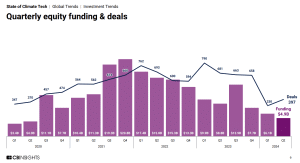

Notably, Q2 2024 marked the second consecutive quarter with none new unicorns (personal firms reaching valuations of $1 billion or extra) within the local weather tech house. This absence of latest unicorns coincides with the decline in late-stage deal sizes, additional emphasizing the present warning amongst buyers.

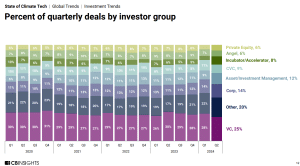

The general decline in climate tech funding and the shift in direction of smaller offers replicate broader traits out there, the place buyers have gotten extra selective and cautious of their method. Enterprise capital (VC) stays the biggest group (25%) investing within the trade quarterly since 2020.

Listed below are the highest 4 enterprise capital local weather firms in accordance with the CB Insights Report, that are value noting in boosting inexperienced applied sciences that assist in the battle towards local weather change.

SOSV: The Accelerator Driving Deep Tech and Planetary Well being

Location: United States

SOSV is a world enterprise capital agency recognized for investing in early-stage deep tech startups with a concentrate on human and planetary well being. Based in 1995 by Sean O’Sullivan, SOSV has grown its property beneath administration to over $1.5 billion, supporting greater than 500 startups worldwide. The agency operates a number of accelerator packages, together with IndieBio and HAX, which offer startups with entry to laboratories, workplace areas, and mentorship.

By way of these packages, SOSV has backed over 1,000 startups throughout varied sectors, together with well being, meals, and sustainability.

SOSV is deeply dedicated to environmental sustainability. The agency has made important strides in supporting firms which might be working to cut back carbon emissions and deal with local weather change. As an example, it has invested in firms creating various proteins, carbon capture technologiesand different options aimed toward decreasing the carbon footprint of industries. SOSV’s portfolio firms have collectively raised billions in follow-on funding, and a number of other have achieved unicorn standing.

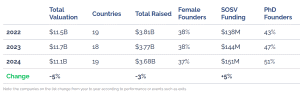

The VC agency created the “Climate Tech 100”, which highlights high climate-focused startups from SOSV’s portfolio. The 2024 version options 30 new firms, with an combination valuation of $11.1 billion and $3.68 billion raised in whole, together with $151 million from SOSV itself.

SOSV 2024 Local weather Tech 100 Portfolio

SOSV’s dedication and management in local weather tech funding have been acknowledged by PitchBook, which ranks SOSV as essentially the most energetic investor in local weather tech, agtech, and carbon emissions expertise since 2018.

Sean O’Sullivan, the Managing Normal Companion of SOSV, emphasizes that regardless of the latest downturn in local weather tech funding, the sector is poised for a resurgence pushed by vital international wants and favorable traits in industrial sustainability and reshoring U.S. manufacturing capabilities.

The investor can be more and more specializing in critical mineralsrecognizing their important function within the renewable power transition. The agency invests throughout the whole vital minerals worth chain, from exploration to extraction and processing. These minerals are very important for the manufacturing of batteries, electric vehiclesand different clear power applied sciences, making their sustainable sourcing a key precedence for SOSV.

World Mind: Fostering World Innovation for a Greener Tomorrow

Location: Japan

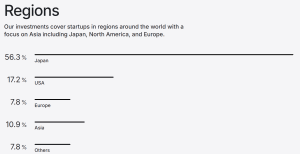

Global Brain is a number one enterprise capital agency with a mission to foster innovation by investing in startups worldwide since 1998. With over $1.9 billion in property beneath administration, World Mind has backed greater than 1,000 startups, protecting industries equivalent to expertise, sustainability, and significant minerals.

The agency is especially targeted on supporting the transition to renewable power, investing in firms that work on eco-friendly applied sciences and the sustainable sourcing of vital minerals important for the clean energy sector.

World Mind Local weather Tech Portfolio Corporations

World Mind operates globally, with a presence in key innovation hubs like Tokyo, Silicon Valley, and London. The agency collaborates carefully with giant companies by way of its company partnership packages, facilitating open innovation and serving to startups scale extra successfully. This collaboration has enabled World Mind to drive developments in vital industries, together with the sourcing and processing of vital minerals essential for renewable energy applied sciences equivalent to batteries and electrical automobiles.

The agency’s notable investments embody firms Orbital Marine Energy, recognized for its pioneering tidal power expertise that guarantees to generate clear, renewable power from ocean currents.

World Mind has additionally performed a major function in increasing its portfolio internationally. The agency’s international attain contains investments in high-growth markets such because the U.S., Europe, and Southeast Asia, contributing to its strong monitor report of profitable exits and partnerships.

