Hyzon Motors, a outstanding title within the hydrogen gas cell know-how sphere, has been navigating uneven monetary waters. The corporate lately regained compliance with Nasdaq’s inventory market guidelines after a strategic reverse inventory cut up. This transfer, aimed toward stabilizing their inventory value and securing their place on the change, is a glimmer of hope in an in any other case tumultuous interval. Regardless of this progress, Hyzon stays precariously near chapter, as monetary challenges proceed to loom giant.

The corporate’s monetary struggles are highlighted by its quarterly earnings report, which confirmed an earnings per share (EPS) of ($0.21). This determine fell wanting the consensus estimate of ($0.15), accompanied by revenues of $0.31 million—considerably under the anticipated $1.00 million. These numbers underscore the hurdles Hyzon faces in aligning its monetary efficiency with market expectations.

Heavy Obligation Trucking Business: Nonetheless Wants Work

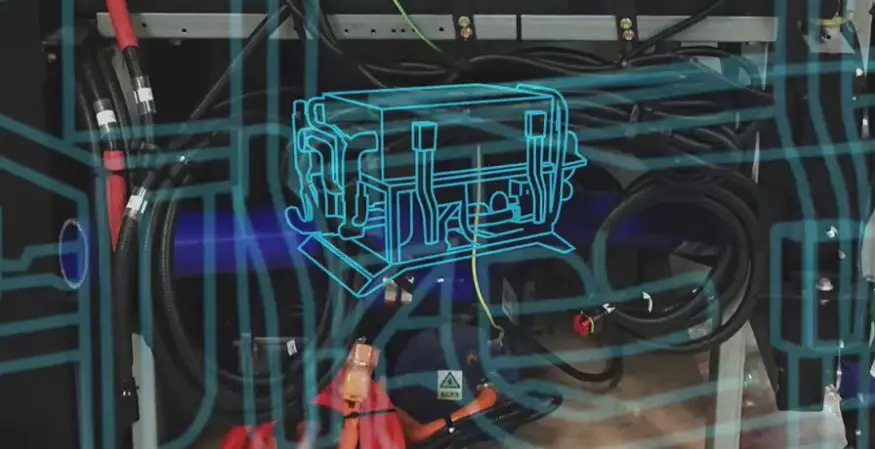

The heavy-duty trucking industry is pivotal to Hyzon’s enterprise mannequin, as their hydrogen-powered automobiles purpose to revolutionize this sector. Regardless of formidable objectives, the trade nonetheless faces vital challenges, significantly within the adoption of latest applied sciences like hydrogen gas cells. Infrastructure for hydrogen refueling remains to be sparse, and the upfront prices of hydrogen automobiles stay a barrier for a lot of fleet operators.

Hyzon has made notable strides on this enviornment by delivering 5 110kW gas cell vehicles to Efficiency Meals Group (PFG) in California and dealing in direction of an settlement for as much as 15 200kW vehicles. PFG’s profitable 540-mile supply run with a Hyzon liquid hydrogen gas cell truck demonstrates the sensible potential of hydrogen know-how in long-haul trucking.

Can They Do It? That is What the Market is Saying

Market perception of Hyzon Motors is a fancy tapestry woven with optimism and warning. The inventory has skilled marked volatility, hitting a 1-year low of $2.12 and a excessive of $67.50. Just lately, the inventory value noticed a 15% enhance, hitting $2.61, reflecting a flicker of investor confidence. Nonetheless, insider buying and selling actions reveal blended sentiments, with main shareholder Gasoline Cell Applied sciences Horizon offloading 1,000,000 shares, indicative of potential apprehension concerning the firm’s future trajectory.

Institutional buyers are additionally recalibrating their positions. Van ECK Associates Corp elevated its stake in Hyzon by 12.2%, showcasing a calculated wager on Hyzon’s potential turnaround. Institutional buyers personal over 61% of the corporate’s inventory, evidencing a big vested curiosity in Hyzon’s restoration.

Hyzon Motors Current Developments

Hyzon’s current strategic partnerships exemplify their dedication to increasing the footprint of hydrogen gas cell know-how throughout numerous industries. Collaborations with corporations like TR Group, New Approach Vehicles, and Recology spotlight their numerous buyer base. TR Group, New Zealand’s largest heavy-duty truck fleet proprietor, has entered right into a business settlement with Hyzon for as much as 20 gas cell electrical automobiles (FCEVs). In the meantime, the partnership with New Approach Vehicles and Recology has resulted in North America’s first hydrogen gas cell electrical refuse truck, marking a milestone in sustainable waste management.

know-how throughout numerous industries. Collaborations with corporations like TR Group, New Approach Vehicles, and Recology spotlight their numerous buyer base. TR Group, New Zealand’s largest heavy-duty truck fleet proprietor, has entered right into a business settlement with Hyzon for as much as 20 gas cell electrical automobiles (FCEVs). In the meantime, the partnership with New Approach Vehicles and Recology has resulted in North America’s first hydrogen gas cell electrical refuse truck, marking a milestone in sustainable waste management.

Hyzon’s hydrogen-powered FCEVs are additionally making inroads with different outstanding corporations reminiscent of Airgas, Bison Transport, Pilot Firm, Talke, and Complete Transportation Providers. These engagements underscore the applicability and rising acceptance of hydrogen gas cell know-how in business operations.

Whereas Hyzon Motors stands at a crossroads, their current developments and strategic initiatives recommend a doable path ahead. The corporate’s potential to navigate the monetary panorama and solidify its place within the heavy-duty trucking trade might be essential. As they attempt to surmount monetary hurdles and broaden their technological attain, the world watches carefully to see if Hyzon can drive the hydrogen gas cell revolution into the long run.