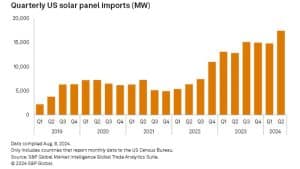

Within the second quarter of 2024, the U.S. noticed an unprecedented surge in photo voltaic panel imports, setting a brand new document as shipments flooded into the nation.

In line with S&P World Market Intelligence’s World Commerce Analytics Suite, U.S. imports reached 17.4 GW. This marks a 36% improve from the identical interval in 2023. This spike was primarily pushed by factories in Vietnam and Thailand, which have been the most important contributors to the inflow of photovoltaic (PV) modules.

The earlier document for quarterly imports was 15 GW, achieved within the final quarter of 2023 and practically matched within the first quarter of 2024.

Racing In opposition to the Clock

The numerous rise in imports follows President Joe Biden’s determination to grant a two-year tariff waiver on photo voltaic cells and modules from Southeast Asia in 2022. This waiver allowed the trade to bypass duties that had beforehand been imposed on Chinese language-made PV shipments that have been discovered to be circumventing U.S. tariffs.

For the reason that waiver’s implementation, the quantity of photo voltaic part imports has tripled, reflecting the trade’s response to the relaxed restrictions.

Because the waiver approached its expiration in June 2024, producers and builders hurried to import as many panels as doable. They accomplish that as they’re anticipating potential new tariffs.

Vietnam led the cost, transport about 7.3 GW of photo voltaic panels to the U.S. within the second quarter. This accounted for 41.6% of whole imports throughout that interval. This was a major improve from the 5.4 GW imported within the first quarter.

Thailand adopted with 3.8 GW, or 22.1% of the whole imports, whereas Malaysia, India, and Cambodia contributed 12.5%, 11%, and 6.4%, respectively. Main importers throughout this era included associates of China-based Trina Photo voltaic Co. Ltd. and Arizona’s First Photo voltaic Inc.

Amid this surge, the U.S. solar industry is witnessing a wave of recent home factories, spurred by Biden’s Inflation Discount Act of 2022, which at the moment are competing for a share of the rising market. Nevertheless, U.S. producers, who’ve invested billions of {dollars}, raised considerations in regards to the sharp improve in imports. They argued that the spike in crystalline-silicon cell and panel imports from Southeast Asia, significantly Thailand and Vietnam, poses a severe threat to the survival of U.S. producers.

The U.S. Photo voltaic Business’s Battle: Home vs. Imported

The American Alliance for Photo voltaic Manufacturing Commerce Committee, with members together with main gamers like First Photo voltaic and Qcells, filed a “critical circumstance” petition with the U.S. Commerce Division.

The petition requests a speedy evaluation to find out whether or not the sudden inflow of imports warrants retroactive duties earlier than the division completes its ongoing investigation into Southeast Asian imports. The group argues that these imports are rushed into the nation to keep away from the imposition of antidumping and countervailing duties.

Dumping is a apply the place merchandise are offered on a market at unfairly low costs, beneath the price of manufacturing.

This petition comes at a time when the U.S. is making an attempt to ascertain a robust home provide chain for its quickly increasing photo voltaic trade, which remains to be closely reliant on imports. In response to those challenges, President Biden not too long ago elevated the cap on the quantity of photo voltaic cells that may be imported with out triggering a 14.25% tariff.

The brand new cap, raised from 5 GW to 12.5 GW, was applied in response to a September 2023 petition from home trade representatives. They argued that US cell manufacturing was inadequate to satisfy demand, making reliance on imports crucial within the quick time period.

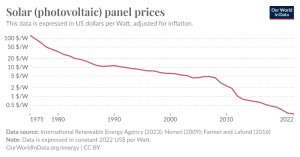

Following the Alliance’s petition, Clear Power Associates (CEA) predicted {that a} profitable final result may result in a bottleneck within the provide of photo voltaic cells within the U.S. This scarcity may improve the costs of each domestically produced and imported photo voltaic modules by as much as $0.15/watt. The U.S. closely depends on SEA international locations for its photo voltaic cell provide, making the potential impression of those tariffs important.

Rising Costs, Falling Prices and the Shifting Panorama of U.S. Photo voltaic Manufacturing

Regardless of these potential challenges, it’s price noting that prices across the PV supply chain have decreased considerably over the previous years. Thus, photo voltaic modules now signify a smaller portion of the general price of a photo voltaic venture than they as soon as did. This worth drop may assist mitigate the impression of any worth will increase on the photo voltaic market.

The U.S. photo voltaic trade is in a state of transition, with home module manufacturing increasing quickly. A report recognized 31 GW of US module manufacturing capability that’s both on-line or within the strategy of ramping up. This contains amenities from First Photo voltaic and Qcells, in addition to U.S. associates of China-based PV corporations like Trina Photo voltaic (U.S.) Inc.

Nevertheless, the report additionally highlighted the absence of U.S. manufacturing for photo voltaic cells and wafers. Qcells plans to deal with this hole by bringing an built-in 3.3-GW ingot, wafer, cell, and panel advanced on-line in Georgia later this yr.

Because the U.S. navigates these advanced dynamics, the result of the continued commerce disputes and the way forward for home manufacturing shall be essential in figuring out the nation’s capability to construct a resilient and self-sufficient photo voltaic trade.