Asian lithium costs are anticipated to remain weak within the first half of Q3 2024 because of oversupply and new import tariffs on Chinese language electrical automobiles (EVs) by the US and the EU. Lithium costs in China are projected to vary between Yuan 80,000-90,000/mt ($11,022-$12,799), whereas costs in North Asia are more likely to stay mushy because of a seasonal summer season lull and ample provide.

A possible turnaround could happen within the latter half of Q3, a peak season for lithium demand.

Oversupply and Seasonal Lull Stress Lithium Costs

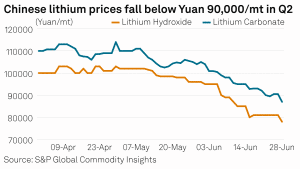

In response to S&P International knowledge, Chinese language lithium prices started Q2 at Yuan 100,000-114,000/mt however fell to a 3-year low of Yuan 80,000-90,000/mt in June because of weak downstream demand and elevated manufacturing.

Furthermore, China’s EV gross sales in Q2 elevated following authorities subsidies for changing polluting automobiles. Nonetheless, new US and EU tariffs on Chinese language EVs could dampen future gross sales in these areas.

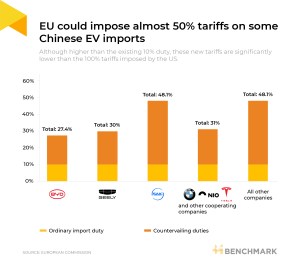

Regardless of better-than-expected EV gross sales in China in June, US tariffs on Chinese EVs will rise from 25% to 100% in August. In the meantime, the EU has imposed provisional countervailing duties of as much as 47.6% on Chinese language EV imports.

Provide strain intensified as extra lithium tasks turned operational and salt lake manufacturing ranges rose in China, leading to a 30% improve in lithium salt output and important will increase in lithium carbonate and hydroxide imports.

Platts assessed lithium carbonate at Yuan 85,500/mt and hydroxide at Yuan 79,000/mt on July 19, down over 20% from the beginning of Q2.

Upstream, spodumene costs started Q2 at $1,100/mt, peaking at $1,200/mt earlier than falling beneath $1,000/mt by quarter’s finish. The price of producing spodumene exceeded the lithium carbonate value, leading to unfavourable margins and restricted curiosity amongst lithium converters.

Spodumene costs must fall beneath $800/mt for favorable margins in Q3. Platts final assessed spodumene at $920/mt FOB Australia on July 19, down 20% because the begin of Q2.

How Do Lithium Miners Reply?

With lithium prices at three-year lows and no indicators of restoration, the main focus is shifting as to whether miners will reduce on the battery metallic’s provide.

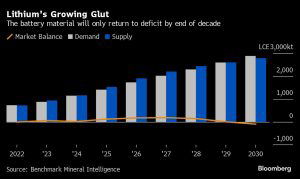

Benchmark Mineral Intelligence predicts a 32% provide development in 2025, surpassing the anticipated 23% demand improve, with the excess peaking in 2027 earlier than a deficit returns later within the decade.

Whereas some smaller producers have already decreased output, the bigger corporations could quickly take into account shutting mines and delaying tasks in areas like Australia and Chile.

Some smaller gamers have already responded to the worth stoop. Australia’s Core Lithium halted operations at its Finniss challenge.

Core Lithium, which opened its mine close to Darwin in October 2022, skilled speedy development however was hit onerous by the next market downturn. CEO Paul Brown famous the extreme commodity cycle’s impression, with the corporate halting manufacturing six months later and shedding over 300 workers.

Core Lithium is now in “care and maintenance” mode, awaiting a market restoration with a $15 million stockpile of processed lithium merchandise but to be bought and a money stability of $87 million.

Equally, Zhicun Lithium Group in China is placing two carbonate items into upkeep.

In response to S&P International Commodity Insights report, sustained low costs may set off additional mine provide cuts and challenge delays. Latest knowledge from Platts reveals spodumene costs nearing ranges that beforehand led to manufacturing cuts.

Chinese language lithium giants Ganfeng and Tianqi reported preliminary web losses within the first half. Alternatively, Pilbara Minerals plans to broaden output after reporting it has “achieved or exceeded” its full-year steerage throughout manufacturing quantity, unit working price, and capital expenditure. The Australian miner recorded file manufacturing within the June quarter.

The Perth-based group produced 725,000 tonnes, surpassing Pilbara’s FY24 steerage vary of 660,000 to 690,000 tonnes. This manufacturing stage displays a 17% improve in comparison with the earlier yr.

When is The Turning Level?

Regardless of minimal revenue margins, some producers preserve output to maintain expert workforces, keep away from restarting prices, and protect purchaser relationships. Different lithium miners face rising strain to scale back manufacturing.

Linda Zhang of CRU Group famous diminished revenue margins in Brazil, Chile, Argentina, and Australia. Curtailments and challenge deferments are anticipated to peak subsequent yr, probably tightening the market stability within the medium time period, in line with Zhang.

With hopes fading for a major demand rebound this yr, BloombergNEF lately lowered its EV gross sales estimates, indicating the auto trade is falling behind in decarbonization efforts.

With provide nonetheless exceeding demand and gradual EV gross sales development, analysts don’t foresee a near-term value restoration. They predict that whereas EV adoption will finally improve lithium demand, but the file costs of 2022 are unlikely to return. The trade should now adapt to a extra sustainable working atmosphere, favoring low-cost producers.