In latest developments throughout the world nickel market, the trajectory of costs has undergone a major downturn. Consequently, nickel prices have plummeted from the highs recorded lately, primarily pushed by a world oversupply.

This has led BHP Group to droop its operations in Western Australia, reflecting the financial challenges throughout the trade.

BHP’s Daring Transfer

BHP Group Ltd., one of many largest mining firms, introduced the suspension of its Nickel West operations and West Musgrave nickel undertaking in Western Australia. This resolution was attributed to the shortcoming to beat financial challenges posed by the worldwide oversupply of nickel.

From October, BHP will halt mining and processing operations at a number of key websites, together with the Kwinana refinery, Kalgoorlie smelter, and Mt. Keith and Leinster mines. The event of West Musgrave may also be suspended as the corporate begins its care and upkeep program.

Geraldine Slattery, BHP’s Australia president, cited substantial financial challenges pushed by the oversupply of nickel as the rationale for the suspension. BHP has flagged an underlying EBITDA lack of roughly $300 million for its Australian nickel operations for the monetary 12 months ending June 30, 2024.

Regardless of the suspension, BHP plans to proceed supporting its workforce and native communities in the course of the transition. The corporate will make investments about $300 million yearly in its Western Australian nickel services, enabling a possible restart of operations. BHP will evaluate its resolution to halt operations by February 2027.

Australia’s sources minister, Madeleine King, expressed disappointment over BHP’s resolution, highlighting its substantial impression on the employees and communities of Kwinana, Kambalda, and Kalgoorlie. Western Australian Premier Roger Prepare dinner echoed these sentiments, noting that the transfer would have an effect on hundreds of employees. Prepare dinner emphasised the significance of diversifying the financial system to construct resilience within the sources sector.

The Fast Development Shaking Up the Nickel Market

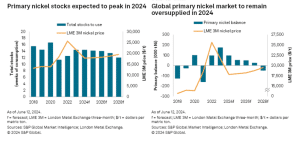

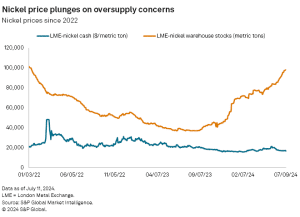

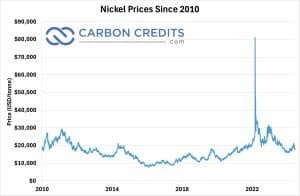

The fast enlargement of Indonesia’s nickel trade has led to a market oversupply, leading to vital value declines from the highs of 2022 and 2023. As of July 10, the London Metallic Trade (LME) money value for nickel was $16,606.41 per metric ton, a 46.4% drop from the 2023 excessive of $30,958/t on January 3, in accordance with S&P International Market Intelligence information.

In 2022, nickel prices peaked at $48,241/t on March 10 as a result of a historic brief squeeze and remained unstable, typically exceeding $30,000/t. The present value is down 65.6% from the 2022 excessive.

The first nickel surplus limits the potential for value will increase, with LME shares reaching a two-year excessive on Might 29 as provide progress, significantly from Indonesia and China, continues to outpace demand, in accordance with S&P International Commodity Insights analyst Anna Duquiatan. Whereas nickel costs rose earlier this 12 months as a result of protests in New Caledonia and US and UK sanctions on Russian steel, they’ve since decreased however stay greater than firstly of the 12 months.

Seizing Alternative in a Difficult Market

Whereas anticipated, BHP’s resolution to droop operations at its nickel property in Western Australia is a major blow to the native mining trade. This suspension will lead to 1,600 staff being both redeployed or provided redundancies. Though nickel exploration and improvement will proceed, Australia’s nickel mining trade is successfully coming to a halt.

Whereas the market stays in oversupply, some trade gamers see alternatives amid the challenges.

The adversity presents a possibility for Lunnon Metals, which is eyeing the mothballed Kambalda nickel concentrator.

With BHP’s suspension of Nickel West operations and the West Musgrave undertaking amid the worldwide nickel downturn, Lunnon is now exploring different processing choices for its Baker and Foster nickel deposits. The corporate is contemplating a bigger function within the district.

Lunnon sees potential in capitalizing on the mothballed Kambalda nickel concentrator by “either purchasing, leasing or otherwise making use of” the plant and its related infrastructure and utilities. Moreover, the corporate envisions the opportunity of collectively or solely constructing a brand new concentrator sooner or later to “meet the needs of various local stakeholders in Kambalda or further afield.”

Regardless of the difficult sentiment surrounding nickel, Lunnon Metals stays optimistic about the way forward for the commodity in Australia and is charting a path ahead. Market analysts additionally share the identical sentiment.