Join daily news updates from CleanTechnica on e mail. Or follow us on Google News!

Europe is the slowest area of progress for electrical automobile (EV) gross sales to this point this 12 months, Rho Movement, the main analysis home targeted on the electrical automobile market, revealed in the present day of their half yearly replace.

Slightly below seven million electrical autos have been bought globally within the passenger automotive and light-duty automobile market within the first half of 2024, rising by 20% in comparison with the identical interval in 2023. Battery electrical autos (BEVs) account for 65% of world gross sales with the remaining 35% plug-in hybrid electrical autos (PHEVs).

Snapshot electrical automobile gross sales in January–June 2024 vs. January–June 2023

- World: 7.0 million in H1 2024, +20% y-o-y

- China: 4.1 million, +30%

- EU & EFTA & UK: 1.5 million, +1%

- USA & Canada: 0.8 million, +10%

- Remainder of World: 0.6 million, +26%

Charles Lester, Lead EV Information Analyst at Rho Movement, mentioned: “The global EV market can take comfort in the 20% growth shown in the first half of the year but the regional disparities are quite remarkable. Europe’s 1% growth compared to China’s 30% needs swift course correction if targets are to be met in the Western region. The other surprising twist of the year is the resurgence of PHEVs which were going out of style towards the end of last year but are now back in favour and accounting for more than one in three electric vehicles sold. The overall picture is that 2024 is not going to see the ambitious growth some may have hoped for the industry and we have lowered our forecasts by 5% to 16.6 million electric cars sold this year.”

EU & EFTA & UK

1.5 million EVs have been bought in Europe within the first half of 2024, rising by only one% in comparison with the identical interval in 2023. There have been blended ends in European progress, with gross sales in Germany falling by 9% in H1 2024 vs H1 2023, however gross sales in France and the UK have elevated by 8% and 13%, respectively. Italy set a file for EV gross sales in June 2024 with nearly 20,000 EVs bought following the discharge of its 2024 EV incentives. Regardless of this, gross sales in Italy have fallen by 11% this 12 months to this point.

China

Chinese language EV gross sales have had the quickest progress in comparison with the main areas, with 4.1 million models bought to this point this 12 months versus 3.2 million over the identical interval in 2023. The share of PHEVs has made a come again because the market share has risen by 8 proportion factors in 2023 to 41% in 2024. That is as a result of rising variety of PHEVs out there from automotive producers, the expansion in Vary Extender Electrical Automobile gross sales (REEVs), and powerful progress from BYD who bought a record-high variety of electrical autos in June 2024. Of the 0.34 million passenger vehicles bought by BYD in June 2024, 195,032 have been PHEVs and 145,179 have been BEVs, setting one other file excessive for PHEVs.

USA & Canada

The US & Canada EV market while off to a shaky begin originally of the 12 months confirmed constructive indicators within the second quarter of the 12 months. GM elevated its BEV gross sales by 34% within the second quarter vs the primary quarter of the 12 months, Ford by 18%, and Honda launched its Prologue SUV and the Acura ZDX in Q2. Normal Motors has additionally been ramping up manufacturing in Mexico producing nearly 60,000 BEVs in H1 2024. This consists of the Chevrolet Blazer, Chevrolet Equinox, Honda Prologue, and most just lately the Cadillac Optiq.

