Li-FT Power Ltd. (TSXV: LIFT) has introduced its first-ever Nationwide Instrument 43-101 (NI 43-101) compliant mineral useful resource estimate (MRE) for the Yellowknife Lithium Challenge (YLP), positioned within the Northwest Territories, Canada. This maiden estimate is a significant milestone for the corporate and marks a major step ahead within the venture’s improvement.

The useful resource estimate positions the Yellowknife Lithium Project as a globally necessary spodumene useful resource, making it one of many high 10 largest spodumene initiatives within the Americas.

A Lithium Big Emerges: Key Highlights of the Maiden MRE

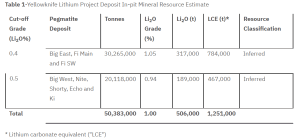

The Yellowknife Lithium Challenge’s preliminary MRE reveals a complete of 50.4 million tonnes grading 1.00% lithium oxide (Li₂O). That is the same as round 506,000 tonnes of Li₂O or 1.25 million tonnes of lithium carbonate equal (LCE). This important quantity of lithium-rich spodumene locations the Yellowknife Challenge among the many largest hard-rock lithium deposits in Canada, presently ranked because the Third-largest hard-rock maiden useful resource within the nation.

The estimate contains 8 of the 13 spodumene-bearing pegmatite dykes positioned on the property. Nevertheless, the vast majority of these deposits stay open at depth, with 6 of the 8 dykes within the estimate displaying unconstrained mineralization. This opens the door for substantial useful resource enlargement via future drill applications.

As well as, 5 undrilled spodumene dykes on the property should not but included within the MRE, presenting additional upside potential for development as exploration continues.

The maiden useful resource estimate is predicated on knowledge gathered from 49,548 meters of diamond drilling, accomplished throughout 286 holes between June 2023 and April 2024. Whereas the estimate represents a considerable useful resource, it’s only the start, with Li-FT aiming to construct on these early findings as extra exploration and drilling are carried out over the approaching years.

Strategic Positioning and Infrastructure Advantages

One of many Yellowknife Lithium Challenge’s important benefits is its wonderful entry to infrastructure. The Ingraham Path, a government-maintained paved freeway, runs via a part of the venture’s mineral useful resource space, offering handy transportation hyperlinks.

Furthermore, the venture is near rail amenities at Hay River, which is related to main ports in Prince Rupert and Vancouver. This logistical infrastructure is important for future delivery, particularly to key markets in Asia, the place lithium demand continues to develop as the worldwide transition to electric vehicles accelerates.

The venture can be near current powerlines close to Yellowknife, which can assist scale back improvement and operational prices. This infrastructure positioning enhances the venture’s financial viability and makes it well-suited for future large-scale mining and processing operations.

Metallurgical Testing and Processing Potential

The metallurgical work carried out thus far confirms the suitability of the Yellowknife Lithium Challenge’s spodumene-bearing pegmatites for dense medium separation (DMS) processing. DMS is an economical methodology for separating lithium from spodumene, and preliminary testing has proven that this method will be utilized efficiently to the YLP deposits.

X-ray diffraction evaluation and pilot-scale testing accomplished as a part of the Yellowknife Lithium Challenge’s metallurgical program have confirmed the presence of easy lithium mineralogy within the pegmatites. The affirmation that low-cost DMS processing is appropriate for the spodumene dykes included within the maiden useful resource estimate provides additional confidence within the venture’s potential to be a low-cost lithium producer.

Yellowknife’s Street to Lithium Dominance

With the maiden useful resource estimate now in place, Li-FT Energy is shifting ahead with plans to conduct a Preliminary Financial Evaluation (PEA) for the Yellowknife Lithium Challenge. The PEA will consider the venture’s financial feasibility, together with components equivalent to capital and working prices, potential manufacturing charges, and total venture profitability.

Li-FT expects to finish the PEA within the second quarter of 2025, marking one other important step towards bringing the lithium project into manufacturing. The corporate’s administration views this preliminary useful resource estimate as a basis for development. CEO Francis MacDonald expressed optimism concerning the venture’s future, saying that:

“The announcement of Li-FT’s first NI 43-101 mineral resource estimate for the Yellowknife Lithium Project marks a significant milestone for both the company and the Northwest Territories.”

What Lies Forward For Lithium

The alternatives offered by the Yellowknife Lithium Challenge are immense. Because the world shifts in direction of electrification and renewable power, lithium demand is predicted to soar, pushed by the expansion of electrical autos (EVs) and power storage methods. Tasks like Yellowknife, with its massive, high-grade lithium sources, will play a vital position in assembly this demand, stabilizing lithium prices and supporting the worldwide transition to cleaner power.

The Northwest Territories, with its wealthy mineral endowment and supportive mining infrastructure, is well-positioned to change into a key participant within the global lithium supply chain. The Yellowknife Lithium Challenge has the potential to be a cornerstone asset within the area’s mining future.

With 50.4 million tonnes of inferred sources and substantial room for enlargement, the venture may change into a key contributor to North America’s lithium supply. As Li-FT Energy advances and continues exploration, this improvement represents a significant alternative within the quickly rising lithium market.

Disclosure: House owners, members, administrators and staff of carboncredits.com have/might have inventory or possibility place in any of the businesses talked about: LIFT

Carboncredits.com receives compensation for this publication and has a enterprise relationship with any firm whose inventory(s) is/are talked about on this article

Further disclosure: This communication serves the only real objective of including worth to the analysis course of and is for info solely. Please do your individual due diligence. Each funding in securities talked about in publications of carboncredits.com contain dangers which may result in a complete lack of the invested capital.