Silver is on the coronary heart of the clear power transition, important for photo voltaic cells and electrical autos (EVs) because of its unmatched conductivity. As demand from the photovoltaic business surges, outpacing provide, silver’s pivotal position highlights each the alternatives and challenges in reaching a sustainable future.

Silver consultants highlighted important challenges in assembly world demand regardless of strong value indicators favoring elevated steel manufacturing amid the increasing power transition. This steel performs a vital position in EVs and photo voltaic cells, with demand surpassing provide lately, resulting in depleted inventories.

In line with the Silver Institute, photovoltaics alone are projected to account for 19% of global silver demand in 2024equal to 232 million ounces. This represents virtually a 20% improve from 2023 and a considerable 96% surge from 2022 ranges.

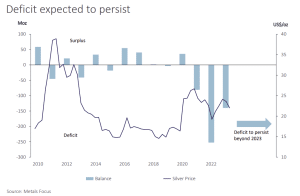

Anticipating a deficit of 215.3 million ounces in 2024, the Silver Institute forecasts that industrial functions will drive 58.3% of the world’s complete demand of 1.2 billion ounces. Nevertheless, world silver provide primarily outcomes from byproduct manufacturing related to different metals. Furthermore, regardless of excessive costs, there’s restricted incentive for brand new manufacturing.

Shining Highlight on Silver

Adrian Day from Adrian Day Asset Administration emphasised the severity of the silver deficit, attributing it to surging demand from sectors like photo voltaic panels and EVs, which have seen demand triple in 3 years. He famous that inventories are critically low with no substantial stockpiles accessible to mitigate the scarcity.

Day additional underscored that solely about 30% of silver manufacturing comes from major silver mines, with the bulk being sourced as a byproduct. This setup implies that the availability of newly mined silver doesn’t reply proportionately to cost fluctuations. Consequently, this might result in heightened value volatility.

Silver costs have surged considerably this yr, prompting hypothesis about their potential peak within the remaining 6 months. An important aspect to observe is the availability and demand dynamics, as silver demand persistently exceeds provide.

Traditionally, silver demand was evenly cut up between industrial use and funding. Nevertheless, industrial demand has surged just lately, now accounting for 64% of world silver demand, a 19% improve from the earlier yr.

This upward pattern is anticipated to proceed, pushed primarily by the Inexperienced Vitality Transition, particularly photo voltaic power.

Photovoltaic Surge: Photo voltaic Vitality’s Rising Urge for food for Silver

A growing solar power industry is fueling up the surge within the demand for silver, important for manufacturing photovoltaic (PV) panels. On account of its excessive electrical conductivity, thermal effectivity, and optical reflectivity, silver is integral to photo voltaic PV manufacturing. Consequently, mining corporations are aiming to spice up output as silver costs climb to decade highs.

International funding in photo voltaic PV manufacturing greater than doubled final yr to round $80 billionaccounting for 40% of world funding in clean-technology manufacturing, in response to the Worldwide Vitality Company (IEA). China considerably elevated its funding in photo voltaic PV manufacturing between 2022 and 2023.

International renewable capability elevated by 50% to almost 510 gigawatts final yr—the quickest development charge in 3 many years. Three-quarters of this development got here from photo voltaic PV power, as reported by the IEA.

Demand for silver from photo voltaic PV panel producers, particularly in China, is forecast to extend by virtually 170% by 2030. The quantity might attain about 273 million ounces, which might represent about one-fifth of complete silver demand, in response to funding supervisor Sprott.

Coeur Mining is increasing to satisfy the rising silver demand, finishing a big enlargement of a mine in Nevada, which is able to grow to be the biggest supply of domestically produced silver within the U.S.

London-based Hochschild Mining can be increasing its silver operations, aiming to safe permits for a silver mission in southern Peru later this yr. Scheduled to begin manufacturing in 2027, the mission is anticipated so as to add 50 million ounces of silver yearly.

Some consultants famous that given the underlying industrial demand dynamics and current provide constraints, the business could also be seeing the beginning of a silver bull market.

Silver’s New Gold Rush

The growth in demand has led to hovering silver costs, reaching $31.3/oz as of writing. This value surge has bolstered the share costs of silver miners.

Nevertheless, rising silver costs would possibly pressure photo voltaic PV panel producers to extend their costs later this yr.

Paul Wong, a market strategist at Sprott, predicts that silver might see an increase just like gold, which hit eight straight periods of document highs in April. Regardless of trailing gold’s recognition with central banks and sovereign establishments, silver maintains a powerful correlation with gold. Wong expects substantial shopping for from the photovoltaic business to drive additional silver demand, noting that:

“Similar to how gold bullion has soared due to a new wave of major purchasers among central banks and sovereign entities, silver has and will likely see even more substantial buying from the photovoltaic industry.”

Discussing authorities affect on silver mining, business leaders highlighted regulatory insurance policies in main jurisdictions like Mexico. The South American nation can both stimulate or deter funding in silver initiatives because of prolonged allowing processes.