Lithium has lately skilled a rollercoaster experience, notably with considerations concerning the doubtlessly dwindling EV trade. This 12 months, costs hit their lowest level in three years as a consequence of rising fears of extreme provide. With shifting commerce guidelines and elevated manufacturing, the lithium market faces new challenges.

Lithium Value Plunges Amid Oversupply

As of early September, lithium carbonate and lithium hydroxide costs fell under $11,000 per metric ton for the primary time since June 2021. Buying and selling Economics reported Lithium carbonate costs remained secure at 10,552.50 per ton in September, marking the bottom degree in over three years. Specialists predict that international provide may enhance by virtually 50% this 12 months, including to the present oversupply.

The S&P World chart exhibits lithium prices dipping into the worldwide value curve, with whole money prices for lithium carbonate and lithium hydroxide properties listed in {dollars} per metric ton of lithium carbonate equal (LCE) as of September 4, 2024:

- Lithium Hydroxide: Usually sourced from lithium-rich salt lakes or brines, primarily used to provide lower-cost, lower-energy density lithium iron phosphate (LFP) batteries. Value: $10,550/ton.

- Lithium Carbonate: Derived from spodumene ore mining, providing larger vitality density and generally utilized in nickel, cobalt, and manganese (NCM) battery chemistries. Value: $10,400/ton.

The chart compares numerous lithium manufacturing initiatives worldwide, exhibiting how their prices relate to those costs. Many initiatives, notably for lithium carbonate, have money prices under present market costs, indicating profitability. Nevertheless, some initiatives, particularly for lithium hydroxide, face monetary strain as a consequence of larger prices.

Supply: S&P World Market Intelligence

Market Considerations: Oversupply and Low EV Gross sales

Lithium costs fell after peaking at over $79,637 per ton in December 2022, pushed by surging demand for EVs. Regardless of beginning the 12 months close to file highs, costs dropped as overcapacity in battery manufacturing, notably lithium iron phosphate (LFP) batteries, started to affect the market. Slowing EV salesparticularly in China (accounting for 60% of worldwide EV registrations), added to the downward strain.

China’s unsure financial restoration and the phase-out of EV subsidies additional dampened demand. Based on the IEA, new electrical automobile registrations grew by 35% in 2023, a notable slowdown in comparison with the 82% progress in 2022. Regardless of this, specialists consider the EV sector will stay a big driver of lithium, with projections exhibiting it would account for over half of worldwide lithium consumption by 2024.

The IEA forecasts international electrical automobile gross sales may hit 17 million items by the tip of 2024, up from 14 million in 2023. Whereas progress continues to be concentrated in China, Europe, and the US, rising markets like Vietnam and Thailand are seeing elevated EV adoption, with electrical vehicles making up 15% and 10% of gross sales, respectively.

Market Uncertainty Forces Lithium Giants to Rethink Methods

Lithium producers are feeling the pinch as oversupply drives costs down. Main gamers like Albemarle Corp. and Arcadium Lithium PLC have paused growth plans, whereas SQM and Ganfeng Lithium Group proceed to ramp up manufacturing, hoping for a value rebound as soon as the market stabilizes.

Albemarle Adapts to Lithium Market Flux

In July, Albemarle halted growth plans at its Kemerton lithium hydroxide refinery in Australia to handle prices extra successfully. CEO Kent Masters emphasised the necessity for adaptability within the altering trade panorama. Regardless of many producers struggling to cowl money prices, the timing for a value restoration stays unsure.

Albemarle, which reported a $1.96 per share internet loss for the second quarter, could shift in the direction of lithium carbonate batteries, doubtlessly influencing future growth methods. The corporate maintains its full-year outlook, reflecting anticipated lithium market value tendencies.

Supply: Albemarle

Supply: Albemarle

Regardless of Albermarle’s July decrease market costs, the $15/kg forecast ought to maintain as a consequence of value reductions, robust quantity progress, elevated Talison shipments, and sturdy Power Storage contracts.

Ganfeng’s Daring Lithium Transfer

Ganfeng Lithium Group plans to splash in 2024 with expanded lithium manufacturing and elevated market presence. The $500 million three way partnership with Turkish lead-acid producer Yiğit Akü for lithium batteries provides a big enhance.

Regardless of current stock declines from a peak of HK$132 in 2021 to HK$17.10, Ganfeng continues to increase globally, securing sources in Argentina, Australia, Mali, and Mexico. The corporate plans to challenge five-year abroad bonds value as much as $200 million to fund a mission in Argentina. Look out Bloomberg’s chart:

Some Extra Trade Changes

- CATL’s Technique Shift: UBS analysts predict an 8% drop in China’s lithium carbonate manufacturing, doubtlessly balancing provide and boosting costs.

- Arcadium’s Cutbacks: Slowing gross sales and lowered earnings prompted the pause of its 40K ton spodumene Galaxy mission in Canada and scaled-back growth in Argentina.

- World Market Tensions: Commerce limitations and sluggish EV demand contribute to cost declines, whereas Chile and China push for elevated lithium output to stability the longer term market.

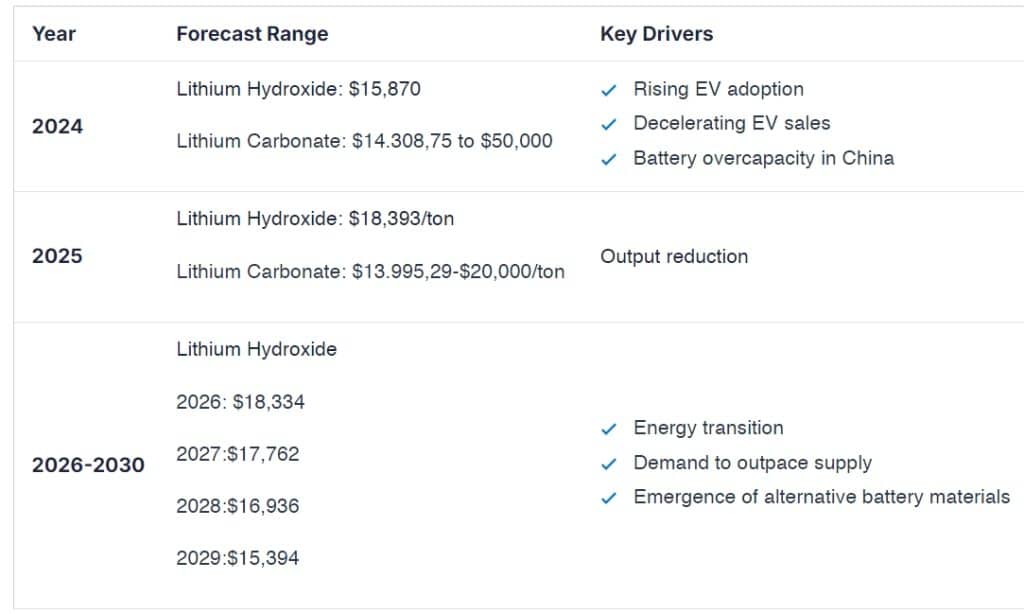

Lithium Value Forecast 2024-2030

Supply: Techopedia

Supply: Techopedia