Lengthy-term uranium contract costs have reached over 16-year highs because of provide uncertainty and elevated demand from utilities increasing capability for AI information facilities. Present time period costs are round $79 per pound, the very best since 2008, with expectations of additional will increase.

Cameco, a number one uranium miner, reported securing contract costs with ceilings of $125-130 per pound and flooring of $70-75 per pound, the very best costs seen in over a decade. Spot uranium priceswhich hit a 14-year excessive in February 2024, at the moment are round $82 per pound.

Uranium Market is Heating Up

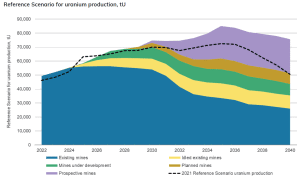

Uranium is the first gas for nuclear vitality. The Worldwide Vitality Company predicts that world nuclear era may double by 2050, calling for a corresponding enhance in provide.

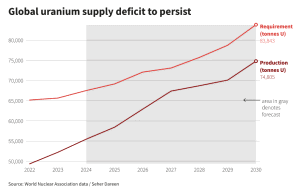

Nevertheless, Plenisfer Investments estimates that costs should exceed the marginal value of manufacturing, at the moment $90-$100 per pound, by no less than 30% to incentivize new initiatives. This projection suggests a continued market deficit over the following decade.

Goldman Sachs estimated that world information middle energy demand, at the moment 1-2% of energy use, may develop by 160% by 2030. Nuclear vitality corporations resembling Constellation and Vistra are poised to profit from the US push for Large Tech to put money into climate-friendly vitality to satisfy the rising wants of AI.

Specialists mentioned that rising demand from utilities is narrowing the hole between time period and spot costs. They additional famous that utilities with ample stock however these with shortages will probably be compelled to purchase.

Firms like Uranium Vitality Corp and Ur-Vitality have restricted volumes however face excessive demand. This prompts them to hunt increased costs or go for spot gross sales, in keeping with Robert Crayfourd, co-fund supervisor of Geiger Counter.

Main Offers and Mergers Mirror Sturdy Market Curiosity

In late June, Australian miner Paladin Vitality launched a $1.1-billion bid for Fission Uranium and its high-grade Patterson Lake South challenge in Saskatchewan. This transfer goals to handle the worldwide nuclear energy push amid a decade-long underinvestment in uranium provide.

Paladin CEO Ian Purdy highlighted the scarcity of major uranium manufacturing and the sturdy demand for his or her Langer Heinrich product. The merger may make Paladin the third largest listed uranium miner globally. The miner has a manufacturing potential of 15 million kilos of uranium oxide (U3O8) yearly by the last decade’s finish.

In one other important market growth, Uranium Royalty Corp. (NASDAQ: UROY) has entered right into a binding royalty buy settlement to accumulate a further royalty on the Churchrock uranium challenge in New Mexico, USA, owned not directly by Laramide Sources. The Churchrock Mission, a sophisticated In-Situ Restoration (ISR) challenge, is likely one of the largest undeveloped uranium initiatives within the U.S.

Uranium Royalty is the world’s solely uranium-focused royalty and streaming firm and the one pure-play uranium listed firm on NASDAQ. UROY gives buyers publicity to uranium costs by means of strategic acquisitions in uranium pursuits. These embrace royalties, streams, debt, and fairness in uranium corporations, in addition to holdings of bodily uranium.

The royalty firm goals to assist the uranium business, which requires important funding to satisfy the rising demand for uranium as gas for carbon-free nuclear vitality.

Mission Overview and Royalty Particulars

The Churchrock Mission, positioned within the Grants Mineral Belt of New Mexico, is owned by Laramide’s subsidiary NuFuels. It’s at a growth stage with important ISR uranium assets, which may play a crucial position within the U.S. uranium manufacturing panorama.

Preproduction wellfield growth is predicted to take 4 years, with all different essential infrastructure already in place. Laramide holds a lot of the permits and licenses required to start out manufacturing. The Lifetime of Mine unit working value is estimated at US$27.70/lb. U3O8, with a static uranium worth assumption of US$75/lb. U3O8.

Boosting U.S. Home Uranium Manufacturing

The transaction aligns with recent U.S. legislative efforts to remove reliance on Russian uranium imports and enhance home uranium manufacturing. These initiatives present funding to broaden uranium, conversion, and enrichment capability within the U.S., focusing on full phase-out of Russian imports by 2028.

Scott Melbye, CEO of UROY, remarked on this growth saying that:

“Our enlarging footprints in the uranium royalty sector in the United States as evidenced by the acquisition of the additional royalty on Churchrock fit squarely in support of those initiatives.”

UROY’s acquisition of a further royalty on the Churchrock Mission is a strategic transfer to assist U.S. uranium manufacturing. That is essential for the nation’s vitality safety and transition to a low-carbon economic system. The transaction is topic to customary closing circumstances and is predicted to shut by the top of July 2024.

Disclosure: House owners, members, administrators and staff of carboncredits.com have/might have inventory or possibility place in any of the businesses talked about: UROY

Extra disclosure: This communication serves the only real objective of including worth to the analysis course of and is for data solely. Please do your individual due diligence. Each funding in securities talked about in publications of carboncredits.com contain dangers which may result in a complete lack of the invested capital.