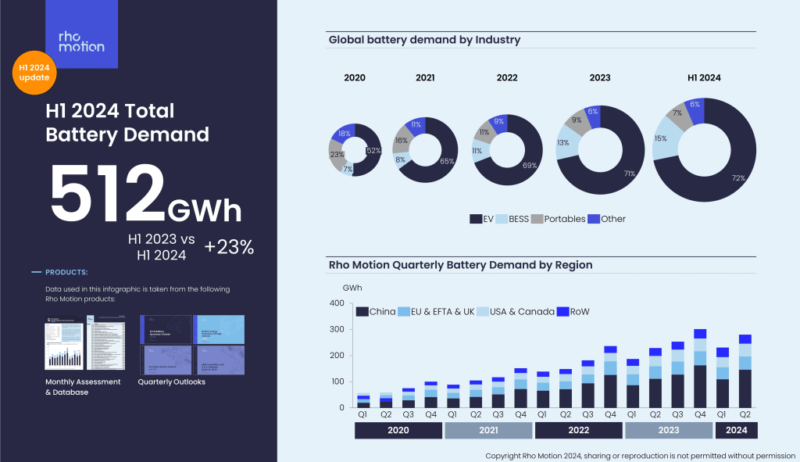

Battery Demand Half 12 months Abstract

Battery demand in H1 2024 exceeded 510GWh throughout all finish use markets, a rise of 23% in comparison with final 12 months revealed analysis home, Rho Movement, in the present day. EV Battery demand accounted for 72% of this, with EV gross sales reaching seven million models within the first half of the 12 months. The stationary storage market noticed the strongest y-o-y progress of near 50%.

Iola Hughes, Head of Analysis at Rho Movement, mentioned: “Amongst so much battery market negativity, the real upside of the year is the stationary storage market which is growing faster than the EV battery market. This is due to the frequency and size of projects entering operation increasing as more markets open themselves up to storage. The battery market is on track to surpass the 1.2TWh mark by the end of the year across all end-uses.”

