Battery storage methods play a vital position in sustaining grid stability by balancing electrical energy provide and demand. They retailer power from renewable sources like wind and photo voltaic, releasing it when wanted, which helps to save lots of energy throughout low-demand intervals. On this quickly rising sector, lithium-ion batteries are taking the lead, driving the power transition with their excessive effectivity and adaptability.

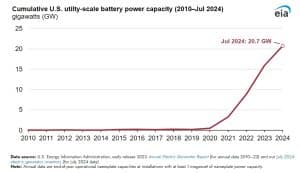

Utility-scale battery power storage is booming throughout the US. Based on the latest report from the U.S. Power Info Administration (EIA), until July 2024, operators added 5 gigawatts (GW) of recent capability to the U.S. energy grid, making a complete accessible battery storage capability greater than 20.7 GW. Notably, builders plan so as to add 15 GW in 2024 and one other 9 GW in 2025.

Supply: HERE

A MESSAGE FROM Li-FT POWER LTD.

Lithium Deposits That Can Be Seen From The Sky

Who’s Li-FT Energy? They’re one of many quickest growing North American lithium juniors with a flagship Yellowknife Lithium project positioned within the Northwest Territories.

Three causes to contemplate Li-FT Energy:

RESOURCE POTENTIAL | EXPEDITED STRATEGY | INFRASTRUCTURE

Li-FT is advancing 5 key initiatives; all positioned within the extraordinarily secure and pleasant mining jurisdiction of Canada.

TXSV: LIFT | OTCQX: LIFFF | FROM: WS0

*** This content material was reviewed and permitted by Li-FT Energy Ltd. and is being disseminated on behalf of Li-FT Energy Ltd. by CarbonCredits.com. ***

Lithium-ion batteries Lead the Cost

The U.S. energy sector has overwhelmingly adopted lithium-ion batteries for power storage. These batteries now account for over 90% of the worldwide demand, outpacing their use in private electronics. Because the world transitions from fossil fuels, battery storage is essential to bettering power effectivity and supporting clear power adoption.

Power storage, whereas not a main electrical energy supply, gives essential backup energy. It shops electrical energy generated from the grid or renewable sources, making it a key participant within the renewable power ecosystem. Batteries permit electrical energy produced throughout peak technology instances to be saved and later equipped throughout peak demand intervals, enhancing grid reliability and lowering power losses.

Regardless of spectacular progress, the battery storage sector faces a number of challenges. Provide chain disruptions, inflation, and delays in grid interconnection are slowing the tempo of recent initiatives. Nevertheless, consultants like power analysts and battery fans count on these points to enhance by the top of this 12 months, resulting in a good sooner deployment.

Michael Craig, a professor on the College of Michigan, emphasizes the necessity for fast technological development to fulfill formidable carbon-reduction targets. The EIA predicts that utility-scale battery storage will virtually double by the top of 2024, an indication that the business is shifting in the best route.

Battery Storage Set to Drive 60% of CO2 Reductions by 2030: IEA

Battery storage is changing into more and more enticing as prices proceed to fall. Corporations like Tesla and Enphase are scaling their battery storage choices to fulfill rising demand, pushed by the rise of AI and data centersthat are anticipated to extend power consumption dramatically.

Based on business projections, the worldwide battery storage market will develop in leaps and bounds with the push for renewable power adoption. By 2030, electrical automobiles are anticipated to displace tens of millions of barrels of oil every day, additional boosting the necessity for large-scale power storage options within the energy sector.

As battery storage continues to develop, it’s clear that this know-how is a cornerstone of the power transition, enabling the shift away from fossil fuels and towards a extra sustainable, electrified future.

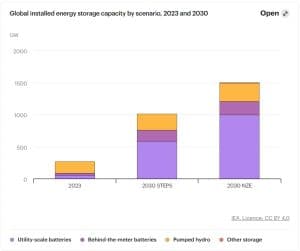

Based on the IEAto triple international renewable power capability by 2030, whereas making certain electrical energy safety, power storage should develop six-fold. Within the Internet Zero Emissions (NZE) Situation, storage capability wants to succeed in 1,500 GW by 2030. Batteries will drive 90% of this growth, rising 14-fold to 1,200 GW, supported by applied sciences like pumped storage and compressed air.

Supply: IEA

This fast progress requires battery deployment to rise 25% yearly. Batteries are key, as they account for 60% of CO2 reductions in 2030immediately in EVs and photo voltaic PV, and not directly via electrification and renewables.

Low-Price Cathode Might Slash Lithium Battery Prices

A workforce led by Hailong Chen at Georgia Tech has developed a low-cost iron chloride (FeCl3) cathode for lithium-ion batteries (LIBs). This breakthrough may scale back electrical automobile (EV) prices, the place batteries make almost half the worth. FeCl3 prices simply 1-2% of conventional cathode supplies like nickel and cobalt whereas delivering the identical power capability, making it a game-changer for EVs and power storage.

The FeCl3 cathode is just not solely cheaper but in addition gives greater voltage than fashionable options like lithium iron phosphate (LiFePO4). Chen’s workforce goals to push for all-solid-state LIBs, which may enhance security and effectivity. This might additionally improve large-scale power storage and strengthen the facility grid.

Chen’s analysis, which started in 2019, reveals FeCl3 as a scalable and eco-friendly possibility. The workforce expects the know-how to be commercially accessible inside 5 years, promising to reshape EVs and renewable power storage with decrease prices and higher sustainability.

