Join daily news updates from CleanTechnica on e-mail. Or follow us on Google News!

Newly launched information compilation from Berkeley Lab tracks operational and proposed crops

Bettering battery expertise and the expansion of variable renewable technology are driving a surge of curiosity in “hybrid” energy crops that mix, for instance, utility-scale wind and/or photo voltaic producing capability with co-located batteries. A newly launched briefing from Berkeley Lab tracks and maps each operational and proposed hybrid crops >1 MW in dimension throughout the US whereas additionally synthesizing information mined from energy buy agreements (PPAs).

This briefing is accompanied by two information visualizations, one targeted on online plants and the opposite on these in interconnection queuesand an Excel information file with element on particular person crops. We are going to current this report throughout a free one-hour webinar on September 30, 1:00 PM Jap. To register, go to: https://lbnl.zoom.us/webinar/register/WN_Mw5i4a5ZQKuUJRKkBPvGgg

Operational hybrid development continued at a wholesome tempo in 2023, particularly for PV+Storage

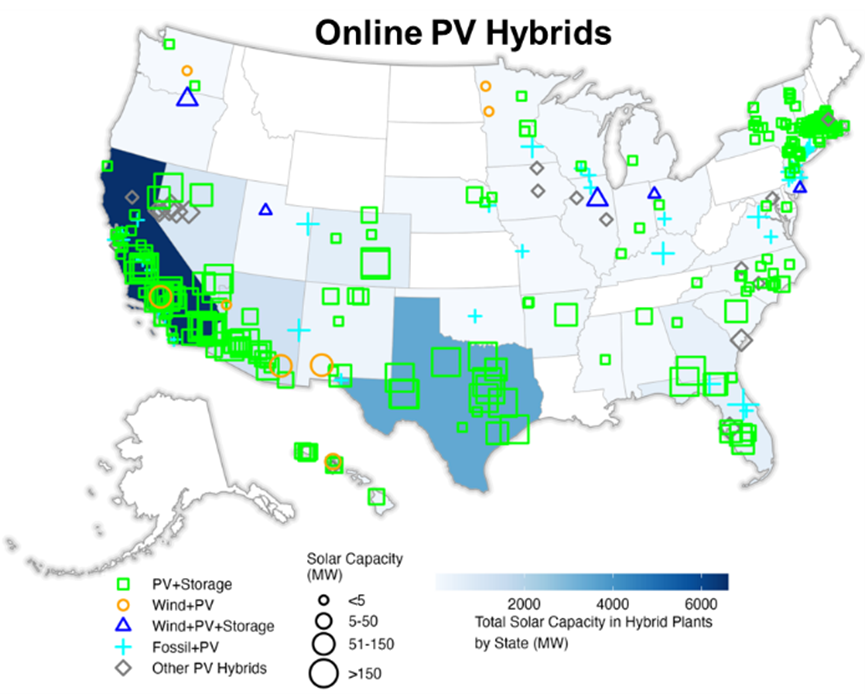

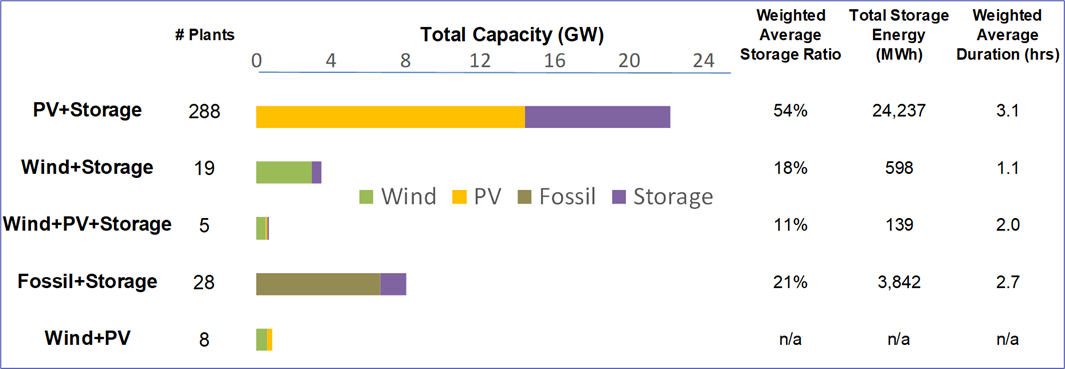

80 new hybrid crops (>1 MW) started working throughout the US in 2023, totaling almost 7.9 GW of producing capability and three.6 GW/11.6 GWh of power storage. PV+storage crops are the commonest and may be discovered all through a lot of the nation (see map for all PV Hybrids put in by the tip of 2023), although the most important such crops are in California and the West, in addition to Texas and Florida. However there are almost twenty different hybrid plant configurations we monitor as properly, together with a number of completely different fossil hybrid classes (every dominated by the fossil element) in addition to wind+storage, wind+PV, wind+PV+storage, geothermal+PV, and others.

