International monetary providers group HSBC is launching a brand new enterprise unit, HSBC Infrastructure Finance (HIF), to give attention to infrastructure financing and mission finance advisory alternatives tied to the transition to a low-carbon economic system. The financial institution has appointed former UK Member of Parliament Danny Alexander as CEO of the brand new unit.

HIF goals to safe a major share of offers in main markets. It can additionally combine components from the financial institution’s International Banking Actual Asset Finance workforce.

Taking the Helm and Driving Infrastructure Finance in Transition Markets

The brand new unit plans to broaden HSBC’s debt origination and distribution companies by constructing new relationships with each private and non-private sector entities.

Greg Guyett, CEO of International Banking and Markets at HSBCremarked on the announcement, noting that:

“We have a leading presence in the regions where infrastructure needs to be developed and financed to enable a just transition to a low carbon economy. We also look to support the UK government’s program to build critical infrastructure in Britain to grow the economy whilst decarbonizing it.”

Danny Alexander, at the moment the vp for coverage and technique on the Asian Infrastructure Funding Financial institution (AIIB) and a former UK authorities minister, will lead the division.

Alexander’s appointment is meant to speed up collaboration with governments, multilateral improvement banks, and corporations, together with supporting the UK authorities’s new initiatives.

In his put up asserting the appointment, Alexander expressed his pleasure about main HIF and pursuing important infrastructure financing and advisory alternatives associated to the low carbon transition in strategic markets.

HSBC’s Web Zero Plan

The launch of HIF follows HSBC’s launch of its first Net Zero Transition Plan earlier this yr, detailing its technique to finance and help the transition to internet zero. The financial institution set a 2050 internet zero goal in 2020, committing to align its financing actions with the Paris Settlement’s targets.

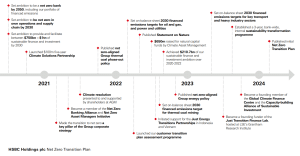

In 2021, HSBC made the transition to internet zero one of many 4 key pillars of our company technique. Since 2020, the worldwide financier has taken a number of steps to start executing its internet zero ambition and managing local weather dangers. The banking firm’s internet zero journey is under.

HSBC NET ZERO JOURNEY

The financial institution’s transition plan covers the HSBC Group and it focuses totally on the sectors and clients the place they anticipate making probably the most important affect on emissions reductions.

For every sector, the financial institution describes the mandatory applied sciences, funding wants, and exterior dependencies for a viable net zero by 2050 pathway, and identifies the place a 1.5°C-aligned 2030 pathway is most in danger. The corporate additionally outlines its associated portfolio, goals, targets, and actions to help sector decarbonization.

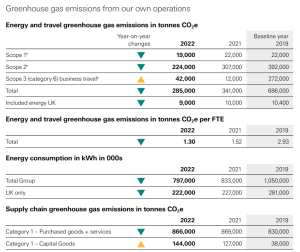

HSBC’s emissions from its personal operations and provide chain are comparatively small in comparison with its financed emissions, however lowering them is essential for changing into a internet zero financial institution.

HSBC Greenhouse Gasoline Emissions from Personal Operations

The financial institution goals to attain internet zero in its personal operations and provide chain by 2030, together with 100% renewable electricity and minimizing its direct affect on nature. This includes chopping emissions throughout power consumption, journey, and provide chains.

In 2022, HSBC exceeded focused reductions by reaching a 58.5% lower in power and journey emissions in comparison with 2019 ranges. This accomplishment was pushed by the financial institution’s three key efforts:

- A 24% discount in power consumption achieved by optimizing constructing use and strategically lowering workplace house and information middle operations.

- Buying 48% of power from renewable sources by leveraging renewable tariffs and fascinating with landlords.

- An 85% discount in enterprise journey, primarily attributed to Covid-19-related worldwide journey restrictions.

Wanting ahead to 2030, HSBC goals for an additional 50% discount in power consumption. Excessive-quality carbon elimination or offsets will likely be used just for residual emissions that can’t be in any other case decreased from 2030 onwards.

The financier engages with market individuals to develop carbon credit and help initiatives for a reputable carbon market. Local weather Asset Administration, HSBC’s three way partnership, is sourcing high-quality carbon removals. The financial institution additionally participates in HKEX’s International Carbon Market Council and advocate for integrity within the voluntary carbon market by initiatives just like the Integrity Council.

Aligning Financing with International Local weather Targets

To attain GHG emissions discount targets and attain internet zero, HSBC is implementing a plan, specializing in these three areas:

-

Supporting Clients

HSBC is prioritizing the transition of its clients to internet zero by offering finance, providers, insights, and instruments. The financial institution is partaking with company clients on their transition plans and providing services to facilitate this shift.

-

Remodeling Operations

In 2021, HSBC made the “transition to net zero” one of many 4 pillars of its company technique. This integration into the company technique has led to embedding internet zero concerns into sustainability danger insurance policies, danger analysis, decision-making instruments, and processes. The financial institution goals to be net zero in its own operations and provide chain by 2030.

-

Partnering for Systemic Change

HSBC is partaking with stakeholders throughout geographies to help insurance policies, laws, and partnerships that facilitate the transition to internet zero. The financial institution is a signatory of the Taskforce on Local weather-related Monetary Disclosures (TCFD) and advocates for climate risk disclosures.

The financial institution additionally pledged to prioritize financing and funding that contributes to the low carbon transitionaiming to help clients with $750 billion to $1 trillion in finance and funding by 2030.