The European Union’s new Methane Regulation is making waves within the world vitality market, particularly within the U.S. liquefied pure fuel (LNG) sector. The regulation goals to curb methane emissions from imported fuels, marking a major step towards reaching internet zero objectives.

Methane, the second-largest contributor to world warming after carbon dioxide, is a potent greenhouse fuel. The regulation units a transparent sign that suppliers, notably these within the U.S., should enhance monitoring and management of methane emissions.

The Regulation’s Affect on the US Pure Fuel Sector

The EU Methane Regulation units a long-term framework with the important thing compliance interval starting in 2027. Nevertheless, reporting necessities will begin earlier, in Might 2025which can set up an emissions baseline. These preliminary studies will assist lay the muse for future compliance efforts.

Cheniere Vitality Inc.the highest U.S. LNG exporter, sees this regulation as a wake-up name for the business to sharpen its concentrate on emissions. Robert Charge, Cheniere’s vice chairman of worldwide affairs and local weather, highlighted that the corporate has already been engaged on methane measurement and reporting for over 6 years. This head begin positions Cheniere to navigate the brand new laws extra easily than a few of its friends. Charge emphasised,

“Today and into the future, that’s going to be in a world where there’s an increasing focus on climate-related issues, and certainly through 2030 industry needs to take action to measure and mitigate methane emissions to near zero.”

Moderately than imposing fast and stringent penalties, the regulation provides firms time to adapt. They’re anticipated to start out by submitting data on current provide offers and progressively incorporate these necessities into new contracts.

This phased strategy has alleviated fears of market disruptions. Charge defined that regardless of the brand new guidelines, the EU nonetheless views U.S. LNG as a vital vitality provide, particularly following the lack of Russian pipeline fuel 3 years in the past.

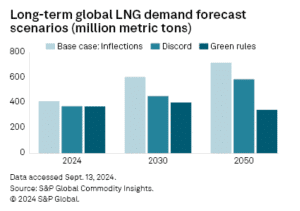

By way of natural gas demand projection, S&P World Commodity Insights estimates present that it’s going to develop to over 70% by 2050 below a base case situation, however it may drop below the inexperienced vitality transition situation.

Challenges for US LNG Suppliers

The brand new regulation sends a transparent message. But, there are nonetheless uncertainties about its precise implementation, particularly regarding the way it applies to LNG importers. This has created a level of uncertainty in provide contract negotiations.

Essentially the most important problem for U.S. exporters is the requirement to gather methane emissions data “at the level of the producer.” This poses a hurdle, as many firms within the U.S. fuel provide chain lack direct entry to emissions data from wellheads.

Ben Cahilla director of vitality markets on the College of Texas, additionally famous that U.S. fuel producers typically wrestle to assemble this data because of the complexity and vastness of the U.S. fuel pipeline community.

EU Methane Push: Taking the Lead on World Efforts

The EU’s new regulation aligns with the Global Methane Pledgea dedication made by the U.S. and over 100 different international locations in 2021 to scale back world methane emissions by 30% from 2020 ranges by 2030. European authorities intention to ascertain the EU as a worldwide chief in methane mitigation by pushing for stringent mitigation measures.

Beginning in 2027, LNG importers should display that the provides they create into the EU meet methane emissions requirements equal to these within the EU.

By 2030, the area could have a methane emissions depth normal that each one imported fuels should meet. The regulation can even align with the Oil and Fuel Methane Partnership 2.0 (OGMP 2.0)a reporting framework developed by the United Nations Setting Program. Cheniere Vitality joined the OGMP 2.0 initiative in 2022, with Charge describing it because the “best measurement framework” for the business.

Regardless of the clear course set by the EU Methane Regulation, a number of particulars stay unresolved. As an illustration, importers should begin reporting to a “competent authority” in every member state by Might 2025. Nevertheless, these authorities haven’t but been established, and penalties for non-compliance are nonetheless unclear.

One other query mark is how the EU will deal with regulatory exemptions for international locations whose methane regulations are deemed equal to these within the EU. U.S. authorities officers could have to collaborate with their EU counterparts to make sure that the U.S. methane charge and the Environmental Safety Company’s emissions laws are acknowledged.

These U.S. laws are among the many strictest globally. Nonetheless, whether or not they are going to fulfill the EU’s new requirements stays to be seen. Analysts consider that this uncertainty has led to a brief pause in long-term provide contract negotiations.

A Rising LNG Market Amid Local weather Laws

Regardless of the challenges posed by the EU’s methane laws, the worldwide demand for LNG is rising. The U.S. LNG export capability, anticipated to exceed 13 billion cubic toes per day (Bcf/d) by the top of 2024, is ready to double by the top of the last decade as new export initiatives come on-line.

For these U.S. LNG exporters, the EU’s stance on methane emissions may carry regulatory continuity. It’s each a problem and a possibility.

Whereas there are compliance hurdles, the phased strategy supplies time for adaptation. Furthermore, the EU’s continued reliance on U.S. LNG provides, mixed with world efforts to curb methane emissions, underscores the significance of U.S. participation in these regulatory frameworks.