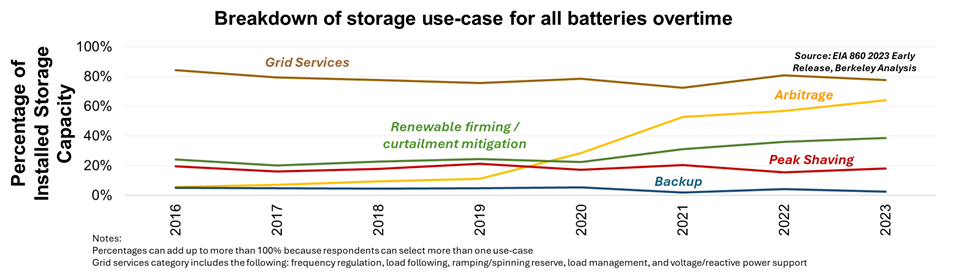

Among the many operational generator+storage hybrids, PV+storage dominates when it comes to plant quantity (288), storage capability (7.8 GW/24.2 GWh), storage:generator capability ratio (54% or 0.54 GW of storage per GW of photo voltaic), and storage length (3.1 hours). This comparatively excessive storage ratio and length particularly recommend that storage is offering useful resource adequacy (i.e., capability firming) and power arbitrage (i.e., shifting energy gross sales from lower- to higher-priced intervals) capabilities to PV+storage crops. In distinction, the comparatively low storage ratio and quick length of wind+storage crops means that they’re primarily concentrating on the ancillary companies markets (e.g., offering regulation and/or reserves).

66 of the 80 hybrids added in 2023 had been PV+storage. As of the tip of 2023, there was roughly as a lot storage capability working in PV+storage hybrids as in standalone storage crops (~7.5 GW every). In storage power phrases, nonetheless, PV+storage edged out standalone storage by ~7 GWh (24.2 GWh vs. 17.5 GWh, respectively). Provision of grid companies stays the preferred use case for storage, however power arbitrage has elevated in reputation within the final 4 years.

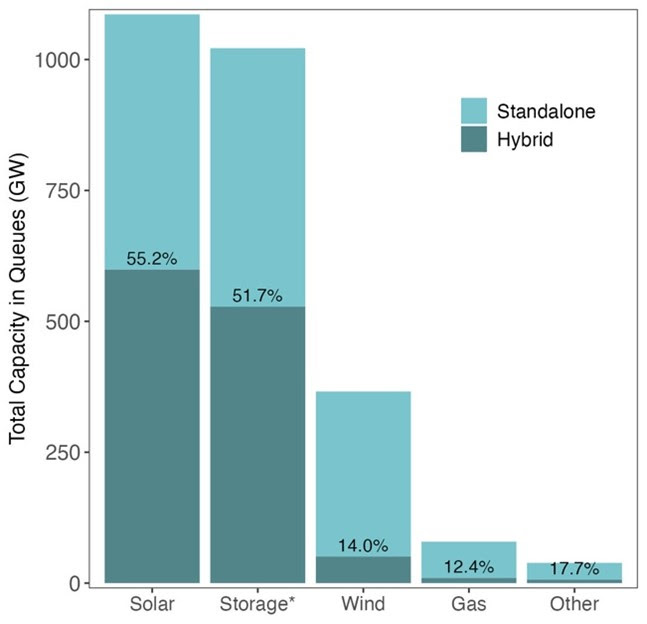

Interconnection queues additionally present development in hybrid proposals in 2023

Knowledge on crops below growth from the interconnection queues of all seven ISOs/RTOs plus 44 non-ISO balancing areas (together with utilities and Energy Advertising and marketing Administrations) present continued robust developer curiosity in hybridization. On the shut of 2023, there was roughly 1,086 GW of photo voltaic crops within the nation’s queues; 599 GW (~55%) of this capability was proposed as a hybrid, most sometimes pairing PV with battery storage (PV+storage represented 86% of all hybrid capability within the queues). For wind, 366 GW of capability sat within the queues, with 51 GW (~14%) proposed as a hybrid, once more most-often pairing wind with storage (wind+storage represented ~5% of all hybrid capability within the queues). Greater than half of all storage within the queues is estimated to be a part of a hybrid plant.