World Mind is actively concerned in supporting applied sciences that contribute to sustainability and carbon footprint discount. The agency invests in startups that concentrate on renewable power, power effectivity, and environmental conservation. For instance, their funding in TerraCycle, an organization devoted to recycling hard-to-recycle waste, displays their dedication to tackling environmental challenges and selling a round economic system.

Lowercarbon Capital: Quick-Monitoring the Low-Carbon Revolution

Location: United States

Lowercarbon Capital is a distinguished enterprise capital agency devoted to accelerating the transition to a low-carbon economic system. Based by Chris Sacca and his workforce, the agency focuses on investing in progressive applied sciences and enterprise fashions that deal with the local weather disaster and cut back international carbon emissions.

Their portfolio contains startups pioneering improvements like zero-carbon cementmethane discount in computing, absolutely electrical planes, and superior carbon removal technologies. Lowercarbon Capital is dedicated to supporting scalable options that may considerably reverse local weather change whereas additionally delivering robust monetary returns. This high VC firm focuses on these three principal areas:

Since its inception, Lowercarbon Capital has raised over $1 billion to spend money on breakthrough local weather applied sciences. The agency’s portfolio contains pioneering firms in sectors equivalent to carbon seize, renewable power, and sustainable agriculture. Notable investments embody firms like Appeal Industrial, which is creating direct air capture and bioenergy with carbon capture and storage (BECCS) applied sciences with the potential to sequester thousands and thousands of tons of CO2 yearly.

One other key funding is in Nori, a platform targeted on carbon elimination by way of regenerative agricultureaiming to sequester 10 million tons of CO2 per yr.

Lowercarbon Capital’s strategic method contains each early-stage and growth-stage investments. The agency’s help has been instrumental in scaling applied sciences which have the potential to realize important emissions reductions. As an example, Lowercarbon Capital has helped fund improvements that might probably cut back international carbon emissions by as much as 5% over the subsequent decade.

The agency’s funding technique is centered on high-impact local weather options with a concentrate on scalability and effectiveness. Lowercarbon Capital targets applied sciences with the potential to chop carbon emissions throughout varied industries, together with power, transportation, and agriculture. Their portfolio options applied sciences that goal to cut back carbon footprints by capturing and storing CO2, enhancing renewable energy integration, and selling sustainable practices, that are essential for attaining net-zero targets.

Breakthrough Vitality Ventures: Billion-Greenback Bets on Internet-Zero Applied sciences

Location: United States

Breakthrough Vitality, based by Invoice Gates and a coalition of influential buyers, is on the forefront of advancing applied sciences aimed toward decreasing international carbon emissions. The agency is devoted to funding and scaling improvements that drive sustainable improvement and deal with local weather change.

Breakthrough Energy Ventures (BEV), the agency’s funding arm, has invested over $2 billion in additional than 60 high-impact startups. BEV has dedicated over $3.5 billion in capital to help greater than 110 progressive firms, spanning from seed to progress levels.

Key investments embody QuantumScape, which has developed a solid-state battery with the potential to extend power density by 50% in comparison with typical lithium-ion batteries, and Twelvean organization turning CO2 into helpful chemical compounds with a aim to cut back emissions by as much as 50 million tons yearly.

BEV’s funding technique is guided by its concentrate on the Grand Challengeswhich goal to:

- Develop Scalable Local weather Options,

- Appeal to Further Funding, and

- Deal with Important Gaps in Local weather Know-how.

Breakthrough Vitality Catalyst, one other arm of the group, helps large-scale tasks with an funding aim of $15 billion to speed up the commercialization of fresh applied sciences. Catalyst tasks embody direct air seize techniques and superior hydrogen electrolyzerswith the potential to take away as much as 1 billion tons of CO2 from the ambiance yearly by 2030.

Breakthrough Energy’s portfolio emphasizes substantial carbon footprint discount. Investments goal areas with important influence potential, equivalent to power storage and low-carbon fuels. By way of strategic partnerships and collaborative efforts, Breakthrough Vitality is driving systemic change and dealing in direction of a net-zero future.

Local weather tech funding skilled a downturn in Q2 2024, with investor warning resulting in fewer giant offers and no new unicorns. Regardless of the decline, early-stage alternatives stay promising.

High enterprise capital local weather firms like SOSV, World Mind, Lowercarbon Capital, and Breakthrough Vitality Ventures proceed to spend money on progressive applied sciences that might form the way forward for local weather options. These companies are pivotal in driving progress in direction of a low-carbon economic system by way of strategic investments and international partnerships.