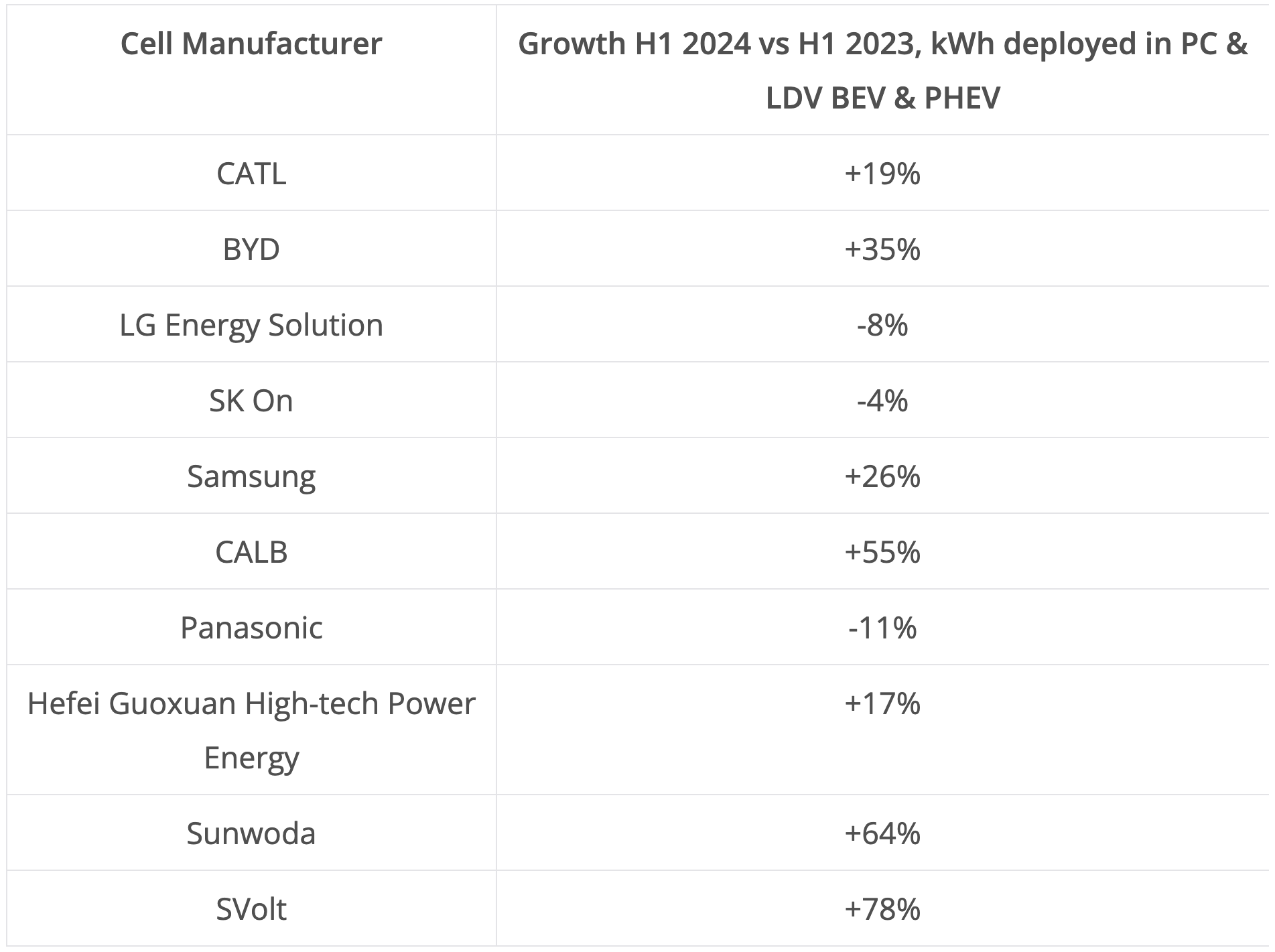

“Amidst the EV & battery slow down, cell manufacturers are being impacted, with Chinese players typically faring much better than their Korean and Japanese counterparts. In the first half of 2024 LG Energy Solution, SK On and Panasonic all saw their batteries deployed in EVs fall compared to H1 2023 as EV slowdown hits them the hardest. This comes at a time of raised concern from a number of these players, with SK On declaring a state of ‘emergency management’ this week.”

At a regional stage China grew 29% y-o-y, accounting for slightly below 50% of world battery demand this quarter. Within the US & Canada, y-o-y progress was 23% with battery demand within the stationary storage market greater than doubling. The weakest progress was seen in Europe, growing simply 8% y-o-y, with notable decline in EV gross sales seen in Germany, Italy, Sweden and Switzerland

Within the EV market within the first half of 2024 has grown by 20% globally and but regional progress in Europe has slowed significantly all the way down to 1%. In the meantime in China there was a 30% 12 months on 12 months enhance in EV gross sales and 10% in North America.

By way of the battery producer panorama, Rho Movement famous a big unfold of progress charges within the first half of the 12 months with Chinese language gamers usually faring higher than their Korean and Japanese counterparts. This comes at a time of raised concern from plenty of these gamers, with SK On declaring a state of ‘emergency management’ this week.

Taking a look at battery know-how within the EV market, LFP (Lithium Iron Phosphate) continues to dominate the market in China, and NCM (Lithium nickel manganese cobalt oxides) outdoors of China. We witnessed LMFP and sodium ion batteries enter the combination within the last months of 2023 and at the moment are seeing low, however constant, gross sales of EVs with these batteries.

Within the stationary storage market over 75GWh of latest capability entered operation, greater than in the entire 12 months in 2022. Over 500 grid-scale tasks entered operation in H1 2024, 4 of which have been bigger than 1GWh, with the most important a 1.4GWh challenge in California. In 2024, there are 18 tasks over 1GWh deliberate to enter operation, in comparison with simply 4 that entered operation in 2023.

The same image of cell producer competitors is seen within the storage market, with the skew of progress a lot greater in direction of Chinese language gamers as a result of recognition of low cost LFP cells in storage, in the end resulting in a continued decline in market share for the Korean cell producers, who at current do producer LFP at scale. In China, 4 sodium ion battery tasks got here on-line within the first half of 2024, in addition to the primary semi-solid state battery tasks.

For the total 12 months 2024 battery demand throughout all finish use markets is about to extend by 20-25% y-o-y in comparison with 2023, which was the primary 12 months to surpass the 1TWh battery demand mark.

Supply: Rho Motion

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy