The rise of Direct Lithium Extraction (DLE) know-how guarantees to open up new sources of lithium provide this decade, probably serving to to avert a forecasted shortfall. In response to a brand new Benchmark particular report, DLE represents a gaggle of applied sciences that selectively extract lithium from brines. This novel know-how provides a major shift within the lithium supply panorama.

What’s Direct Lithium Extraction?

DLE is a well-established know-how with operational tasks in China and South America. The method begins with extracting brine from aquifers, which is then transported to a processing unit. Right here, lithium is selectively extracted utilizing a resin or adsorption materials, whereas the spent brine is reinjected into the aquifer, guaranteeing no depletion or environmental injury.

The resin captures or adsorbs lithium chloride (LiCl) from the brine. Then the captured lithium is stripped with water, making a lithium eluate. This eluate undergoes additional focus via reverse osmosis and mechanical evaporation earlier than being processed into battery-grade lithium utilizing business strategies.

One of many key benefits of DLE is its capability to scale back the environmental influence in comparison with conventional extraction strategies. Typical methods typically result in soil degradation, water air pollution, and destruction of habitats and biodiversity. In distinction, DLE minimizes these points by avoiding in depth evaporation ponds and utilizing selective extraction strategies.

Furthermore, DLE applied sciences assist decrease the carbon footprint of lithium extraction by decreasing power consumption and greenhouse gasoline emissions. By using extra environment friendly and focused extraction strategies, DLE considerably cuts the power required in comparison with conventional methods.

This effectivity contributes to the decarbonization of the power sector, making DLE a vital know-how for decreasing the general environmental influence of lithium production.

Present and Future DLE Manufacturing

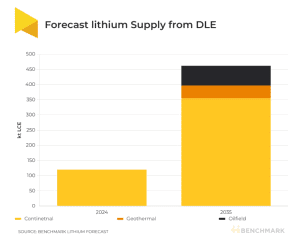

At the moment, there are 13 operational DLE tasks projected to provide about 124,000 tonnes of lithium chemical substances in 2024. By 2035, DLE is predicted to contribute 14% of the overall lithium provide, amounting to round 470,000 tonnes of lithium carbonate equal (LCE), as per Benchmark’s Lithium Forecast.

Whereas most of this provide will come from continental brines, geothermal and oil fields may contribute 9% and 14% respectively.

The Function of DLE in New Brine Tasks

Virtually 75% of latest brine tasks are anticipated to make use of some type of DLE. This highlights the rising significance of unconventional lithium sources and the increasing ecosystem of latest gamers within the lithium worth chain, particularly oil firms that carry substantial capital and experience.

Regardless of its potential, DLE’s path to commercialization faces a number of challenges, together with:

- points with scalability,

- inflationary pressures, and

- delays at new brine tasks.

Technical dangers additionally pose hurdles for brand new buyers. Benchmark’s DLE particular report outlines numerous DLE applied sciences, together with adsorption, ion alternate, solvent extraction, and membranes, with adsorption being probably the most broadly adopted and best-established, significantly in China.

Every brine supply is exclusive when it comes to impurity ranges and lithium focus, which means there isn’t a ‘one-size-fits-all solution’. Consequently, every DLE answer should be tailor-made to the particular environmental and financial situations of the challenge.

Unlocking New Sources: Oil-field Brines

DLE know-how has the potential to unlock beforehand undeveloped sources of lithium, resembling petro brines and geothermal deposits, by reaching restoration charges of 80-90% in comparison with the present evaporation yields of 20-50%. That is significantly important for “unconventional” brine assets in western jurisdictions, aligning with the political priorities within the US and European Union to construct localized and diversified streams of important minerals.

DLE’s potential is attracting important curiosity from main gamers, together with oil and gasoline firms. For instance, Normal Lithium’s Stage 1A challenge in Arkansas may very well be the primary petro brine challenge to come back on-line in 2026. It has an preliminary manufacturing of 5,000 tonnes per 12 months.

Moreover, Exxon Mobil has signed a non-binding memorandum of understanding (MOU) with battery producer SK On for the availability of as much as 100,000 tonnes from its DLE lithium challenge in Arkansas.

Regardless of the keenness, DLE tasks face important capital and working price challenges. These tasks have seen substantial price will increase as they advance and feasibility research are up to date.

Rising international inflation charges, together with greater tools, utility, and labor prices, have pushed these will increase. For instance, early-stage DLE tasks have a mean capital depth of $37 per kilogram of lithium carbonate equal (LCE), whereas superior tasks common $60 per kilogram of LCE.

Given these challenges, Direct Lithium Extraction is unlikely to be a short-term answer for the lithium business. Benchmark doesn’t consider that DLE know-how alone can bridge the structural deficits within the lithium market. Nevertheless, it stays a promising avenue for increasing lithium provide in the long term.