As nations ramp up decarbonization efforts, the demand for vital minerals like lithium and copper continues to surge. Current developments within the U.S. and Argentina, two main gamers within the vital minerals house, spotlight the strategic significance of securing dependable provides to fulfill the rising world demand for clear power options.

A MESSAGE FROM Li-FT POWER LTD.

This content material was reviewed and accepted by Li-FT Energy Ltd. and is being disseminated on behalf of CarbonCredits.com.

2 Million Tons of Lithium-Wealthy Spodumene Actually At The Floor

A Lithium Growth in Q2 2024

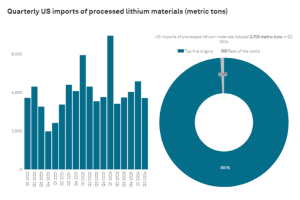

The US has seen a major enhance within the import of lithium and demanding minerals through the second quarter of 2024, in response to S&P International Market Intelligence. These supplies are essential for electrical automobiles (EVs) and different clear power functions.

Processed lithium supplies, together with lithium carbonate and lithium hydroxide, rose 8.7% year-over-year, totaling 3,709 metric tons. Furthermore, the import of refined lithium compounds, important for creating cathode supplies and electrolyte options for batteries, noticed a pointy 49.2% rise to 17,122 metric tons.

Regardless of a slowdown in plug-in electrical car (PEV) gross sales this 12 months, the US market continues to develop, with an anticipated long-term demand for lithium. Alice Yu, a senior metals analyst at S&P International Commodity Insights, famous that passenger PEVs will account for 88.2% of lithium demand development from 2023 to 2028. Moreover, authorities insurance policies worldwide proceed to push for the onshoring of PEV provide chains, reflecting robust optimism for the sector.

South American nations, notably Chile and Argentina, have been main suppliers of processed lithium to the US in Q2. Chile, a US free commerce settlement (FTA) accomplice, equipped 61.7% of the entire lithium imports, whereas Argentina accounted for 35%.

Argentina lacks an FTA with the U.S. however the two nations signed an settlement to strengthen vital mineral provide chains. In the meantime Canada, as an FTA accomplice, equipped 9,588 metric tons of refined lithium compounds, representing 56% of US imports, with China contributing round 28%.

Argentina’s Ambitions: Lithium & Copper Giants within the Making

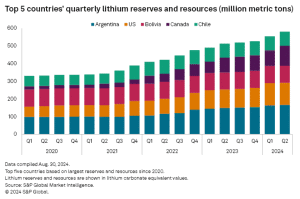

Argentina is quickly positioning itself as a major player in the global lithium and copper markets. The South American nation goals to greater than double mining exports by $10 billion by 2027.

Presently, the world’s 4th-largest lithium producer, Argentina holds the world’s largest lithium reserves. It additionally ranks eighth in copper exploration spending, in response to S&P International Market Intelligence.

The Argentine authorities focuses on bettering power infrastructure and highway connectivity to boost metals exports. Nevertheless, key lithium initiatives require over $8 billion in investments, whereas main copper initiatives want about $20 billion.

In an interview, Luis Lucero, Argentina’s Mining Secretary, emphasised the necessity for a talented workforce to handle these large-scale initiatives.

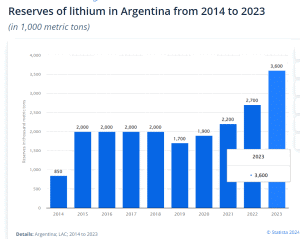

Argentina’s lithium manufacturing is projected to soar from 43,719 metric tons in 2023 to over 261,000 metric tons by 2027. By 2028, the nation is anticipated to surpass Chile as the most important lithium producer in South America, capturing 13.1% of worldwide lithium manufacturing, up from 4.4% in 2023.

Lithium mine production within the nation hit a report excessive for a similar 12 months. The identical goes for its lithium reserves as proven under.

Alice Yu famous that Argentina’s favorable regulatory setting and funding alternatives appeal to vital curiosity from firms worldwide, together with these within the US, China, and India.

Why Lithium Demand Isn’t Slowing Down

David Dickson, CEO of Lake Sources NL, a lithium explorer in Argentina, pointed to rising investor curiosity in lithium property. For instance, in April, CNGR Netherlands New Power Expertise BV acquired the Solaroz venture from Lithium Power.

Argentina’s aggressive mining laws and decrease taxes in comparison with its neighbors within the Lithium Triangle—Chile and Bolivia—are seen as key benefits for attracting overseas funding. Argentine President Javier Milei has additionally launched a tax and customs incentives bundle to spice up the nation’s home mining sector.

Argentina’s push to ramp up lithium manufacturing is additional bolstered by current worldwide agreements. In August, Jose Fernandez, the US undersecretary of state for financial development, and Argentina’s Diana Mondino signed a memorandum of understanding to strengthen cooperation on vital minerals. This deal displays Argentina’s rising significance as a key supplier of lithium to world markets.

Within the close to time period, Rio Tinto Group’s Rincon venture is anticipated to be a major contributor to Argentina’s lithium output. The corporate’s lithium carbonate plant, with a capability of three,000 metric tons of battery-grade product per 12 months, is slated to begin operations by the tip of 2024.

Though Rio Tinto’s CEO, Jakob Stausholm, acknowledges dangers in Argentina, he expressed optimism about alternatives in Latin America. This view is pushed by the area’s sturdy sources and favorable regulatory setting.

How Argentina Goals to Be a International Copper Large

Argentina can be producing a small quantity of mined copper and doesn’t export copper ore. Nevertheless, new initiatives may change this by 2027.

Two vital copper initiatives—Josemaria and Taca Taca—may begin operations, with a mixed capability of over 400,000 tons/12 months. If these initiatives come on-line as anticipated, Argentina may turn out to be a significant participant in global copper markets.

The BHP Group and Lundin Mining are main the cost within the Latin American nation’s copper exploration efforts. Mike Henry, CEO of BHP, highlighted the nation’s potential in an August 27 name, declaring that Argentina’s proximity to Chile—a worldwide copper powerhouse—makes it a sexy area for copper discoveries.

“This is a rare opportunity to grow our pipeline of long-term copper options by securing access to what we consider to be one of the most significant copper discoveries globally in recent decades.”

Because the nation continues to develop its lithium and copper sources, Argentina may play a vital function in assembly the world’s rising demand for clear power supplies. With world curiosity in these vital minerals rising, the nation’s mining sector may turn out to be a key driver of worldwide commerce.