The mining business faces a essential provide scarcity of key metals, regardless of progress in provide over the previous decade. In keeping with BloombergNEF’s Transition Metals Outlook, the world wants $2.1 trillion in new mining investments by 2050 to fulfill the demand for clear vitality applied sciences. It additional illustrates that important metals like aluminum, copperand lithium may face deficits as early as this yr, which could make EVs, wind generators, and different low-carbon applied sciences costlier.

Kwasi Ampofo, head of metals and mining at BNEF and lead creator of the report stated,

“The prolonged deficit of these metals will lead to higher prices for raw materials, which increases the cost of clean energy technologies. High costs could slow their adoption, and the energy transition at large”

Apparently, BloombergNEF’s Financial Transition Situation (ETS) highlights, that between 2024 and 2050, the world will want about 3 billion metric tons of metals to drive the worldwide vitality transition. It additional estimates that reaching internet zero emissions by 2050 may push that demand to six billion metric tons. This implies this could spike metallic costs and gradual the progress of inexperienced applied sciences.

Recycling Metals, A Viable Resolution for Provide and Emissions

Nonetheless, BNEF says recycling metals can ease provide pressures. Sooner, recycled supplies will play a vital position within the provide chain, which may even cut back total emissions from manufacturing.

In keeping with Allan Ray Restauro, a metals and mining affiliate at BNEF,

“Good government policies are crucial to the industry’s success. For batteries and stationary storage, governments need to establish collection networks, set the requirements for recovery rates, develop the frameworks to trace individual cells and provide the principles on second-life battery management. These actions can build a robust system that oversees the full lifecycle of battery metals.”

Decarbonizing Mining for a Low-Carbon Future

Because the world strikes towards a low-emissions financial system, resource-rich international locations face a troublesome problem: lowering emissions whereas creating their mining sectors. This is as a result of the mining business is important for supplying minerals wanted for clear vitality applied sciences. Sadly, mining nonetheless contributes to world emissions, particularly in coal extraction.

Minerals utilized in chosen clear vitality applied sciences

Supply: IEA, 2022, p. 6. CC BY 4.0

Nations like Chile are displaying progress by utilizing renewable vitality in mining operations, however many creating nations wrestle to stability progress, sustainability, and emissions objectives. On this regard, governments should undertake insurance policies that decarbonize mining whereas making certain financial progress and assembly Paris Settlement targets. Nations that implement robust local weather insurance policies together with sturdy financing are those to reach their world commitments.

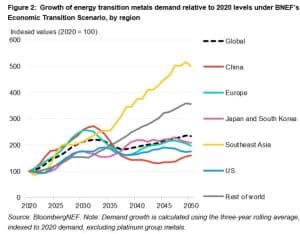

Southeast Asia Set to Lead in Steel Demand Development

Definitelythe demand for vitality transition metals will fluctuate by area. The analysis indicated that Southeast Asia is poised to change into the fastest-growing marketplace for these supplies within the 2030s. The area’s huge mining business may benefit from this demand surge, serving to to speed up industrialization whereas contributing to world emissions reductions. Conversely, China’s consumption outpaced the worldwide common between 2020 and 2023. The nation’s consumption of transition metals is predicted to peak by 2030.

In abstract, a $2.1 trillion funding in mining is essential to fulfill the worldwide push for clear vitality. As metallic provides tighten and costs rise, recycling and supportive insurance policies will likely be important to retaining the vitality transition on monitor.

Silver Surges as Coeur Mining Acquires SilverCrest

Coeur Mining is making a strategic transfer to strengthen silver within the business. In a $1.7 billion all-share deal, Coeur is about to accumulate Canadian silver producer SilverCrest, including the high-grade, low-cost Las Chispas mine in Mexico to its portfolio.

With this acquisition, Coeur has all the potential to change into a serious world silver producer, aiming to supply 21 million ounces of silver and 432,000 ounces of gold yearly. The Las Chispas mine, which started manufacturing in late 2022, has over 10.25 million silver equal ounces produced in its first full yr of operations. Hearts CEO Mitchell J. Krebs highlighted the mine’s robust operational efficiency and low money prices of $7.73 per ounce.

The press release reported, that on this partnership Coeur could have a 63% share, and SilverCrest will maintain 37%. The acquisition worth of $11.34 per share affords an 18% premium to SilverCrest’s current buying and selling ranges. Each firms’ boards have endorsed the deal, which is predicted to shut in Q1 2025 as regulatory and shareholder approval is pending.

Rising Silver Demand and Market Consolidation

In keeping with the US Geological Survey (USGS), Mexico led world silver manufacturing in 2022, producing an estimated 6,300 metric tons of silver. This output far surpassed China, the second-largest producer, with 3,600 metric tons.

Whereas Mexico dominates in manufacturing, Peru holds the biggest silver reserves globally, with 98,000 metric tons. Australia follows intently, with reserves totaling 92,000 metric tons. Peru’s secure silver output is supported by its huge reserves and superior mining infrastructure.

In 2023, silver costs jumped almost 35% as a result of heightened demand for photo voltaic vitality and electronics. This surge has triggered important mergers within the silver mining sector, together with Coeur Mining’s $1.7 billion acquisition of SilverCrest and First Majestic’s $970 million buy of Gatos Silver. Regardless of these strikes, the market grapples with supply shortagesintensifying the race for reserves. On a optimistic word, Hearts acquisition ought to be a ray of hope for the worldwide silver business.