As the worldwide demand for cleaner applied sciences rises, nickel’s function turns into more and more very important. Nevertheless, the market stays risky, influenced by geopolitical methods, provide chain dynamics, and fluctuating costs. Understanding these forces is essential to navigating nickel’s future in a quickly altering power panorama.

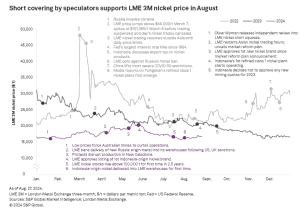

In August 2024, the London Metallic Trade (LME) three-month nickel price surged to a six-week excessive of $17,035 per metric ton by August 20, in keeping with S&P Global knowledge. This rise was primarily pushed by brief overlaying from speculators who responded to better-than-expected U.S. financial knowledge.

Brief Masking Sparks Worth Surge: A Non permanent Excessive?

The improved financial outlook eased fears of an impending U.S. recession, thereby encouraging traders to shut their brief positions in nickel. Regardless of this non permanent increase, the worth retreated to $16,603 per metric ton by August 22 as a result of a rise in LME nickel shares.

LME nickel inventories noticed a major enhance, climbing from 109,950 metric tons on the finish of July to 116,616 metric tons by August 22. This 81.8% enhance in 2024 displays a considerable rise in accessible inventory, contributing to the following worth decline.

In July, the LME recorded its largest month-to-month enhance in open tonnage for the yr, with a 12,942 metric ton rise. This increase was attributed to greater refined class 1 nickel inflows from China, pushing China’s share of LME nickel open tonnage from 27.8% in June to 35.2% in July.

This enhance in Chinese language inventory was notably as a result of refined nickel from Indonesia coming into the LME system for the primary time, following the approval of Indonesia’s first nickel model, DX-zwdx, by the LME in Might 2024.

China’s Nickel Inflow and Indonesia’s Strategic Strikes

Indonesia, a serious participant within the nickel market, is actively working to scale back Chinese language possession in new nickel tasks. The Asian nation’s aim is to qualify for tax credit beneath the U.S. Inflation Discount Act of 2022.

The Act gives a $7,500 tax credit score for electrical autos, however corporations with at the very least 25% possession by a “covered nation,” together with China, are ineligible. This regulation has prompted Indonesia to hunt new funding constructions, with China-based corporations probably being restricted to minority stakes.

The Indonesian authorities’s efforts additionally mirror its broader technique to diversify its investments and enchantment to different overseas traders. Nevertheless, vital boundaries stay. Experiences point out that main European corporations, reminiscent of BASF and Eramet, have determined towards investing in Indonesian nickel tasks as a result of issues over environmental, social, and governance (ESG) points. Moreover, Indonesia’s current coverage shifts, together with a proposed moratorium on new nickel pig iron crops, might additional deter non-Chinese language funding.

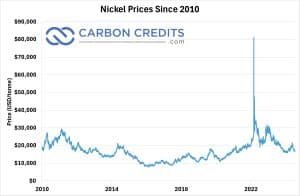

The speedy progress of Indonesia’s nickel business has triggered an oversupply out there, resulting in a major decline in costs from the peaks seen in 2022 and 2023. This surplus has put downward strain on nickel costs as provide outstrips demand, affecting the broader market dynamics.

Why 2024’s Nickel Costs Might Keep Low Regardless of the Hype

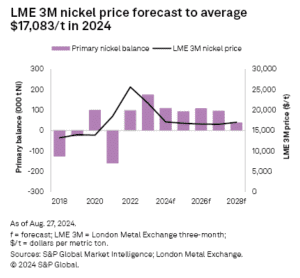

Trying forward, regardless of potential short-term positive factors from a potential U.S. rate of interest minimize in September, the nickel market’s general outlook stays subdued. The prevailing weak fundamentals within the world major nickel market recommend that present worth positive factors might not be sustainable.

The S&P International Commodity Insights has maintained its 2024 forecast for the common LME three-month nickel worth at $17,083 per metric ton. This forecast represents a 21.2% decline from the 2023 common worth, reflecting ongoing challenges out there.

When it comes to funding traits and market projections, China’s dominance in Indonesia’s nickel sector is predicted to proceed. The S&P International knowledge beneath exhibits that the mixed share of Indonesia and China in world major nickel manufacturing might enhance from 69.6% in 2023 to 77.5% by 2028.

This marks a major rise from their 49.8% share in 2019, previous to the implementation of Indonesia’s nickel ore export ban. The persevering with affect of Chinese language investments underscores the strategic significance of Indonesia within the world nickel provide chain.

The nickel market is at present experiencing a short-term stoop as a result of oversupply, with costs anticipated to stay low all through 2024. Analysts at S&P International Commodity Insights predict that major nickel shares will attain a four-year excessive, limiting any vital worth restoration this yr.

Nevertheless, the long-term outlook is extra constructive, pushed by rising demand from the electrical car and renewable power sectors. Regardless of the present challenges, nickel’s crucial function within the power transition means that demand and costs will strengthen sooner or later.