Supply: Hailong Chen and analysis workforce, Georgia Tech

BESS Market Poised for Explosive Progress by 2030, A McKinsey Report

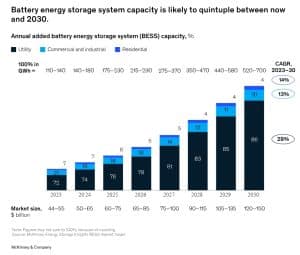

The Battery Power Storage System (BESS) market is quickly rising, creating an enormous alternative for buyers and firms. In 2022, over $5 billion was invested in BESS, almost tripling from the earlier 12 months.

- Based on McKinsey, the worldwide BESS market is projected to develop considerably, reaching between $120 billion and $150 billion by 2030—greater than 2x its present measurement.

Supply: McKinsey

Supply: McKinsey

Though the BESS market is increasing, it stays fragmented, leaving many corporations unsure about their subsequent transfer. Now could be the time for companies to pinpoint the most effective alternatives and safe their place. With rising competitors and growing demand for renewable power, corporations should act swiftly to carve out their share of this booming market.

Key Methods to Succeed within the BESS Market

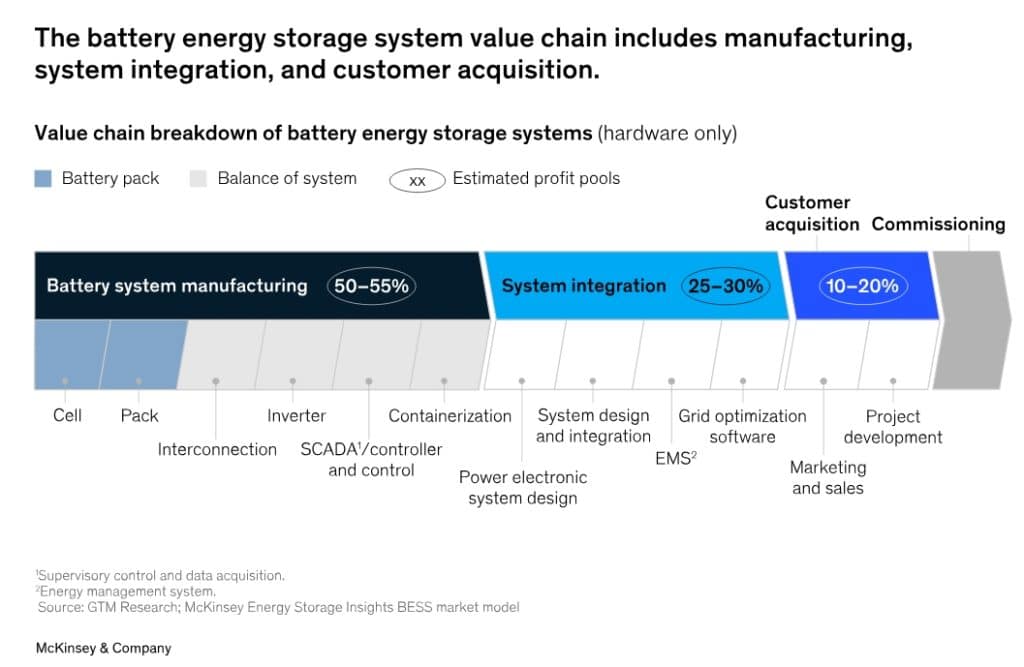

McKinsey has give you modern options for corporations to achieve the dynamic BESS market:

They need to concentrate on filling gaps within the worth chain and prioritizing software program improvement. System integrators can discover new alternatives by partnering with battery producers, whereas battery makers can add integration providers to focus on particular sectors. Moreover, investing in software program that optimizes BESS efficiency will unlock bigger markets and drive greater margins.

Strengthening provide chains and staying agile are additionally essential. Corporations want strategic partnerships and multi-sourcing choices to handle provide disruptions. Smaller companies ought to act rapidly, leverage their mental property, and take dangers to remain aggressive in opposition to bigger gamers.

With international investments in BESS surging, reaching between $120 billion and $150 billion by 2030, corporations must determine the most effective alternatives and act decisively.

Supply: McKinsey

Can the U.S. Dominate the Battery Power Storage Market?

EIA has additionally estimated that U.S. battery storage capability could increase by 89% by the top of 2024. This progress depends upon builders bringing deliberate power storage methods on-line by their meant industrial operation dates.

- At the moment, builders intention to develop U.S. battery capability to over 30 gigawatts (GW) by the top of 2024. This could surpass the capability of petroleum liquids, geothermal, wooden and wooden waste, and landfill fuel.

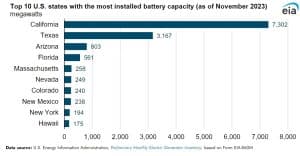

California and Texas dominate the battery storage market. California leads with 7.3 GW of put in battery storage, adopted by Texas with 3.2 GW. Considerably, Vistra’s facility in Moss Touchdown, California, is at present the most important, with 750 megawatts (MW).

By 2025, builders count on to finish over 300 utility-scale battery storage initiatives throughout the U.S., with Texas accounting for about 50% of the deliberate capability. The 5 largest battery storage initiatives set to come back on-line in 2024 or 2025 embody:

- Monday Creek BESS SLF (Texas, 621 MW)

- Clear Fork Creek BESS SLF (Texas, 600 MW)

- Hecate Power Ramsey Storage (Texas, 500 MW)

- Bellefield Photo voltaic and Power Storage Farm (California, 500 MW)

- Dogwood Creek Photo voltaic and BESS (Texas, 443 MW)

Supply: HERE

Supply: HERE

With formidable battery storage plans and declining prices, the U.S. is poised to attain a cleaner, extra dependable power future, quickly closing the hole with China.