaluation by College of Wyoming researchers examines the affect of present federal financial incentives on large-scale, blue hydrogen manufacturing applied sciences and estimates the anticipated outcomes in long-term bills as these hydrogen manufacturing pathways evolve.

The researchtitled “Technological Evolution of Large-Scale Blue Hydrogen Production Toward the U.S. Hydrogen Energy Earthshot,” was led by Haibo Zhai, the Roy and Caryl Cline Distinguished Chair in Engineering and a professor within the UW School of Engineering and Bodily Sciences. The research seems within the journal Nature Communications.

Wanying Wu, Zhai’s UW Ph.D. pupil, was lead creator.

Launched in 2021, the U.S. Division of Power’s (DOE) Power Earthshots Initiative goals to speed up breakthroughs of extra ample, inexpensive and dependable clear vitality options throughout the decade by decreasing the price of clear hydrogen manufacturing and deployment. The formidable purpose of this system is to scale back manufacturing prices of hydrogen by 80% to $1 per kilogram of hydrogen in a decade.

The brand new UW research estimates the economic benefits from studying expertise by deploying large-scale blue hydrogen tasks; evaluates each the 45Q tax credit for carbon sequestration and 45V tax credit score for clear hydrogen manufacturing; and compares the credit’ financial position in selling blue hydrogen manufacturing towards the Hydrogen Power Earthshots Initiative.

“Currently, the cost of hydrogen is high, especially when produced from renewables,” Zhai says. “However, blue hydrogen—that is, hydrogen produced using fossil fuels and paired with carbon sequestration—has the potential to significantly reduce the costs of production, substantially lower emissions and support new economic opportunities in line with the goals of the Energy Earthshots Initiative so long as the tax incentives and infrastructure funding remain available to technology developers. This study is an important snapshot of where we are and where we could be in the future while building out clean hydrogen systems.”

The premise is that the extra prevalent and superior (or “experienced”) large-scale blue hydrogen methods grow to be, the extra environment friendly and inexpensive they’ll grow to be. Nevertheless, that is just one piece of the puzzle, Zhai says.

“We apply experience curves to estimate the evolving costs of blue hydrogen production and to further examine the economic effect on technological evolution of the Inflation Reduction Act’s tax credits for carbon sequestration and clean hydrogen,” he explains.

“We concluded in our models that the break-even cumulative production capacity required for gas-based blue hydrogen to reach DOE’s $1/kg H2 target is highly dependent on tax credits, natural gas prices, inflation rates, carbon capture uncertainties and learning rates.”

Regardless of these uncertainties, the research concludes that have from the deployment of blue hydrogen tasks can be useful in decreasing future prices of hydrogen manufacturing and can stay price aggressive. Moreover, paired with prolonged tax incentives for carbon sequestrationprices may very well be considerably lowered additional.

Extra info:

Wanying Wu et al, Technological evolution of large-scale blue hydrogen manufacturing towards the U.S. Hydrogen Power Earthshot, Nature Communications (2024). DOI: 10.1038/s41467-024-50090-w

Supplied by

University of Wyoming

Quotation:

Examine evaluates tax credit’ position in blue hydrogen manufacturing prices (2024, July 9)

retrieved 9 July 2024

from https://techxplore.com/information/2024-07-tax-credits-role-blue-hydrogen.html

This doc is topic to copyright. Other than any truthful dealing for the aim of personal research or analysis, no

half could also be reproduced with out the written permission. The content material is supplied for info functions solely.