Canada’s metal and aluminum industries are sounding the alarm over what they describe as an “existential threat” whereas urging the federal authorities to align with the US and Mexico in imposing tariffs on Chinese language metal and aluminum to forestall market dumping. This plea comes amid rising considerations that Canada may turn into a conduit for Chinese language merchandise circumventing American and Mexican tariffs.

Why Canada’s Metal and Aluminum Industries Increase The Alarm

Canada at present produces major aluminum—somewhat than recycled aluminum—at eight smelters situated in Quebec and one in Kitimat, British Columbia. These services are owned by three main firms: Alcoa, Aluminerie Alouette, and Rio Tinto. Rio Tinto additionally operates an alumina refinery in Vaudreuil, Quebec.

The Canadian aluminum business produces a variety of merchandise, together with doorways, home windows, home siding, beverage cans, foil merchandise, cooking utensils, and electrical wiring.

As of 2022, Canada ranked because the world’s 4th-largest producer of major aluminum, following China, India, and Russia. The North American nation produced about 3.0 million tonnes of major aluminum in 2022, which accounts for about 4.4 % of world manufacturing. In distinction, China alone produces greater than half of the world’s aluminum.

A notable benefit of Canada’s aluminum business is its decrease carbon footprint in comparison with different main producers, because of its reliance on renewable energy sources, significantly hydroelectric energy.

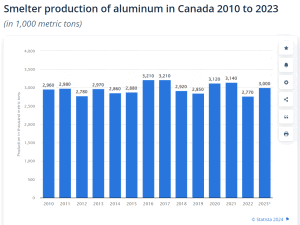

In 2023, Canada’s smelter manufacturing of aluminum was estimated at round 3 million metric tons as seen under. All through the noticed interval, Canada’s aluminum manufacturing quantity remained comparatively secure. The nation’s peak manufacturing occurred in each 2016 and 2017, when it reached 3.2 million metric tons.

How Vital Is Canada’s Aluminum Manufacturing and Export Market?

Canada is the world’s second-largest exporter of aluminum, with aluminum product exports totaling $18.2 billion in 2022. The USA is the first marketplace for these Canadian exports, making it an important companion within the aluminum commerce. This shut commerce relationship underscores the significance of sustaining sturdy financial ties and aggressive benefits within the aluminum business.

Nevertheless, the current actions of the U.S. authorities of imposing tariffs on China imports spurred the business’s curiosity to do the identical.

Catherine Cobden, President and CEO of the Canadian Metal Producers Affiliation (CSPA), emphasised the urgency of the difficulty throughout a press convention in Ottawa. She confused the necessity for Canada to behave in live performance with its North American commerce companions underneath the Canada-United States-Mexico Settlement (CUSMA).

“We can’t be the only CUSMA country that is not taking this serious action,” Cobden said, highlighting the crucial nature of the second for Canada’s metal business.

-

The CSPA represents 13 metal firms, together with main gamers like Stelco, Algoma Metal Inc., and Rio Tinto.

The Canadian business leaders’ name to motion follows the U.S. authorities’s Might announcement of a 25% tariff improve on Chinese language metal and aluminum. Moreover, the U.S. has imposed increased tariffs on different Chinese language merchandise, together with electric vehicles (EVs), semiconductors, crucial minerals, and batteries.

In response, Mexico, in July, launched a ten% tariff on aluminum and a 25% tariff on metal not produced inside Mexico, in collaboration with the U.S. These measures intention to forestall Chinese language producers from bypassing tariffs by way of Mexican commerce routes.

The Implications of Urging Tariffs on Chinese language Imports

The CSPA and the Aluminium Affiliation of Canada are advocating for a 25% tariff on all Chinese language metal merchandise and most aluminum merchandise coming into Canada. This is able to mirror the current U.S. choice to impose tariffs on 289 totally different Chinese language metal and aluminum imports. Cobden confused the urgency of the scenario, warning that failure to behave may lead to job losses and hinder financial progress and funding in Canada’s metal and aluminum industries.

The priority now could be that Canada may turn into a “back door” for Chinese language metal and aluminum coming into North America, undermining the protecting measures taken by the U.S. and Mexico. This potential loophole has prompted Canadian business leaders to push for comparable tariffs to safeguard home jobs and industries.

What extra Jean Simard, President and CEO of the Aluminium Affiliation of Canada famous that:

”China’s metallic is seven instances extra carbon-intensive than Canada’s.”

Thus, Simard stated that permitting Chinese language metal and aluminum into Canada would improve the nation’s carbon footprint and undermine efforts to advertise sustainable industrial practices. He known as on the federal government to behave swiftly to guard Canadian jobs, expertise investments, and the surroundings.

What Are The Penalties of No Motion?

The potential penalties of failing to impose tariffs are stark. Over 760,000 tonnes of Chinese language metal entered the American market in 2023, with comparable quantities the earlier yr. These volumes are 20% increased than the present quantity of Chinese language metal coming into Canada yearly. Business leaders worry that any Chinese language metal diverted from the U.S. market attributable to tariffs may flood the Canadian market, additional eroding the home metal and aluminum industries.

The CSPA and Aluminium Affiliation of Canada are urging the federal authorities to behave shortly and decisively. They warn that any delay may result in an additional decline within the Canadian metal and aluminum industries, with long-term penalties for employment, financial progress, and Canada’s place within the world market.

As the federal government considers its subsequent steps, business leaders are making it clear that pressing motion is required to guard Canada’s metal and aluminum sectors from the rising menace of Chinese language overcapacity.