The Science Primarily based Targets initiative (SBTi), the main authority on company local weather objectives, has launched new analysis that implies carbon credit will not be efficient for offsetting worth chain emissions. This marks a major shift from earlier plans, which had proposed a broader position for carbon credit.

The SBTi’s reviewprimarily based on numerous third-party research, finds that many carbon credits fall wanting delivering the meant environmental advantages. This revelation means that reliance on carbon credit may hinder decarbonization efforts and restrict the movement of local weather finance.

The report’s findings may considerably influence the carbon offset market, which has been scrutinized for its effectiveness in delivering promised emissions discount.

SBTi’s New Findings Problem Carbon Credit score Market

Based in 2015, SBTi’s mission is to determine science-based goal setting as a normal for company local weather motion. It supplies pointers and validation for firms aiming to satisfy web zero targets, initially requiring 90-95% decarbonization by 2050 and neutralizing remaining emissions.

Earlier this yr, SBTi proposed revising its Company Internet-Zero Customary to incorporate carbon credit for managing Scope 3 emissionsthat are essentially the most difficult to regulate and sometimes characterize the vast majority of an organization’s emissions. This proposal led to controversy inside SBTi, leading to workers considerations and requires management modifications.

The SBTi board later clarified that any modifications relating to carbon credit can be evidence-based and {that a} dialogue paper can be revealed earlier than finalizing the brand new normal.

Current analysis by SBTi signifies that many carbon credit are “ineffective” in attaining significant local weather influence and will probably hinder net-zero progress and cut back local weather finance. The analysis acknowledges the restrictions of present research however requires extra proof to higher assess the effectiveness of carbon credit.

The SBTi report highlights that 84% of proof submissions argue in opposition to treating carbon credit as interchangeable with different emission discount strategies, deeming it illogical or counterproductive to international mitigation objectives.

Round half of the submissions assist contribution claims over offsetting or compensation claims. The SBTi obtained 111 distinctive proof items, together with analysis research and white papers, which is able to inform updates to its Company Internet-Zero Customary—a framework guiding company decarbonization.

SBTi’s Sport Plan: Revising Company Internet-Zero Customary

The report’s findings are anticipated to strengthen SBTi’s credibility throughout the business, in response to specialists. They praised the evaluation’s concentrate on the science of carbon credit, suggesting it restores the SBTi’s relevance in guiding company local weather motion amidst vital exterior pressures.

Sue Jenny Ehr, the interim CEO of SBTi, careworn that the findings ought to be seen throughout the context of the reviewed proof, with out making broad generalizations. Ehr additionally mentioned that:

“Targets are the first step to decarbonization and it is important that the SBTi conducts a comprehensive process to revise the Standard to help companies take the lead on climate action and drive down emissions.”

Interim CEO Sue Jenny Ehr careworn the significance of an intensive revision course of to assist efficient local weather motion and emission reductions.

Alberto Carrillo Pineda, SBTi’s Chief Technical Officer, said that the evaluation goals to supply a nuanced understanding of the carbon credit debate, which has turn out to be extremely polarized. Pineda additional remarked that the standard-setter stresses the significance of prioritizing direct decarbonization for local weather motion.

The SBTi plans to launch a draft of the revised Company Internet-Zero Customary for public session in late 2024.

A Carbon Credit score Market Shake-Up: A Name for Rethinking Emissions Methods

Ideally, a carbon credit score represents a ton of carbon dioxide emissions which have been both faraway from or prevented from coming into the ambiance, typically by means of initiatives like reforestation or renewable energy. It’s additionally referred to as carbon offsets in voluntary carbon markets.

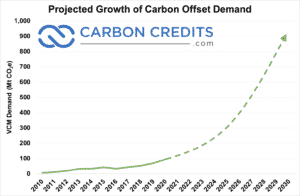

The carbon credit score market, estimated by BloombergNEF to probably broaden from $2 billion to $1 trillion with proper guidelines, is pushed by the popularity that firms will battle to realize the required emissions reductions to satisfy the 1.5°C goal set by the Paris Settlement.

These market devices might be useful if used appropriately and in the event that they incentivize the suitable outcomes, in response to Pineda.

Efforts are underway to deal with the dangers related to carbon credit score buying and selling. As an example, new US pointers purpose to revive belief within the voluntary carbon market (VCM), with Treasury Secretary Janet Yellen noting its potential as a strong software in opposition to local weather change if correctly regulated. The US Commodity Futures Trading Commission can be making ready to finalize its carbon credit score steering by the top of the yr.

In conclusion, the SBTi’s report requires a extra stringent analysis and utility of carbon credit. The initiative’s renewed emphasis on science and rigorous requirements goals to make sure that carbon credit contribute meaningfully to local weather objectives and don’t undermine broader decarbonization efforts.