The talk over U.S. tariff insurance policies on vital minerals from China is gaining consideration because the nation approaches its November presidential election. Each main candidates—Vice President Kamala Harris and former President Donald Trump—are prone to proceed utilizing tariffs as a software within the ongoing commerce tensions with China.

Nevertheless, their approaches differ considerably, with every reflecting distinct methods towards power transition, industrial coverage, and U.S.-China relations.

How Harris and Trump Plan to Use Tariffs within the Power Race

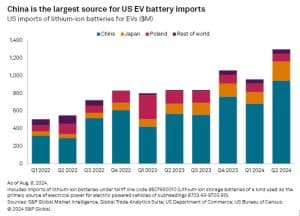

Below the Biden administration, Part 301 tariffs had been imposed on a variety of Chinese language merchandise, together with key elements important to the power transition. These elements, akin to lithium-ion batteries and pure graphite, are important for applied sciences like electrical autos and renewable power storage. These tariffs, which had been elevated in Could 2024, embrace a 100% tariff on electrical autos (EVs) and a 25% tariff on vital minerals, excluding lithium.

This technique is a part of a broader effort to scale back U.S. reliance on Chinese language imports for vital minerals important to the power transition, particularly these utilized in EVs and renewable energy applied sciences.

Harris’ Method

Kamala Harris has been a robust supporter of the Biden administration’s local weather insurance policies, together with the Inflation Discount Act. The legislation gives incentives for home manufacturing and “friendshoring” of vital minerals provide chains.

If elected, Harris is predicted to keep up the present administration’s method, utilizing tariffs strategically to additional local weather targets. This may seemingly contain persevering with to impose focused tariffs on particular merchandise which can be essential for the power transition, thereby encouraging home manufacturing and lowering dependency on China.

Harris’s potential administration would seemingly view tariffs as a software to advertise sustainable growth and obtain local weather aims, significantly in aligning with worldwide commitments such because the Paris Settlement. By specializing in particular merchandise, her administration may purpose to steadiness the necessity for critical minerals with the overarching purpose of decarbonizing the U.S. financial system. This method is seen by coverage consultants as a continuation of Biden’s insurance policies, which have been designed to create a degree enjoying discipline for home producers whereas advancing the nation’s local weather targets.

Trump’s Method

In distinction, Donald Trump has indicated that if he had been to return to workplace, his administration would undertake a extra aggressive and sweeping method to tariffs. Trump has beforehand expressed help for a 60% or increased tariff on all items imported from China, together with a ten% tariff on all U.S. imports. This broad method displays Trump’s longstanding skepticism of commerce with China and his administration’s deal with defending U.S. industries from international competitors.

A Trump administration would seemingly implement broad tariffs throughout a variety of merchandise, together with vital minerals, with out the focused focus seen within the present administration, in response to Scot Anderson, power and pure sources metals and mining subsector head at Womble Bond Dickinson.

Responding on this, Vice President Harris remarked throughout a speech that Trump’s tariffs:

“…will mean higher prices on just about every one of your daily needs: a Trump tax on gas, a Trump tax on food, a Trump tax on clothing, a Trump tax on over-the-counter medication.”

For coverage consultants, this is able to seemingly end in increased tariffs on all vital minerals imported from China, no matter their position within the power transition. Such a coverage might be seen as a part of a broader technique to scale back the U.S. commerce deficit with China and defend home industries.

Can U.S. Producers Thrive Below New Tariff Insurance policies?

The continuation or strengthening of vital minerals tariffs beneath both administration may present some advantages to U.S. producers.

Corporations like Pure Lithium Corp., a Massachusetts-based lithium companyview tariffs as useful for attracting traders and selling home manufacturing. Tariffs can create market certainty, which is essential for firms seeking to scale up operations within the U.S.

The potential variations in tariff coverage between Harris and Trump spotlight the broader debate over how the U.S. ought to method commerce and industrial coverage within the context of the power transition.

Harris’s continuation of focused tariffs would seemingly deal with reaching local weather targets and lowering dependency on China for vital minerals. Alternatively, Trump’s broad tariffs may prioritize defending U.S. industries however on the threat of upper prices for clear power applied sciences.

The U.S.-China Tug-of-Struggle for Vital Mineral Dominance

Because the presidential election approaches, the competitors to safe vital minerals important for clean energy manufacturing is intensifying. No matter whether or not Donald Trump or Kamala Harris emerges victorious, the subsequent administration might want to deal with strengthening the U.S.’s place within the world race for these important sources.

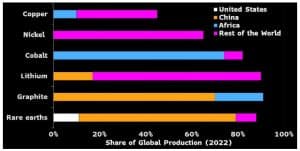

Africa holds greater than a fifth of the world’s reserves of essential minerals like cobalt, copper, nickeland lithium. Nevertheless, China has established a extra important presence in Africa, with extra operational mines on the continent than the U.S., making America weak to potential provide disruptions and value surges in these vital inputs.

To counter China’s dominance in Africa’s vital mineral area, the U.S. might want to develop strategic partnerships and commerce agreements with African nations. One key initiative on this effort is the African Growth and Opportunity Act (AGOA)a flagship U.S. program that gives almost 40 sub-Saharan African nations with duty-free entry to the American market.

African commerce ministers have known as for a swift renewal of the AGOA deal, urging that it’s prolonged for at the least 16 years with minimal modifications to stabilize commerce, promote funding, and protect regional worth chains. The U.S. has a big alternative to shut the hole with China, particularly as greenfield foreign-direct funding into Africa’s extractive industries declines.

Because the U.S. strikes towards the 2024 election, the way forward for tariff coverage on vital minerals stays a key concern. Each Harris and Trump are seemingly to make use of tariffs as a software to deal with commerce imbalances with China, however their differing approaches replicate broader visions for the U.S. financial system and its position within the world energy transition.