On the finish of 2023, there have been 18% extra hybrid crops—representing 33% extra producing capability—within the queues than there have been on the finish of 2022. Storage capability in hybrid kind elevated by 48% from 2022 to 2023; by comparability, standalone storage capability within the queues elevated by 52% year-over-year. This relative development is especially notable provided that the Inflation Discount Act (IRA), which grew to become regulation in August 2022, supplies standalone storage with entry to the funding tax credit score (ITC) for the primary time, thereby eradicating among the impetus to couple battery storage with photo voltaic in a hybrid configuration. It’s subsequently considerably shocking to see roughly equal development of each hybrid and standalone storage capability mirrored on this 12 months’s report (each for initiatives coming on-line in 2023 in addition to being proposed within the queues). It could possibly be that the market nonetheless wants extra time to react, however there are a number of countervailing the explanation why the development of hybridization would possibly proceed regardless of the standalone storage ITC, equivalent to bypassing clogged queues or boosting a PV plant’s capability credit score, which in the end would possibly outweigh different issues. We are going to proceed to trace this development in future stories.

Whereas most of the crops proposed within the queues is not going to in the end attain industrial operations, the depth of curiosity in hybrid crops—particularly PV+storage—is notable, notably in sure areas. For instance, in CAISO, 98% of all photo voltaic capability and 34% of all wind capability within the queues is proposed as a hybrid. Business curiosity in California little question derives from the state’s want for capability sources to fulfill useful resource adequacy necessities, however additionally it is pushed by the pronounced day by day wholesale pricing patterns induced by excessive photo voltaic penetrations that create arbitrage alternatives for storage that don’t but exist in the identical magnitude in most different wholesale markets.

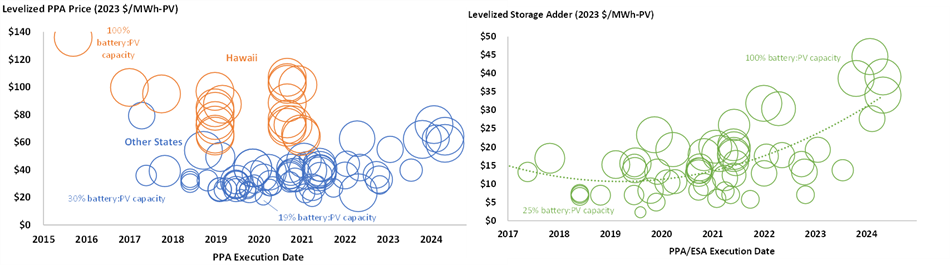

PPA costs for PV+storage are growing

Lastly, we survey pricing information from 105 PV+storage PPAs in 10 states totaling 13 GW of PV and seven.8 GW/30.9 GWh of batteries. Sixty-eight of those 105 PPAs are from working PV+storage crops, whereas the opposite 37 crops are nonetheless below development or in growth. PV+storage PPA costs have began to extend since 2020 (left graph, beneath), although such worth will increase don’t appear to have put a damper on curiosity in growing these hybrids. The “levelized storage adders” have additionally elevated to ~$10000/MW-month, ~$80/MWh-stored (assuming one full cycle per day), or ~$35/MWh-PV (as proven in the correct graph, beneath). A few of the latest worth enhance might merely mirror a development in direction of greater battery:PV capability ratios on the mainland over time (whereas this ratio is often pegged at 1 to 1 in Hawaii), which can enhance prices, all else being equal. The well-publicized impression of inflationary and provide chain pressures on costs in 2022 may be a short-term contributor, although battery costs have extra just lately hit all-time lows.

For additional particulars on these and different findings, together with new evaluation on battery roundtrip efficiencies, please seek advice from the PowerPoint-style information compilation, which may be downloaded right here. The briefing can also be accompanied by two information visualizations, one targeted on on-line crops and the opposite on these in interconnection queues, and an Excel information file with element on particular person crops.

Lastly, as soon as once more we are going to current this report throughout a free one-hour webinar on September thirtieth, 1 PM Jap. To register, go to: https://lbnl.zoom.us/webinar/register/WN_Mw5i4a5ZQKuUJRKkBPvGgg

Courtesy of Will Gorman & Joe Rand, Lawrence Berkeley Nationwide Laboratory

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy