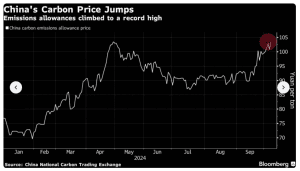

China’s carbon market has seen a big surge in costs, with carbon permits or credit reaching an all-time excessive as industries put together for a looming compliance deadline.

On Monday, emissions permits rose 2.5% to 103.49 yuan ($14.62) per ton. That is the very best for the reason that nationwide market’s launch in mid-2021, as reported by the Nationwide Carbon Buying and selling Company. This enhance represents a 35% rise in carbon prices thus far this 12 months, fueled by latest authorities actions aimed toward tightening rules and driving higher exercise throughout the market.

Compliance Countdown: Fueling the Worth Surge

China’s carbon market features a compliance or obligatory Emission Buying and selling System (ETS) and a voluntary greenhouse gasoline (GHG) emissions discount market, often known as the China Certified Emission Reduction (CCER) scheme, which was revamped earlier this 12 months.

China’s ETS plans to incorporate 8 main emitting sectors—energy era, metal, constructing supplies, non-ferrous metals, petrochemicals, chemical substances, paper, and civil aviation—representing 75% of China’s complete emissions.

Since its launch, the ETS has turn into the world’s largest emissions buying and selling platform. It covers about 5.1 billion tons of carbon dioxide equal or 40% of China’s complete emissions.

The spike in costs comes as China’s energy utilities face a year-end deadline to safe sufficient carbon allowances, additionally referred to as carbon creditsto offset their 2023 emissions.

The present ETS system allocates a specific amount of free permits to corporations. Nevertheless, if their emissions exceed these allowances, they have to buy extra credit available on the market. The approaching deadline has intensified demand for these permits, contributing to the value surge.

This 12 months, the Chinese language authorities launched stricter rules to additional develop the nationwide carbon market. The aim is to extend the stress on polluting industries to curb their emissions. These adjustments may spur a extra aggressive transition towards lower-carbon operations amongst industrial gamers.

Increasing the Scope of Regulation

The most recent regulatory shift broadens the scope of China’s carbon market, which at the moment covers round 2,200 energy utilities that collectively account for about 4.5 billion tons of carbon dioxide emissions yearly. New guidelines will prolong emissions obligations to other high-polluting sectors starting next yeartogether with:

- metal,

- aluminum, and

- cement manufacturing.

Furthermore, fossil-fuel energy turbines are dealing with tighter emissions caps, which additional pushes them towards both lowering their carbon output or buying extra permits to adjust to regulatory necessities.

These measures align with China’s broader local weather commitments to peak carbon emissions earlier than 2030 and obtain carbon neutrality by 2060. By intensifying rules, China goals to make use of its carbon market to steer industries in direction of cleaner vitality and decrease emissions.

Strategic Implications for Industries

Because the market adapts to the stricter compliance necessities, industries are being prompted to reassess their carbon methods. Firms that exceed their allotted emissions should issue within the rising value of permits. This, in flip, may put stress on revenue margins, particularly for high-emitting sectors like energy era, steeland cement.

To mitigate prices, these industries could speed up their investments in clear vitality options, akin to renewable energy sources or effectivity upgrades, to cut back their reliance on carbon credit.

The inclusion of latest industrial sectors into the carbon buying and selling scheme is anticipated to extend market liquidity, because the demand for permits will broaden past energy utilities to different key gamers. This variation may additionally drive extra transparency and effectivity in China’s carbon pricing mechanism as extra corporations take part.

What’s Subsequent for China’s Carbon Buying and selling?

With China’s nationwide carbon market nonetheless in its early phases, the latest surge in costs represents an important section in its growth. Analysts imagine that tightening rules might be instrumental in enhancing the market’s effectiveness as a software for lowering emissions. The Chinese language authorities’s efforts to refine and broaden the market are more likely to proceed, because it goals to strike a steadiness between financial progress and local weather targets.

If China can efficiently combine extra industries into its carbon buying and selling system and proceed to implement stringent emissions requirements, the nationwide market may turn into one of the crucial important on the earth. This could assist the world’s largest greenhouse gasoline emitter transfer nearer to its local weather targets. It may additionally present precious classes for different international locations searching for to implement or broaden their very own carbon markets.

The response from industrial gamers within the coming months—significantly as they navigate the end-of-year compliance deadline—will function an early indicator of the market’s long-term affect on China’s decarbonization efforts.