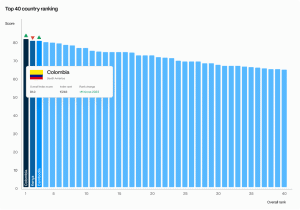

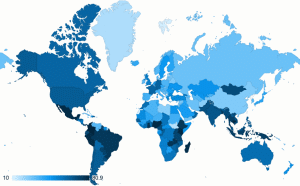

Based on Abatable’s VCM Funding Attractiveness Index, Colombia, Kenya, Cambodia, Mexico, and Peru are the highest 5 nations for carbon credit score buyers in 2024. The Index, launched throughout Local weather Week NYC, ranks nations based mostly on their attractiveness for voluntary carbon market (VCM) investments.

The rating considers elements corresponding to regulatory advances, market readiness, challenge alternatives, and talent to form future carbon markets.

Abatable is a prime supplier of carbon market options, providing instruments to assist companies navigate carbon markets, discover the appropriate companions, assess market dangers, and increase environmental affect.

Abatable co-founder Maria Eugenia Filmanovic defined that their strategy additionally considers a rustic’s potential for affect on local weather, nature, and folks. Valerio Magliulo, Abatable’s CEO and co-founder emphasised that because the carbon market landscape evolvesentry to dependable information is crucial for making knowledgeable funding choices. He additional famous that:

“The VCM Investment Attractiveness Index is a critical tool that helps democratize carbon market data for the benefit of participants across the market, enabling them to make informed decisions and navigate the VCM, ultimately helping to scale the market as a whole.”

Regulatory Progress in Carbon Market Drives Rankings

The highest-ranked nations owe their success largely to their regulatory progress. For instance, Colombia’s carbon tax has considerably boosted market exercise. Its new regulatory framework and nationwide carbon registry appeal to important curiosity from carbon buyers.

Colombiaone of many world’s 17 megadiverse nations, is residence to a good portion of Earth’s species, largely attributable to its share of the Amazon rainforest. This wealthy biodiversity has helped the nation turn out to be a world chief in nature-based resolution (NBS) carbon creditswith 142 million tonnes issued because the market’s begin.

The South American nation has additionally excelled within the world carbon market, utilizing a mixture of compliance mechanisms and VCMs to showcase an modern strategy to carbon pricing.

Equally, Kenya’s 2024 carbon market regulation created a extra favorable atmosphere for carbon challenge growth and funding. The nation has not too long ago accepted carbon market insurance policies that create an investor-friendly atmosphere and facilitate Article 6 compliance with the Paris Settlement, making certain steady progress within the carbon credit score provide.

Their regulatory basis positions Colombia and Kenya as key gamers within the world carbon market.

Key Insights From 2024 VCM Funding Index

Abatable VCM Investment Index makes use of 3 pillars and 24 indicators to evaluate the carbon market panorama, particularly analyzing the next elements:

- funding potential,

- nationwide readiness for carbon tradingand

- alternatives for enhancing environmental and social situations.

Notable actions within the rankings embody Colombia leaping 13 locations to first and Cambodia leaping to 3rd.

The Index additionally displays the volatility and complexity of the carbon credit score market, with some nations advancing attributable to groundwork for Article 6 of the Paris Settlement, which permits carbon buying and selling between nations.

Nations like Madagascar, Zambia, and Brazil have additionally gained prominence attributable to important regulatory developments and a rise in carbon credit score provide. These nations have benefitted from early engagement with Article 6, providing buyers a first-mover benefit in these evolving markets.

Brazil, for example, jumped 33 spots attributable to its surge in carbon credit score availability, highlighting its rising function out there. Large tech corporations, together with Google, MetaMicrosoft, and Amazon, are pouring hundreds of thousands into Brazil’s carbon credit score initiatives.

Trying Forward: Progress in Compliance Schemes and Restoring VCM Confidence

The Index additionally underscores the affect of compliance schemes with built-in carbon credit score mechanisms on a rustic’s attractiveness for investments. Nations are more and more adopting such schemes to satisfy formidable worldwide local weather targets and reply to mechanisms just like the EU Carbon Border Adjustment Mechanism.

Throughout the voluntary carbon market, challenges abound over the previous two years. Sure carbon tasks are scrutinized however a renewed deal with carbon elimination initiatives is rebuilding belief.

Filmanovic highlighted that Abatable’s Index has been acquired positively by buyers, serving as an essential instrument in shaping funding sentiment. The rising curiosity in Article 6.2 credit—permitting cross-border buying and selling of emissions reductions—is seen as an indication of restoration for the market.