TotalEnergies made a historic announcement of partnering with Adani Inexperienced Power Restricted (AGEL) to the following stage with a brand new three way partnership to develop over 1GW of photo voltaic power in Gujarat, India. This collaboration is a part of a broader technique to spice up renewable power manufacturing in India and assist international decarbonization efforts.

Unlocking TotalEnergies-Adani JV

This partnership will push Adani Green to develop t a brand new photo voltaic portfolio of 1,150 megawatt alternating present (MWac) in Khavda, Gujarat. Consequently, this initiative will strengthen their current collaboration and assist India’s renewable power targets.

Notably, the electrical energy generated shall be bought by Energy Buy Agreements (PPAs) with the Photo voltaic Power Company of India (SECI) and on the open market. The undertaking aligns with TotalEnergies’ technique to capitalize on India’s evolving renewable electrical energy and pure fuel market.

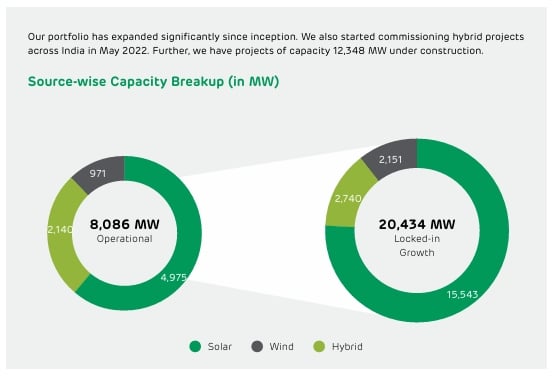

Talking concerning the funding, TotalEnergies will make investments $444 million with a 19.7% stake within the JV, whereas Adani Inexperienced will contribute belongings. Presently, AGEL has 11 GW of solar and wind capacity throughout India and goals to achieve 50 GW by 2030.

Adani’s power portfolio as per 2023 sustainability report

Supply: Adani

With Extra Energy Comes Extra Investments

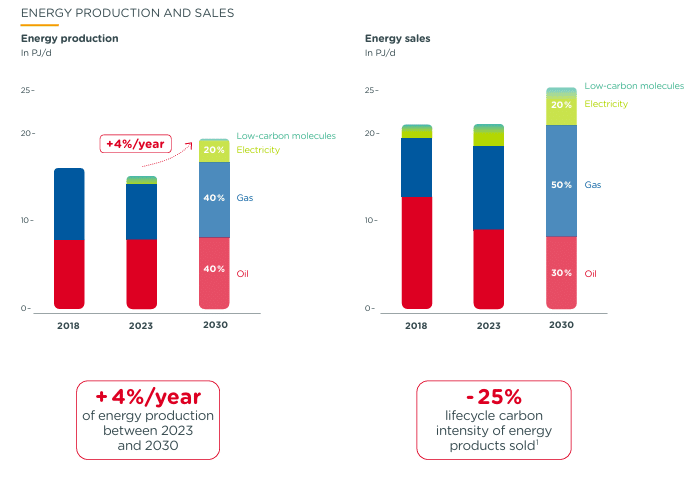

TotalEnergies is investing considerably in renewable power and low-carbon options. This funding is a testomony to this formidable aim of increasing its electrical energy technology from renewable sources like wind, photo voltaic, bioenergy, and hydropower. As well as, it is usually investing in low-carbon mobility infrastructure, together with EV charging stations and hydrogen filling stations. It’s present power portfolio seems to be like this:

- Gross put in capability of twenty-two GW for renewable electrical energy by the top of 2023.

- Goals to exceed 100 TWh of web electrical energy manufacturing by 2030 and broaden its renewable electrical energy capability to 35 GW by 2025.

In 2023, the corporate invested $16.8 billion, allocating 35% of that quantity to low-carbon power. By the top of this 12 months, it goals to speculate $17-18 billion, together with $5 billion for its rising Built-in Energy phase. This dedication highlights the corporate’s shift to sustainable power and its efforts to chop carbon emissions whereas staying worthwhile.

supply: TotalEnergies

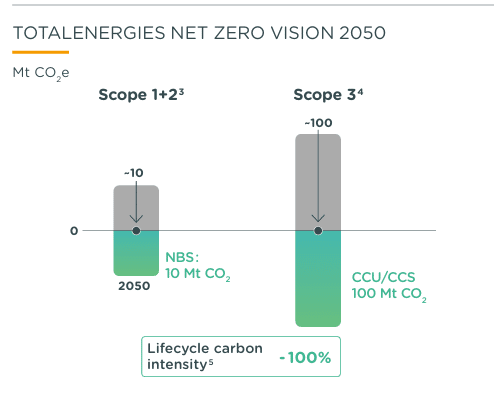

TotalEnergies Emissions Discount Technique

TotalEnergies is dedicated to the Paris Settlement’s aim of protecting international temperature rise “well below 2°C.” Thus, the corporate evaluates each new undertaking for profitability and most significantly its affect on scope 1 and a couple of emissions.

Scope 1+2 emissions for brand new oil and fuel initiatives:

- In comparison with the typical emissions depth of upstream manufacturing or downstream items (like LNG vegetation or refineries).

- As of 2024, the brink has been lowered to 18 kg CO2e/boe (from 19 kg CO2e/boe), showcasing the corporate’s progress in decreasing emissions.

Concisely, its net zero highway map entails making 3x renewable power, 2x power effectivity and reducing methane emissions by 2030.

supply: TotalEnergies

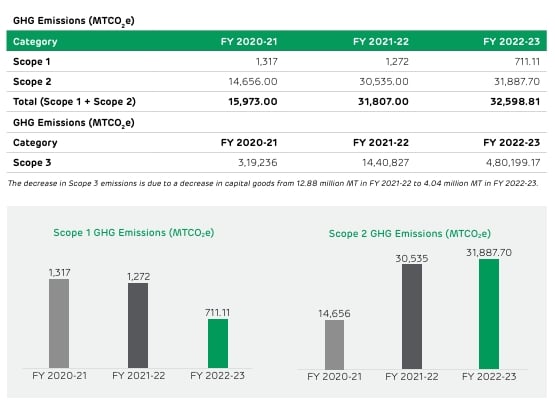

Adani’s Imaginative and prescient for a Web Zero Future

Their partnership dates again to September 2023, when each firms signed a binding settlement for the three way partnership.

The portfolio included 1,050 MW, with 300 MW already operational, 500 MW below development, and 250 MW in improvement. At the moment, TotalEnergies invested $300 million in Adani Inexperienced, buying a 50% stake within the solar and wind projects.

The press release additional reveals that this undertaking in Khavda is a part of Adani’s bigger ambition to develop the world’s largest renewable power web site, which can span 538 km² and generate 30 GW of energy as soon as absolutely operational. With strong efforts and investments, the power large will flip Khavda right into a key landmark on India’s web zero path.

supply: Adani

Thus, we will see that Adani’s each transfer aligns with the nation’s decarbonization efforts. With this aim intact, they mitigated 36.7 MT of CO2 and generated 3.9 million carbon credit within the earlier monetary 12 months. Total, TotalEnergies, recognizing India as a key marketplace for its renewable and pure fuel ventures, will play a big position in Adani’s mammoth power enlargement plan.