Andurand Capital Administration, led by famend oil dealer Pierre Andurand, has set its sights on the UK carbon market as a serious progress alternative. The fund is betting on a major rise in UK carbon priceswith expectations that the market will outperform different cooling commodities markets within the coming months.

The UK authorities’s push towards stricter local weather insurance policies, mixed with the nation’s post-Brexit carbon market developments, is setting the stage for what may very well be a serious value surge in carbon allowances.

The UK Carbon Pricing System: An Overview

Following Brexit in 2021, the UK has developed its personal Emissions Buying and selling System (ETS) to interchange the EU’s carbon market. The UK ETS requires energy crops, industrial amenities, and airways to purchase permits for every tonne of carbon they emit.

The UK carbon permits, additionally referred to as carbon allowances (UKAs) or carbon creditscould be traded out there, with costs fluctuating primarily based on demand and coverage adjustments. By capping the entire quantity of emissions allowed, the system successfully forces companies to both lower emissions or purchase allowances. As such, it turns into a key device for reaching the nation’s local weather targets.

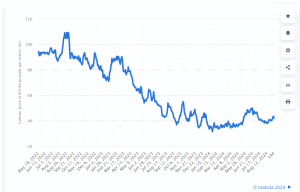

At present, the UK carbon value trades at a reduction of greater than 20% in comparison with its EU counterpart, a spot that buyers like Andurand see as a possible alternative. The EU ETS has benefited from a sequence of reforms which have pushed carbon costs greater. Nevertheless, the UK’s system has been slower to align with these strikes.

UK Allowance (UKA) Futures Pricing from Could 2022 to September 2024 (in GBP per metric ton of carbon dioxide)

Remarkably, with the Labour authorities trying to shut a £22 billion ($28.8 billion) fiscal hole and speed up decarbonization efforts, an increase in carbon costs may benefit each the setting and authorities revenues.

Andurand’s Bullish Guess on UK Carbon

Mark Lewis, Andurand’s head of analysis and portfolio supervisor, believes the UK carbon value may rise by 50% within the close to time period. It may attain over £60 per ton, up from its present stage of £42 per ton.

The value forecast is pushed by a number of potential coverage adjustments, which may align the UK market extra carefully with the EU’s, the place costs have surged following strikes to tighten emissions caps.

Lewis argues that the UK market presents a novel alternative for progress, notably as insurance policies may probably drive costs greater. He mentioned in an interview that:

“This is a significant-policy driven catalyst. Those catalysts don’t exist in other markets.”

Buyers are more and more specializing in UK carbon credit as one of the vital fascinating alternatives within the compliance carbon market.

Main Catalysts for UK Carbon Value Surge

Apparently, a number of upcoming developments may drive UK carbon costs greater and nearer to EU ranges.

A key issue is a possible linkage between the UK and EU ETS, permitting companies to commerce permits throughout each areas. This might considerably cut back the value hole.

The UK government can also be contemplating elevating the ground value for the allowances, making a minimal value to forestall sharp declines and provide stability for companies. Moreover, the introduction of a mechanism to take away extra permits from the market may assist increase costs by limiting provide.

One other measure consists of lowering the variety of free allowances given to industries, which might improve demand and drive costs up. These adjustments, if applied, would create a extra aggressive and secure carbon market. It may well then encourage companies to put money into discount efforts and assist the UK transition to a low-carbon financial system extra successfully.

Dangers and Uncertainty

Although Andurand’s outlook on UK carbon costs is bullish, there are dangers. For one, it’s unclear when these adjustments shall be applied, and a few of the specifics stay undecided.

Key coverage adjustments, like linking the UK and EU carbon marketselevating the ground value, and lowering free permits, lack a confirmed timeline. Moreover, demand for carbon permits has weakened as a result of progress of renewable vitality like wind and photo voltaic.

As extra clear vitality is added to the grid, fossil-fuel crops want fewer carbon permits, probably limiting value will increase. Analyst Henry Lush from Veyt highlights that whereas the long-term outlook is constructive, short-term uncertainty may result in value volatility earlier than particulars are finalized.

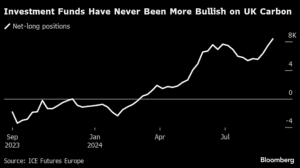

Hedge Funds Betting on UK Carbon

Regardless of the dangers, hedge funds are more and more turning their consideration to the UK carbon market. On the finish of final week, funding funds positioned a report variety of bets that the UK carbon value would improve, based on knowledge from ICE Futures Europe. This development highlights rising confidence that policy-driven catalysts will push costs greater, making the market a horny alternative for speculative buyers.

The UK carbon market has the potential to reflect the EU’s success. In 2021, reforms to the EU ETS pushed the carbon value up by almost 150%creating profitable alternatives for buyers who had positioned themselves early. Andurand and different hedge funds are hoping to duplicate that success within the UK.

The UK ETS stands at a pivotal second, with a mixture of coverage adjustments and market dynamics more likely to drive costs greater within the coming months. For buyers like Andurand, the market presents a uncommon alternative to revenue from the energy transition whereas supporting the combat towards local weather change.